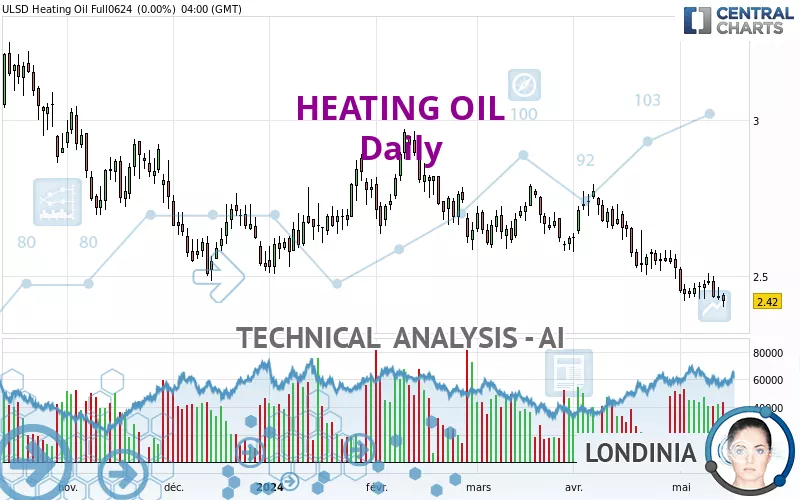

HEATING OIL - Daily - Technical analysis published on 05/15/2024 (GMT)

- 116

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The HEATING OIL price is 2.4310 USD. The price has increased by +0.46% since the last closing and was traded between 2.4261 USD and 2.4368 USD over the period. The price is currently at +0.20% from its lowest and -0.24% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by HEATING OIL:

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this HEATING OIL chart shows a sharp bearish trend. 92.86% of the signals given by moving averages are bearish. The overall trend is supported by the strong bearish signals from short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

The probability of a further decline is moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

RSI indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of these bullish patterns in Japanese candlesticks:

Bullish harami

Type : Bullish

Timeframe : Daily

Bullish harami cross

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.2537 | 1.8416 | 2.4106 | 2.4310 | 2.6154 | 2.7883 | 3.1702 |

| Change (%) | -48.43% | -24.25% | -0.84% | - | +7.59% | +14.70% | +30.41% |

| Change | -1.1773 | -0.5894 | -0.0204 | - | +0.1844 | +0.3573 | +0.7392 |

| Level | Intermediate | Major | Major | - | Intermediate | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.3527 | 2.3771 | 2.3985 | 2.4229 | 2.4443 | 2.4687 | 2.4901 |

| Camarilla | 2.4074 | 2.4116 | 2.4158 | 2.4200 | 2.4242 | 2.4284 | 2.4326 |

| Woodie | 2.3513 | 2.3764 | 2.3971 | 2.4222 | 2.4429 | 2.4680 | 2.4887 |

| Fibonacci | 2.3771 | 2.3946 | 2.4054 | 2.4229 | 2.4404 | 2.4512 | 2.4687 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.3200 | 2.3732 | 2.4038 | 2.4570 | 2.4876 | 2.5408 | 2.5714 |

| Camarilla | 2.4114 | 2.4190 | 2.4267 | 2.4344 | 2.4421 | 2.4498 | 2.4575 |

| Woodie | 2.3087 | 2.3676 | 2.3925 | 2.4514 | 2.4763 | 2.5352 | 2.5601 |

| Fibonacci | 2.3732 | 2.4052 | 2.4250 | 2.4570 | 2.4890 | 2.5088 | 2.5408 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.9688 | 2.2073 | 2.3296 | 2.5681 | 2.6904 | 2.9289 | 3.0512 |

| Camarilla | 2.3527 | 2.3858 | 2.4188 | 2.4519 | 2.4850 | 2.5181 | 2.5511 |

| Woodie | 1.9107 | 2.1783 | 2.2715 | 2.5391 | 2.6323 | 2.8999 | 2.9931 |

| Fibonacci | 2.2073 | 2.3451 | 2.4303 | 2.5681 | 2.7059 | 2.7911 | 2.9289 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 32.83 | |

| MACD (12,26,9): | -0.0557 | |

| Directional Movement: | -14.1437 | |

| AROON (14): | -85.7142 | |

| DEMA (21): | 2.4275 | |

| Parabolic SAR (0,02-0,02-0,2): | 2.5042 | |

| Elder Ray (13): | -0.0393 | |

| Super Trend (3,10): | 2.5900 | |

| Zig ZAG (10): | 2.4324 | |

| VORTEX (21): | 0.8245 | |

| Stochastique (14,3,5): | 11.31 | |

| TEMA (21): | 2.4062 | |

| Williams %R (14): | -84.11 | |

| Chande Momentum Oscillator (20): | -0.1136 | |

| Repulse (5,40,3): | -1.4222 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.3079 | |

| Courbe Coppock: | 9.56 |

| MA7: | 2.4487 | |

| MA20: | 2.4982 | |

| MA50: | 2.6129 | |

| MA100: | 2.6339 | |

| MAexp7: | 2.4451 | |

| MAexp20: | 2.5003 | |

| MAexp50: | 2.5761 | |

| MAexp100: | 2.6066 | |

| Price / MA7: | -0.72% | |

| Price / MA20: | -2.69% | |

| Price / MA50: | -6.96% | |

| Price / MA100: | -7.70% | |

| Price / MAexp7: | -0.58% | |

| Price / MAexp20: | -2.77% | |

| Price / MAexp50: | -5.63% | |

| Price / MAexp100: | -6.74% |

News

The last news published on HEATING OIL at the time of the generation of this analysis was as follows:

-

Northeast heating oil shortage a 'problem that's not going away': Gas analyst

-

Heating oil states prepare to pay ‘$5 per gallon or more’ this winter

Add a comment

Comments

0 comments on the analysis HEATING OIL - Daily