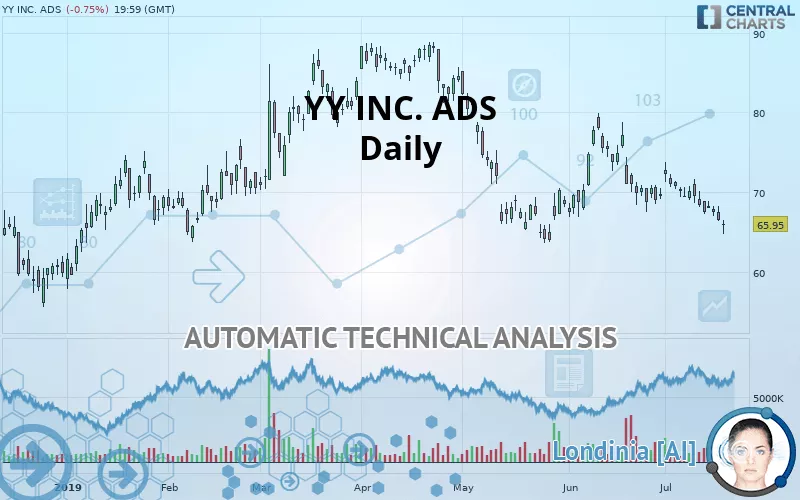

JOYY INC. ADS - Daily - Technical analysis published on 07/19/2019 (GMT)

- 287

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The YY INC. ADS price is 65.95 USD. On the day, this instrument lost -0.75% and was traded between 64.72 USD and 66.54 USD over the period. The price is currently at +1.90% from its lowest and -0.89% from its highest.A bearish gap was detected at the opening by the Central Gaps scanner. There are a lot of sellers and they have the upper hand in the very short term.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Technical

A technical analysis in Daily of this YY INC. ADS chart shows a sharp bearish trend. 92.86% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators scanner does not detect any result on moving averages that would impact this trend.

An assessment of technical indicators shows a bearish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Horizontal support is broken

Type : Bearish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 47.75 | 56.74 | 63.93 | 65.95 | 68.76 | 73.96 | 78.00 |

| Change (%) | -27.60% | -13.97% | -3.06% | - | +4.26% | +12.15% | +18.27% |

| Change | -18.20 | -9.21 | -2.02 | - | +2.81 | +8.01 | +12.05 |

| Level | Minor | Major | Major | - | Major | Intermediate | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 64.03 | 65.22 | 65.83 | 67.02 | 67.63 | 68.82 | 69.43 |

| Camarilla | 65.96 | 66.12 | 66.29 | 66.45 | 66.62 | 66.78 | 66.95 |

| Woodie | 63.75 | 65.08 | 65.55 | 66.88 | 67.35 | 68.68 | 69.15 |

| Fibonacci | 65.22 | 65.90 | 66.33 | 67.02 | 67.70 | 68.13 | 68.82 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 61.54 | 64.38 | 65.94 | 68.78 | 70.34 | 73.18 | 74.74 |

| Camarilla | 66.28 | 66.68 | 67.09 | 67.49 | 67.89 | 68.30 | 68.70 |

| Woodie | 60.89 | 64.06 | 65.29 | 68.46 | 69.69 | 72.86 | 74.09 |

| Fibonacci | 64.38 | 66.06 | 67.10 | 68.78 | 70.46 | 71.50 | 73.18 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 51.34 | 59.10 | 64.39 | 72.15 | 77.44 | 85.20 | 90.49 |

| Camarilla | 66.10 | 67.30 | 68.49 | 69.69 | 70.89 | 72.08 | 73.28 |

| Woodie | 50.12 | 58.48 | 63.17 | 71.53 | 76.22 | 84.58 | 89.27 |

| Fibonacci | 59.10 | 64.08 | 67.16 | 72.15 | 77.13 | 80.21 | 85.20 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 37.39 | |

| MACD (12,26,9): | -1.3800 | |

| Directional Movement: | -15.32 | |

| AROON (14): | -85.71 | |

| DEMA (21): | 67.55 | |

| Parabolic SAR (0,02-0,02-0,2): | 69.79 | |

| Elder Ray (13): | -2.85 | |

| Super Trend (3,10): | 71.72 | |

| Zig ZAG (10): | 65.95 | |

| VORTEX (21): | 0.6800 | |

| Stochastique (14,3,5): | 7.51 | |

| TEMA (21): | 67.08 | |

| Williams %R (14): | -86.41 | |

| Chande Momentum Oscillator (20): | -6.76 | |

| Repulse (5,40,3): | -2.6100 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.1800 | |

| Courbe Coppock: | 8.21 |

| MA7: | 67.62 | |

| MA20: | 69.36 | |

| MA50: | 70.01 | |

| MA100: | 75.97 | |

| MAexp7: | 67.50 | |

| MAexp20: | 69.22 | |

| MAexp50: | 71.37 | |

| MAexp100: | 72.87 | |

| Price / MA7: | -2.47% | |

| Price / MA20: | -4.92% | |

| Price / MA50: | -5.80% | |

| Price / MA100: | -13.19% | |

| Price / MAexp7: | -2.30% | |

| Price / MAexp20: | -4.72% | |

| Price / MAexp50: | -7.59% | |

| Price / MAexp100: | -9.50% |

News

The latest news and videos published on YY INC. ADS at the time of the analysis were as follows:

- Ethernet Switch Market Hits $7.5B in 1Q‘19, According to 650 Group; Campus Switching, North America, and China Drive Robust Y/Y Growth

- YY Announces Completion of Acquisition of Bigo, Ping An Overseas Holdings was the Exclusive Investor in Bigo's Series C Round Funding

- Report: Developing Opportunities within YY, Ingredion, Standex International, Graham, Cooper-Standard, and Titan Machinery — Future Expectations, Projections Moving into 2018

- Market Trends Toward New Normal in NEXEO SOLUTIONS, Mimecast, Mellanox Technologies, YY, Enerplus, and Costamare — Emerging Consolidated Expectations, Analyst Ratings

- PJSC PHOSAGRO - PhosAgro's revenue in 4Q17 up 14% y/y to RUB 45.8 bln

Add a comment

Comments

0 comments on the analysis JOYY INC. ADS - Daily