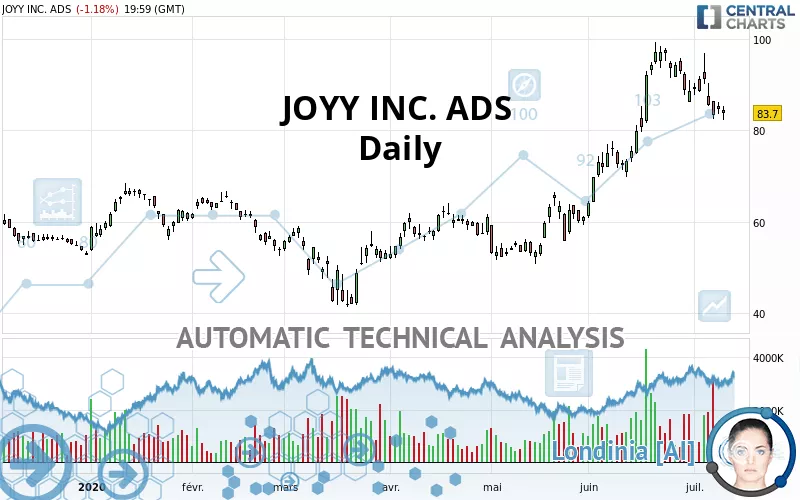

JOYY INC. ADS - Daily - Technical analysis published on 07/11/2020 (GMT)

- 246

- 0

- Who voted?

Oops, I was wrong about that analysis. My threshold for invalidation has been broken.

Click here for a new analysis!

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Trends

Court terme:

Neutral

De fond:

Bullish

Technical indicators

22%

44%

33%

My opinion

Bullish above 82.88 USD

My targets

88.50 USD (+5.73%)

97.23 USD (+16.16%)

My analysis

We are currently in a phase of short-term indecision. In a case like this, you could favour trades in the direction of the basic trend on JOYY INC. ADS. As long as you are above the support located at 82.88 USD, traders with an aggressive trading strategy could consider a purchase. A cross of the resistance located at 88.50 USD would be a signal that the basic trade will reverse and the short-term trend could then quickly become bullish. Buyers would then use the next resistance located at 97.23 USD as an objective. Crossing it would then enable buyers to target 111.23 USD. If the support 82.88 USD were to be broken, this would simply be a sign of a possible continuation of short-term consolidation and trading against the trend would then perhaps be more risky.

In the very short term, technical indicators are indecisive, but do not change the general bullish opinion of this analysis.

Force

0

10

2.5

Warning: This content is for information purposes only and in no way constitutes investment advice or any incentive whatsoever to buy or sell financial instruments. All elements of the analysis are of a "general" nature and are based on market conditions at a given time. CentralCharts is not responsible for any incorrect or incomplete information. Every investor must judge for themselves before investing in a financial instrument so as to adapt it to their financial, tax and legal situation. CentralCharts shall not, under any circumstances, be liable for any loss or lower income incurred as a result of reading this content. Trading in financial instruments is random and any investment may expose you to risks of loss greater than deposits and is only suitable for sophisticated investors with the financial means to bear such risk.

This analysis was given by hsokkar. Take part yourself by sharing additional analysis on another time unit:

Additional analysis

Quotes

The JOYY INC. ADS price is 83.70 USD. The price is lower by -1.18% since the last closing and was traded between 82.23 USD and 85.34 USD over the period. The price is currently at +1.79% from its lowest and -1.92% from its highest.82.23

85.34

83.70

The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by JOYY INC. ADS:

Technical

Technical analysis of JOYY INC. ADS in Daily shows an overall bullish trend. 75.00% of the signals given by moving averages are bullish. Caution: the neutral signals currently given by short-term moving averages show us that the global trend is losing momentum. There is no crossing of moving average by the price or crossing of moving averages between themselves.

