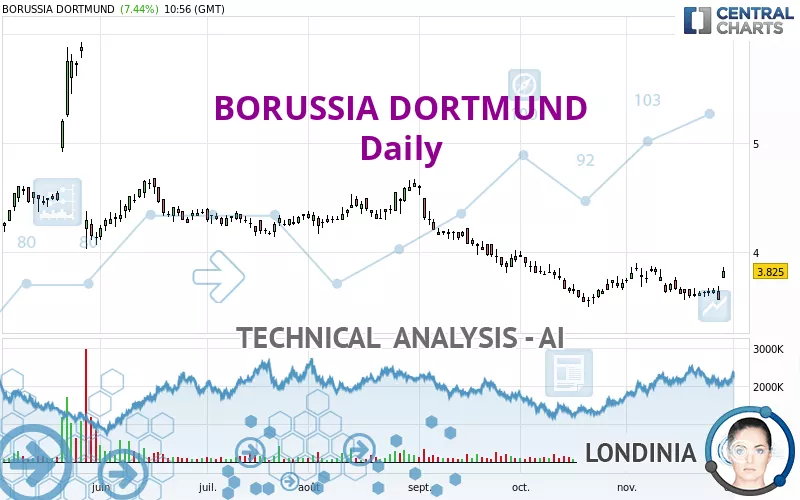

BORUSSIA DORTMUND - Daily - Technical analysis published on 11/29/2023 (GMT)

- 222

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

BORUSSIA DORTMUND rating 3.825 EUR. On the day, this instrument gained +7.44% and was between 3.760 EUR and 3.860 EUR. This implies that the price is at +1.73% from its lowest and at -0.91% from its highest.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BORUSSIA DORTMUND:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of BORUSSIA DORTMUND indicates that the overall trend is slightly bearish. 57.14% of the signals given by moving averages are bearish. Caution: the strong bullish signals currently being given by short-term moving averages indicate that this slightly bearish trend could quickly be reversed. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

The technical indicators are bullish. There is still some doubt about the price increase.

But beware of excesses. The Central Indicators scanner currently detects this:

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

RSI indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

MACD crosses UP its Moving Average

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.696 | 3.278 | 3.545 | 3.825 | 3.857 | 4.187 | 4.637 |

| Change (%) | -55.66% | -14.30% | -7.32% | - | +0.84% | +9.46% | +21.23% |

| Change | -2.129 | -0.547 | -0.280 | - | +0.032 | +0.362 | +0.812 |

| Level | Minor | Major | Intermediate | - | Minor | Major | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.387 | 3.473 | 3.517 | 3.603 | 3.647 | 3.733 | 3.777 |

| Camarilla | 3.524 | 3.536 | 3.548 | 3.560 | 3.572 | 3.584 | 3.596 |

| Woodie | 3.365 | 3.463 | 3.495 | 3.593 | 3.625 | 3.723 | 3.755 |

| Fibonacci | 3.473 | 3.523 | 3.554 | 3.603 | 3.653 | 3.684 | 3.733 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.487 | 3.533 | 3.577 | 3.623 | 3.667 | 3.713 | 3.757 |

| Camarilla | 3.595 | 3.604 | 3.612 | 3.620 | 3.628 | 3.637 | 3.645 |

| Woodie | 3.485 | 3.533 | 3.575 | 3.623 | 3.665 | 3.713 | 3.755 |

| Fibonacci | 3.533 | 3.568 | 3.589 | 3.623 | 3.658 | 3.679 | 3.713 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.958 | 3.227 | 3.473 | 3.742 | 3.988 | 4.257 | 4.503 |

| Camarilla | 3.578 | 3.626 | 3.673 | 3.720 | 3.767 | 3.814 | 3.862 |

| Woodie | 2.948 | 3.221 | 3.463 | 3.736 | 3.978 | 4.251 | 4.493 |

| Fibonacci | 3.227 | 3.423 | 3.545 | 3.742 | 3.938 | 4.060 | 4.257 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 59.12 | |

| MACD (12,26,9): | -0.0270 | |

| Directional Movement: | 2.984 | |

| AROON (14): | -42.857 | |

| DEMA (21): | 3.638 | |

| Parabolic SAR (0,02-0,02-0,2): | 3.560 | |

| Elder Ray (13): | 0.139 | |

| Super Trend (3,10): | 3.888 | |

| Zig ZAG (10): | 3.840 | |

| VORTEX (21): | 0.9040 | |

| Stochastique (14,3,5): | 41.16 | |

| TEMA (21): | 3.667 | |

| Williams %R (14): | -6.67 | |

| Chande Momentum Oscillator (20): | 0.210 | |

| Repulse (5,40,3): | 0.0490 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.1410 | |

| Courbe Coppock: | 6.38 |

| MA7: | 3.647 | |

| MA20: | 3.700 | |

| MA50: | 3.741 | |

| MA100: | 4.021 | |

| MAexp7: | 3.671 | |

| MAexp20: | 3.681 | |

| MAexp50: | 3.785 | |

| MAexp100: | 3.935 | |

| Price / MA7: | +4.88% | |

| Price / MA20: | +3.38% | |

| Price / MA50: | +2.25% | |

| Price / MA100: | -4.87% | |

| Price / MAexp7: | +4.20% | |

| Price / MAexp20: | +3.91% | |

| Price / MAexp50: | +1.06% | |

| Price / MAexp100: | -2.80% |

News

Don't forget to follow the news on BORUSSIA DORTMUND. At the time of publication of this analysis, the latest news was as follows:

- EQS-Adhoc: Borussia Dortmund reports preliminary figures for the first quarter (Q1) of the 2023/2024 financial year

- Borussia Dortmund Reports Preliminary Figures for the First Quarter (Q1) of the 2023/2024 Financial Year

- EQS-Adhoc: Borussia Dortmund publishes preliminary figures for the 2022/2023 financial year

- EQS-News: annual press conference – preliminary results fiscal year 2022/2023

- Borussia Dortmund Publishes Preliminary Figures for the 2022/2023 Financial Year

Add a comment

Comments

0 comments on the analysis BORUSSIA DORTMUND - Daily