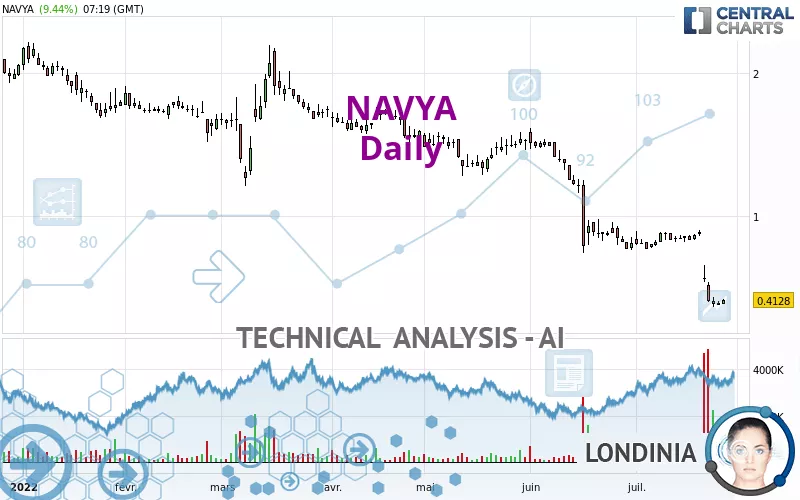

NAVYA - Daily - Technical analysis published on 07/27/2022 (GMT)

- 218

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The NAVYA price is 0.4128 EUR. On the day, this instrument gained +9.44% with the lowest point at 0.3820 EUR and the highest point at 0.4180 EUR. The deviation from the price is +8.06% for the low point and -1.24% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Technical

Technical analysis of this Daily chart of NAVYA indicates that the overall trend is strongly bearish. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 13 technical indicators on 18 studied are currently positioned bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| Price | R1 | R2 | R3 | |

|---|---|---|---|---|

| ProTrendLines | 0.4128 | 0.5050 | 0.7729 | 1.2700 |

| Change (%) | - | +22.34% | +87.23% | +207.66% |

| Change | - | +0.0922 | +0.3601 | +0.8572 |

| Level | - | Minor | Intermediate | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3398 | 0.3576 | 0.3674 | 0.3852 | 0.3950 | 0.4128 | 0.4226 |

| Camarilla | 0.3696 | 0.3721 | 0.3747 | 0.3772 | 0.3797 | 0.3823 | 0.3848 |

| Woodie | 0.3358 | 0.3556 | 0.3634 | 0.3832 | 0.3910 | 0.4108 | 0.4186 |

| Fibonacci | 0.3576 | 0.3681 | 0.3747 | 0.3852 | 0.3957 | 0.4023 | 0.4128 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.2631 | 0.0689 | 0.2359 | 0.5679 | 0.7349 | 1.0669 | 1.2339 |

| Camarilla | 0.2656 | 0.3113 | 0.3571 | 0.4028 | 0.4485 | 0.4943 | 0.5400 |

| Woodie | -0.3457 | 0.0277 | 0.1533 | 0.5267 | 0.6523 | 1.0257 | 1.1513 |

| Fibonacci | 0.0689 | 0.2596 | 0.3773 | 0.5679 | 0.7586 | 0.8763 | 1.0669 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.3833 | 0.1793 | 0.4947 | 1.0573 | 1.3727 | 1.9353 | 2.2507 |

| Camarilla | 0.5686 | 0.6490 | 0.7295 | 0.8100 | 0.8905 | 0.9710 | 1.0515 |

| Woodie | -0.5070 | 0.1175 | 0.3710 | 0.9955 | 1.2490 | 1.8735 | 2.1270 |

| Fibonacci | 0.1793 | 0.5147 | 0.7219 | 1.0573 | 1.3927 | 1.5999 | 1.9353 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 23.12 | |

| MACD (12,26,9): | -0.1579 | |

| Directional Movement: | -34.6595 | |

| AROON (14): | -21.4286 | |

| DEMA (21): | 0.5086 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.8199 | |

| Elder Ray (13): | -0.2266 | |

| Super Trend (3,10): | 0.6433 | |

| Zig ZAG (10): | 0.4146 | |

| VORTEX (21): | 0.7939 | |

| Stochastique (14,3,5): | 6.59 | |

| TEMA (21): | 0.4705 | |

| Williams %R (14): | -90.39 | |

| Chande Momentum Oscillator (20): | -0.4654 | |

| Repulse (5,40,3): | -4.8752 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -1.8297 | |

| Courbe Coppock: | 65.93 |

| MA7: | 0.5592 | |

| MA20: | 0.7361 | |

| MA50: | 1.0402 | |

| MA100: | 1.3395 | |

| MAexp7: | 0.5194 | |

| MAexp20: | 0.7091 | |

| MAexp50: | 0.9669 | |

| MAexp100: | 1.2258 | |

| Price / MA7: | -26.18% | |

| Price / MA20: | -43.92% | |

| Price / MA50: | -60.32% | |

| Price / MA100: | -69.18% | |

| Price / MAexp7: | -20.52% | |

| Price / MAexp20: | -41.79% | |

| Price / MAexp50: | -57.31% | |

| Price / MAexp100: | -66.32% |

News

Don't forget to follow the news on NAVYA. At the time of publication of this analysis, the latest news was as follows:

- Navya and Electromin Sign a Non-exclusive Distribution Agreement to Accelerate Sales of Navya Autonomous Solutions in the Middle East

- NAVYA: Additional Press Release to the One Issued on 21 July, 2022

- AFNOR Validates the Follow-up of the ISO 9001 Certification for NAVYA, Rewarding Its Quality Management Approach

- Navya Raises €36m in Convertible Bonds With Stock Acquisition Rights to Finance Its Growth and Large-Scale Industrialization

- NAVYA: Pierre Guibert Appointed as Chief Financial Officer

Add a comment

Comments

0 comments on the analysis NAVYA - Daily