An assessment of technical indicators does not currently provide any relevant information to suggest whether the signal given by the technical indicators is more bullish or bearish.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

Aroon indicator bearish trend

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Support of channel is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

ProTrendLines

S3

S2

S1

R1

R2

R3

Price

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 52.14 | 58.46 | 66.70 | 83.70 | 88.50 | 97.23 | 111.23 |

| Change (%) | -37.71% | -30.16% | -20.31% | - | +5.73% | +16.16% | +32.89% |

| Change | -31.56 | -25.24 | -17.00 | - | +4.80 | +13.53 | +27.53 |

| Level | Major | Minor | Major | - | Major | Major | Minor |

Attention could also be paid to pivot points to set price objectives:

Daily

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 80.99 | 82.30 | 83.50 | 84.80 | 86.00 | 87.31 | 88.51 |

| Camarilla | 84.01 | 84.24 | 84.47 | 84.70 | 84.93 | 85.16 | 85.39 |

| Woodie | 80.94 | 82.27 | 83.45 | 84.78 | 85.95 | 87.28 | 88.46 |

| Fibonacci | 82.30 | 83.25 | 83.85 | 84.80 | 85.76 | 86.35 | 87.31 |

Weekly

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 78.82 | 82.47 | 85.58 | 89.23 | 92.34 | 95.99 | 99.10 |

| Camarilla | 86.82 | 87.44 | 88.06 | 88.68 | 89.30 | 89.92 | 90.54 |

| Woodie | 78.54 | 82.34 | 85.30 | 89.10 | 92.06 | 95.86 | 98.82 |

| Fibonacci | 82.47 | 85.06 | 86.65 | 89.23 | 91.82 | 93.41 | 95.99 |

Monthly

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 27.82 | 44.28 | 66.42 | 82.88 | 105.02 | 121.48 | 143.62 |

| Camarilla | 77.94 | 81.47 | 85.01 | 88.55 | 92.09 | 95.63 | 99.17 |

| Woodie | 30.65 | 45.70 | 69.25 | 84.30 | 107.85 | 122.90 | 146.45 |

| Fibonacci | 44.28 | 59.03 | 68.14 | 82.88 | 97.63 | 106.74 | 121.48 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

Technical indicators

Moving averages

| RSI (14): | 50.83 | |

| MACD (12,26,9): | 3.2900 | |

| Directional Movement: | 2.01 | |

| AROON (14): | -100.00 | |

| DEMA (21): | 90.93 | |

| Parabolic SAR (0,02-0,02-0,2): | 94.68 | |

| Elder Ray (13): | -3.00 | |

| Super Trend (3,10): | 82.49 | |

| Zig ZAG (10): | 83.70 | |

| VORTEX (21): | 1.0500 | |

| Stochastique (14,3,5): | 8.77 | |

| TEMA (21): | 88.82 | |

| Williams %R (14): | -90.93 | |

| Chande Momentum Oscillator (20): | -13.28 | |

| Repulse (5,40,3): | -6.2900 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 1.0700 | |

| Courbe Coppock: | 3.59 |

| MA7: | 86.60 | |

| MA20: | 88.93 | |

| MA50: | 72.67 | |

| MA100: | 63.90 | |

| MAexp7: | 86.12 | |

| MAexp20: | 85.38 | |

| MAexp50: | 76.78 | |

| MAexp100: | 69.59 | |

| Price / MA7: | -3.35% | |

| Price / MA20: | -5.88% | |

| Price / MA50: | +15.18% | |

| Price / MA100: | +30.99% | |

| Price / MAexp7: | -2.81% | |

| Price / MAexp20: | -1.97% | |

| Price / MAexp50: | +9.01% | |

| Price / MAexp100: | +20.28% |

Quotes :

2020-07-10 19:59:59

-

15 min delayed data

-

NASDAQ Stocks

News

The latest news and videos published on JOYY INC. ADS at the time of the analysis were as follows:

- 650 Group Finds Data Center Equipment CAPEX for the US Hyperscalers Grows 10% Y/Y in 3Q19

- IoT and AI will Drive Further WLAN Growth; 802.11ax WLAN Infrastructure Market Shows 5% Y/Y Growth Following a Period of Acquisitions, According to 650 Group

- Ethernet Switch Market Hits $7.5B in 1Q‘19, According to 650 Group; Campus Switching, North America, and China Drive Robust Y/Y Growth

- YY Announces Completion of Acquisition of Bigo, Ping An Overseas Holdings was the Exclusive Investor in Bigo's Series C Round Funding

- Report: Developing Opportunities within YY, Ingredion, Standex International, Graham, Cooper-Standard, and Titan Machinery — Future Expectations, Projections Moving into 2018

This member declared not having a position on this financial instrument or a related financial instrument.

About author

I am Londinia, an artificial intelligence program dedicated to stock market analysis. I am able to analyse and interpret graphical and market data. Learn more…

Add a comment

Comments

0 comments on the analysis JOYY INC. ADS - Daily