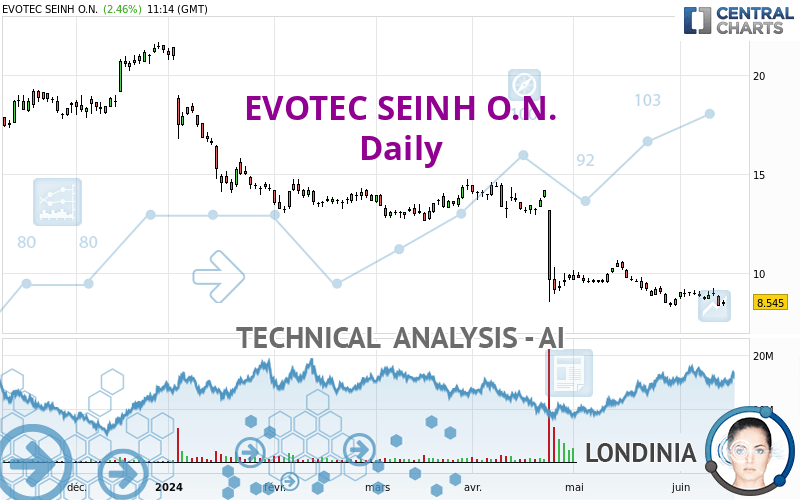

EVOTEC SEINH O.N. - Daily - Technical analysis published on 06/14/2024 (GMT)

- 156

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The EVOTEC SEINH O.N. rating is 8.545 EUR. The price registered an increase of +2.46% on the session and was traded between 8.320 EUR and 8.645 EUR over the period. The price is currently at +2.70% from its lowest and -1.16% from its highest.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by EVOTEC SEINH O.N.:

Near a new LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

The Central Volumes scanner notes the presence of abnormal volumes:

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of EVOTEC SEINH O.N. in Daily shows a overall strongly bearish trend. 92.86% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

In fact, of the 18 technical indicators analysed by Central Analyzer, 6 are bullish, 5 are neutral and 7 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Bullish harami

Type : Bullish

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 3.178 | 8.545 | 10.480 | 14.975 | 17.988 |

| Change (%) | -62.81% | - | +22.64% | +75.25% | +110.51% |

| Change | -5.367 | - | +1.935 | +6.430 | +9.443 |

| Level | Intermediate | - | Minor | Major | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 7.633 | 7.987 | 8.163 | 8.517 | 8.693 | 9.047 | 9.223 |

| Camarilla | 8.194 | 8.243 | 8.291 | 8.340 | 8.389 | 8.437 | 8.486 |

| Woodie | 7.545 | 7.943 | 8.075 | 8.473 | 8.605 | 9.003 | 9.135 |

| Fibonacci | 7.987 | 8.189 | 8.314 | 8.517 | 8.719 | 8.844 | 9.047 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 8.088 | 8.377 | 8.603 | 8.892 | 9.118 | 9.407 | 9.633 |

| Camarilla | 8.688 | 8.736 | 8.783 | 8.830 | 8.877 | 8.924 | 8.972 |

| Woodie | 8.058 | 8.361 | 8.573 | 8.876 | 9.088 | 9.391 | 9.603 |

| Fibonacci | 8.377 | 8.573 | 8.695 | 8.892 | 9.088 | 9.210 | 9.407 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5.348 | 6.812 | 7.733 | 9.197 | 10.118 | 11.582 | 12.503 |

| Camarilla | 7.999 | 8.218 | 8.436 | 8.655 | 8.874 | 9.092 | 9.311 |

| Woodie | 5.078 | 6.676 | 7.463 | 9.061 | 9.848 | 11.446 | 12.233 |

| Fibonacci | 6.812 | 7.723 | 8.286 | 9.197 | 10.108 | 10.671 | 11.582 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 38.17 | |

| MACD (12,26,9): | -0.4690 | |

| Directional Movement: | -10.258 | |

| AROON (14): | -14.286 | |

| DEMA (21): | 8.368 | |

| Parabolic SAR (0,02-0,02-0,2): | 10.139 | |

| Elder Ray (13): | -0.357 | |

| Super Trend (3,10): | 9.690 | |

| Zig ZAG (10): | 8.540 | |

| VORTEX (21): | 0.7310 | |

| Stochastique (14,3,5): | 32.38 | |

| TEMA (21): | 8.545 | |

| Williams %R (14): | -75.60 | |

| Chande Momentum Oscillator (20): | 0.035 | |

| Repulse (5,40,3): | -4.2650 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.7850 | |

| Courbe Coppock: | 9.57 |

| MA7: | 8.744 | |

| MA20: | 8.943 | |

| MA50: | 10.453 | |

| MA100: | 12.093 | |

| MAexp7: | 8.696 | |

| MAexp20: | 9.057 | |

| MAexp50: | 10.259 | |

| MAexp100: | 12.068 | |

| Price / MA7: | -2.28% | |

| Price / MA20: | -4.45% | |

| Price / MA50: | -18.25% | |

| Price / MA100: | -29.34% | |

| Price / MAexp7: | -1.74% | |

| Price / MAexp20: | -5.65% | |

| Price / MAexp50: | -16.71% | |

| Price / MAexp100: | -29.19% |

News

Don't forget to follow the news on EVOTEC SEINH O.N.. At the time of publication of this analysis, the latest news was as follows:

- EQS-News: Evotec announces progress in neuroscience collaboration with Bristol Myers Squibb

- Evotec Announces Progress in Neuroscience Collaboration with Bristol Myers Squibb

- EQS-News: Evotec SE: Results of the Annual General Meeting 2024

- Evotec SE: Results of the Annual General Meeting 2024

- EQS-News: Evotec, Inserm, Lille University Hospital and Inserm Transfert enter collaboration to identify novel therapeutic targets in obesity and metabolic diseases

Add a comment

Comments

0 comments on the analysis EVOTEC SEINH O.N. - Daily