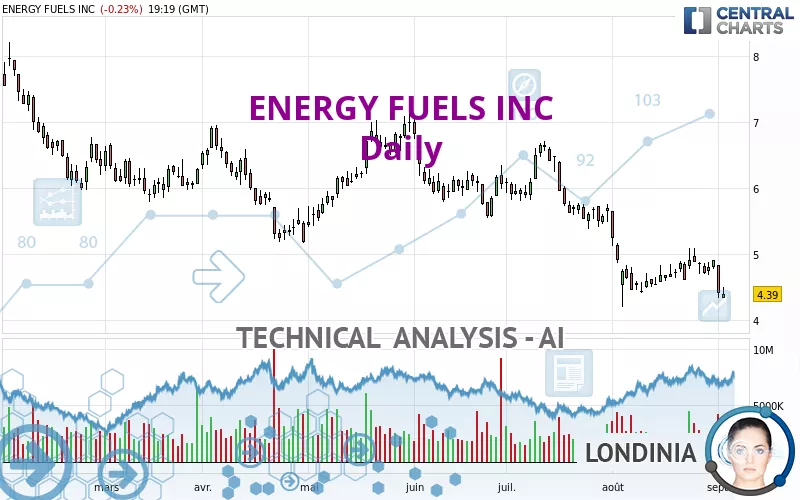

ENERGY FUELS INC - Daily - Technical analysis published on 09/04/2024 (GMT)

- 133

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

ENERGY FUELS INC rating 4.39 USD. The price is lower by -0.23% since the last closing and was between 4.33 USD and 4.49 USD. This implies that the price is at +1.39% from its lowest and at -2.23% from its highest.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of ENERGY FUELS INC indicates that the overall trend is strongly bearish. 92.86% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

In fact, 10 technical indicators on 18 studied are currently positioned bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near support of channel

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.31 | 2.63 | 4.09 | 4.39 | 4.44 | 5.18 | 6.01 |

| Change (%) | -70.16% | -40.09% | -6.83% | - | +1.14% | +18.00% | +36.90% |

| Change | -3.08 | -1.76 | -0.30 | - | +0.05 | +0.79 | +1.62 |

| Level | Intermediate | Minor | Major | - | Intermediate | Major | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.71 | 4.02 | 4.21 | 4.52 | 4.71 | 5.02 | 5.21 |

| Camarilla | 4.26 | 4.31 | 4.35 | 4.40 | 4.45 | 4.49 | 4.54 |

| Woodie | 3.65 | 3.99 | 4.15 | 4.49 | 4.65 | 4.99 | 5.15 |

| Fibonacci | 4.02 | 4.21 | 4.33 | 4.52 | 4.71 | 4.83 | 5.02 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.28 | 4.48 | 4.69 | 4.89 | 5.10 | 5.30 | 5.51 |

| Camarilla | 4.79 | 4.83 | 4.86 | 4.90 | 4.94 | 4.98 | 5.01 |

| Woodie | 4.29 | 4.48 | 4.70 | 4.89 | 5.11 | 5.30 | 5.52 |

| Fibonacci | 4.48 | 4.64 | 4.73 | 4.89 | 5.05 | 5.14 | 5.30 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.72 | 3.45 | 4.18 | 4.91 | 5.64 | 6.37 | 7.10 |

| Camarilla | 4.50 | 4.63 | 4.77 | 4.90 | 5.03 | 5.17 | 5.30 |

| Woodie | 2.71 | 3.45 | 4.17 | 4.91 | 5.63 | 6.37 | 7.09 |

| Fibonacci | 3.45 | 4.01 | 4.36 | 4.91 | 5.47 | 5.82 | 6.37 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 36.24 | |

| MACD (12,26,9): | -0.1900 | |

| Directional Movement: | -15.41 | |

| AROON (14): | -42.86 | |

| DEMA (21): | 4.51 | |

| Parabolic SAR (0,02-0,02-0,2): | 5.07 | |

| Elder Ray (13): | -0.28 | |

| Super Trend (3,10): | 5.15 | |

| Zig ZAG (10): | 4.38 | |

| VORTEX (21): | 0.9600 | |

| Stochastique (14,3,5): | 27.20 | |

| TEMA (21): | 4.55 | |

| Williams %R (14): | -95.89 | |

| Chande Momentum Oscillator (20): | -0.27 | |

| Repulse (5,40,3): | -8.0800 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.6200 | |

| Courbe Coppock: | 3.87 |

| MA7: | 4.70 | |

| MA20: | 4.65 | |

| MA50: | 5.34 | |

| MA100: | 5.70 | |

| MAexp7: | 4.62 | |

| MAexp20: | 4.78 | |

| MAexp50: | 5.19 | |

| MAexp100: | 5.62 | |

| Price / MA7: | -6.60% | |

| Price / MA20: | -5.59% | |

| Price / MA50: | -17.79% | |

| Price / MA100: | -22.98% | |

| Price / MAexp7: | -4.98% | |

| Price / MAexp20: | -8.16% | |

| Price / MAexp50: | -15.41% | |

| Price / MAexp100: | -21.89% |

News

Don't forget to follow the news on ENERGY FUELS INC. At the time of publication of this analysis, the latest news was as follows:

- Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) Breaking Cycle of Dependence

- Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) Tilting Balance Back to America

- Energy Fuels Inc. CEO Discusses Newly Released Sustainability Report and Entry Into Rare Earths Production for 2021

- Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) Marks Milestone, Produces Mixed REE Concentrate at Utah Mill

- Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) Working to Re-Ignite REE production in the US

Add a comment

Comments

0 comments on the analysis ENERGY FUELS INC - Daily