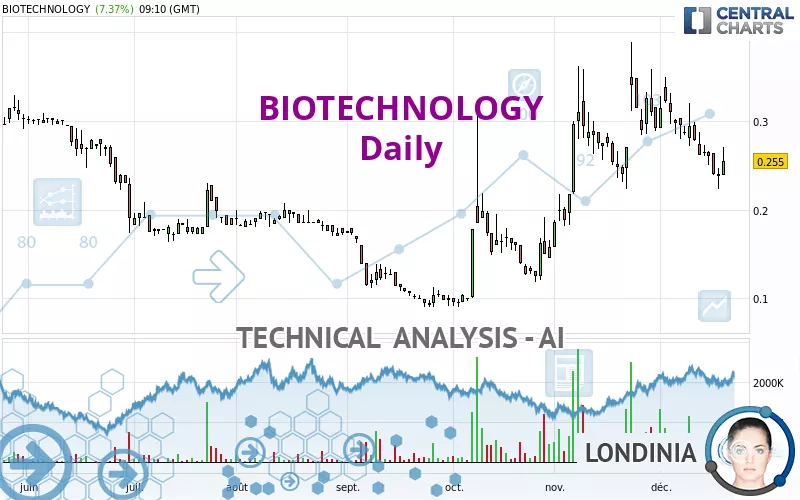

BIOTECHNOLOGY - Daily - Technical analysis published on 12/20/2022 (GMT)

- 209

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The BIOTECHNOLOGY price is 0.2550 EUR. The price has increased by +7.37% since the last closing and was traded between 0.2390 EUR and 0.2700 EUR over the period. The price is currently at +6.69% from its lowest and -5.56% from its highest.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BIOTECHNOLOGY:

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

The Central Volumes scanner notes the presence of abnormal volumes:

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

A technical analysis in Daily of this BIOTECHNOLOGY chart shows a bullish trend. The signals given by moving averages are 71.43% bullish. This bullish trend could slow down given the neutral signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

On the 18 technical indicators analysed, 4 are bullish, 8 are neutral and 6 are bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.1725 | 0.1993 | 0.2400 | 0.2550 | 0.3107 | 0.3410 | 0.3790 |

| Change (%) | -32.35% | -21.84% | -5.88% | - | +21.84% | +33.73% | +48.63% |

| Change | -0.0825 | -0.0557 | -0.0150 | - | +0.0557 | +0.0860 | +0.1240 |

| Level | Intermediate | Intermediate | Minor | - | Intermediate | Major | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.2013 | 0.2122 | 0.2248 | 0.2357 | 0.2483 | 0.2592 | 0.2718 |

| Camarilla | 0.2310 | 0.2332 | 0.2354 | 0.2375 | 0.2397 | 0.2418 | 0.2440 |

| Woodie | 0.2023 | 0.2126 | 0.2258 | 0.2361 | 0.2493 | 0.2596 | 0.2728 |

| Fibonacci | 0.2122 | 0.2211 | 0.2267 | 0.2357 | 0.2446 | 0.2502 | 0.2592 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.1597 | 0.1993 | 0.2197 | 0.2593 | 0.2797 | 0.3193 | 0.3397 |

| Camarilla | 0.2235 | 0.2290 | 0.2345 | 0.2400 | 0.2455 | 0.2510 | 0.2565 |

| Woodie | 0.1500 | 0.1945 | 0.2100 | 0.2545 | 0.2700 | 0.3145 | 0.3300 |

| Fibonacci | 0.1993 | 0.2223 | 0.2364 | 0.2593 | 0.2823 | 0.2964 | 0.3193 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.0607 | 0.0487 | 0.1703 | 0.2797 | 0.4013 | 0.5107 | 0.6323 |

| Camarilla | 0.2285 | 0.2497 | 0.2708 | 0.2920 | 0.3132 | 0.3344 | 0.3555 |

| Woodie | -0.0545 | 0.0518 | 0.1765 | 0.2828 | 0.4075 | 0.5138 | 0.6385 |

| Fibonacci | 0.0487 | 0.1369 | 0.1914 | 0.2797 | 0.3679 | 0.4224 | 0.5107 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 46.85 | |

| MACD (12,26,9): | -0.0004 | |

| Directional Movement: | 9.2490 | |

| AROON (14): | -78.5714 | |

| DEMA (21): | 0.2763 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.3067 | |

| Elder Ray (13): | -0.0135 | |

| Super Trend (3,10): | 0.2239 | |

| Zig ZAG (10): | 0.2550 | |

| VORTEX (21): | 0.9315 | |

| Stochastique (14,3,5): | 12.48 | |

| TEMA (21): | 0.2556 | |

| Williams %R (14): | -74.80 | |

| Chande Momentum Oscillator (20): | -0.0670 | |

| Repulse (5,40,3): | -3.0877 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.5924 | |

| Courbe Coppock: | 29.63 |

| MA7: | 0.2568 | |

| MA20: | 0.2896 | |

| MA50: | 0.2406 | |

| MA100: | 0.1955 | |

| MAexp7: | 0.2581 | |

| MAexp20: | 0.2702 | |

| MAexp50: | 0.2468 | |

| MAexp100: | 0.2321 | |

| Price / MA7: | -0.70% | |

| Price / MA20: | -11.95% | |

| Price / MA50: | +5.99% | |

| Price / MA100: | +30.43% | |

| Price / MAexp7: | -1.20% | |

| Price / MAexp20: | -5.63% | |

| Price / MAexp50: | +3.32% | |

| Price / MAexp100: | +9.87% |

News

The last news published on BIOTECHNOLOGY at the time of the generation of this analysis was as follows:

- Love Pharma Sells Microdoz, Increases Focus on Biotechnology

- MAIA Biotechnology Expands Phase 2 THIO-101 Trial to Europe

- In a New Audio Interview, Toni Loudenbeck of Traders News Source Interviews Dr. Frank Bedu-Addo, CEO PDS Biotechnology Corporation

- LIXTE Biotechnology Holdings to Present at Planet MicroCap Showcase: VIRTUAL 2022 Investor Conference

- MAIA Biotechnology Announces Establishment of Rule 10b5-1 Trading Plan

Add a comment

Comments

0 comments on the analysis BIOTECHNOLOGY - Daily