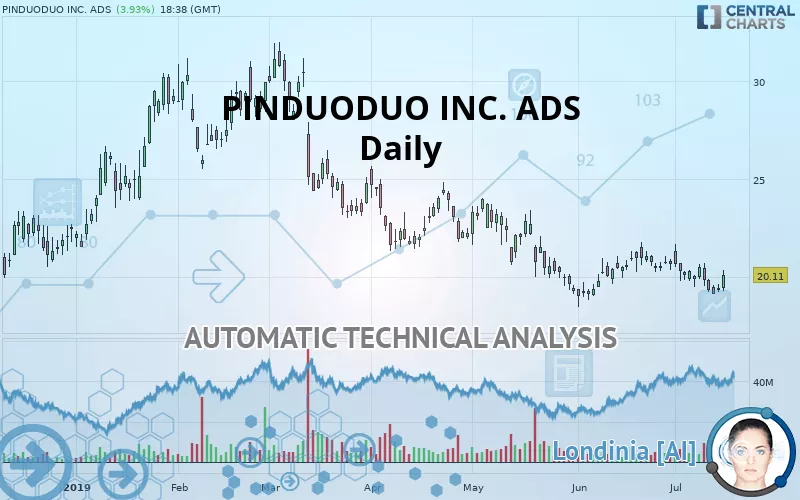

PDD HOLDINGS INC. ADS - Daily - Technical analysis published on 07/16/2019 (GMT)

- 459

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The PINDUODUO INC. ADS price is 20.11 USD. The price has increased by +3.93% since the last closing with the lowest point at 19.30 USD and the highest point at 20.37 USD. The deviation from the price is +4.20% for the low point and -1.28% for the high point.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of PINDUODUO INC. ADS in Daily shows a overall strongly bearish trend. 92.86% of the signals given by moving averages are bearish. The overall trend is supported by the strong bearish signals from short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

An assessment of technical indicators does not currently provide any relevant information to suggest whether the signal given by the technical indicators is more bullish or bearish.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Ichimoku - Bearish crossover : Tenkan & Kijun

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near support of triangle

Type : Bullish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 17.18 | 19.03 | 20.11 | 21.08 | 24.41 | 25.93 |

| Change (%) | -14.57% | -5.37% | - | +4.82% | +21.38% | +28.94% |

| Change | -2.93 | -1.08 | - | +0.97 | +4.30 | +5.82 |

| Level | Intermediate | Major | - | Major | Minor | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 18.76 | 19.00 | 19.17 | 19.41 | 19.58 | 19.82 | 19.99 |

| Camarilla | 19.24 | 19.28 | 19.31 | 19.35 | 19.39 | 19.43 | 19.46 |

| Woodie | 18.74 | 18.98 | 19.15 | 19.39 | 19.56 | 19.80 | 19.97 |

| Fibonacci | 19.00 | 19.15 | 19.25 | 19.41 | 19.56 | 19.66 | 19.82 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 17.02 | 18.06 | 18.60 | 19.65 | 20.19 | 21.23 | 21.77 |

| Camarilla | 18.70 | 18.85 | 19.00 | 19.14 | 19.29 | 19.43 | 19.58 |

| Woodie | 16.76 | 17.93 | 18.35 | 19.52 | 19.93 | 21.10 | 21.52 |

| Fibonacci | 18.06 | 18.67 | 19.04 | 19.65 | 20.25 | 20.63 | 21.23 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 15.48 | 16.97 | 18.80 | 20.29 | 22.12 | 23.61 | 25.44 |

| Camarilla | 19.72 | 20.02 | 20.33 | 20.63 | 20.93 | 21.24 | 21.54 |

| Woodie | 15.65 | 17.06 | 18.97 | 20.38 | 22.29 | 23.70 | 25.61 |

| Fibonacci | 16.97 | 18.24 | 19.02 | 20.29 | 21.56 | 22.34 | 23.61 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 47.56 | |

| MACD (12,26,9): | -0.3100 | |

| Directional Movement: | 2.24 | |

| AROON (14): | -57.14 | |

| DEMA (21): | 19.73 | |

| Parabolic SAR (0,02-0,02-0,2): | 20.95 | |

| Elder Ray (13): | -0.13 | |

| Super Trend (3,10): | 21.54 | |

| Zig ZAG (10): | 20.10 | |

| VORTEX (21): | 0.9100 | |

| Stochastique (14,3,5): | 15.61 | |

| TEMA (21): | 19.75 | |

| Williams %R (14): | -63.97 | |

| Chande Momentum Oscillator (20): | -0.72 | |

| Repulse (5,40,3): | 0.6800 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.1500 | |

| Courbe Coppock: | 9.50 |

| MA7: | 19.75 | |

| MA20: | 20.33 | |

| MA50: | 20.68 | |

| MA100: | 22.86 | |

| MAexp7: | 19.78 | |

| MAexp20: | 20.12 | |

| MAexp50: | 20.87 | |

| MAexp100: | 21.95 | |

| Price / MA7: | +1.82% | |

| Price / MA20: | -1.08% | |

| Price / MA50: | -2.76% | |

| Price / MA100: | -12.03% | |

| Price / MAexp7: | +1.67% | |

| Price / MAexp20: | -0.05% | |

| Price / MAexp50: | -3.64% | |

| Price / MAexp100: | -8.38% |

News

The last news published on PINDUODUO INC. ADS at the time of the generation of this analysis was as follows:

- Pinduoduo Announces First Quarter 2019 Unaudited Financial Results

- Pinduoduo to Report First Quarter 2019 Unaudited Financial Results on May 20, 2019

- Pinduoduo Files Annual Report on Form 20-F for Fiscal Year 2018

- Pinduoduo Announces Fourth Quarter and Fiscal Year 2018 Results

- Pinduoduo to Report Fourth Quarter and Fiscal Year 2018 Unaudited Financial Results on March 13, 2019

Add a comment

Comments

0 comments on the analysis PDD HOLDINGS INC. ADS - Daily