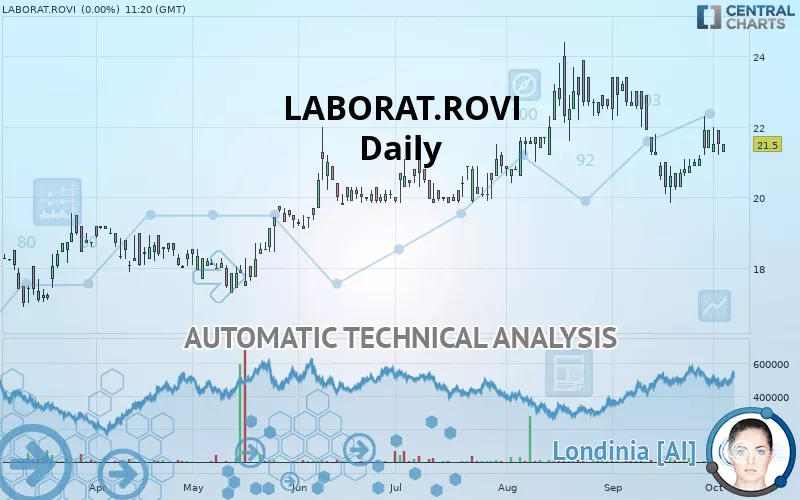

LABORAT.ROVI - Daily - Technical analysis published on 10/03/2019 (GMT)

- 187

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The LABORAT.ROVI rating is 21.50 EUR. On the day, this instrument gained +0.00% and was between 21.30 EUR and 21.50 EUR. This implies that the price is at +0.94% from its lowest and at 0% from its highest.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by LABORAT.ROVI:

Technical

A technical analysis in Daily of this LABORAT.ROVI chart shows a bullish trend. The signals given by moving averages are 78.57% bullish. This bullish trend is slowing down slightly given the slightly bullish signals of short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 12 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near resistance of triangle

Type : Bearish

Timeframe : Daily

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 18.84 | 19.40 | 21.10 | 21.50 | 21.60 | 22.40 | 23.20 |

| Change (%) | -12.37% | -9.77% | -1.86% | - | +0.47% | +4.19% | +7.91% |

| Change | -2.66 | -2.10 | -0.40 | - | +0.10 | +0.90 | +1.70 |

| Level | Minor | Major | Major | - | Minor | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 20.47 | 20.83 | 21.17 | 21.53 | 21.87 | 22.23 | 22.57 |

| Camarilla | 21.31 | 21.37 | 21.44 | 21.50 | 21.56 | 21.63 | 21.69 |

| Woodie | 20.45 | 20.83 | 21.15 | 21.53 | 21.85 | 22.23 | 22.55 |

| Fibonacci | 20.83 | 21.10 | 21.27 | 21.53 | 21.80 | 21.97 | 22.23 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 18.87 | 19.73 | 20.57 | 21.43 | 22.27 | 23.13 | 23.97 |

| Camarilla | 20.93 | 21.09 | 21.24 | 21.40 | 21.56 | 21.71 | 21.87 |

| Woodie | 18.85 | 19.73 | 20.55 | 21.43 | 22.25 | 23.13 | 23.95 |

| Fibonacci | 19.73 | 20.38 | 20.78 | 21.43 | 22.08 | 22.48 | 23.13 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 16.48 | 18.17 | 20.03 | 21.72 | 23.58 | 25.27 | 27.13 |

| Camarilla | 20.92 | 21.25 | 21.58 | 21.90 | 22.23 | 22.55 | 22.88 |

| Woodie | 16.58 | 18.21 | 20.13 | 21.76 | 23.68 | 25.31 | 27.23 |

| Fibonacci | 18.17 | 19.52 | 20.36 | 21.72 | 23.07 | 23.91 | 25.27 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 50.32 | |

| MACD (12,26,9): | -0.1200 | |

| Directional Movement: | 5.51 | |

| AROON (14): | 50.00 | |

| DEMA (21): | 21.26 | |

| Parabolic SAR (0,02-0,02-0,2): | 20.24 | |

| Elder Ray (13): | 0.03 | |

| Super Trend (3,10): | 22.75 | |

| Zig ZAG (10): | 21.50 | |

| VORTEX (21): | 0.9000 | |

| Stochastique (14,3,5): | 67.35 | |

| TEMA (21): | 21.12 | |

| Williams %R (14): | -32.65 | |

| Chande Momentum Oscillator (20): | 1.20 | |

| Repulse (5,40,3): | 0.4200 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.1500 | |

| Courbe Coppock: | 1.97 |

| MA7: | 21.41 | |

| MA20: | 21.33 | |

| MA50: | 21.73 | |

| MA100: | 20.77 | |

| MAexp7: | 21.40 | |

| MAexp20: | 21.43 | |

| MAexp50: | 21.39 | |

| MAexp100: | 20.78 | |

| Price / MA7: | +0.42% | |

| Price / MA20: | +0.80% | |

| Price / MA50: | -1.06% | |

| Price / MA100: | +3.51% | |

| Price / MAexp7: | +0.47% | |

| Price / MAexp20: | +0.33% | |

| Price / MAexp50: | +0.51% | |

| Price / MAexp100: | +3.46% |

Add a comment

Comments

0 comments on the analysis LABORAT.ROVI - Daily