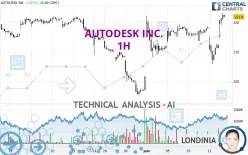

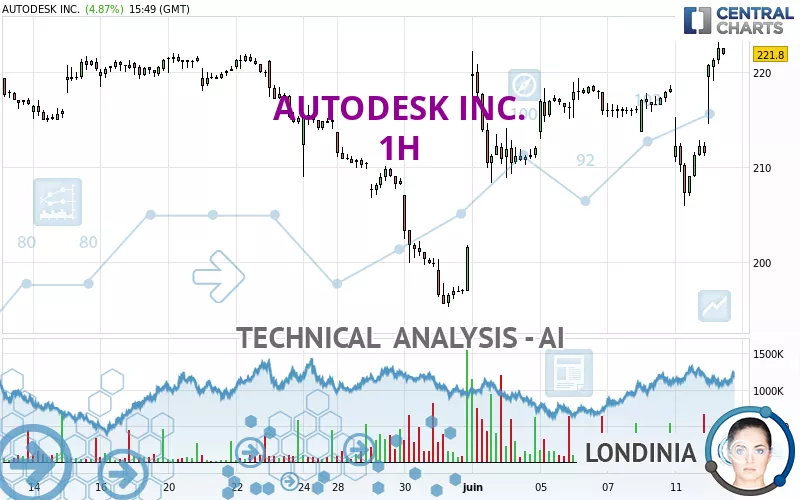

AUTODESK INC. - 1H - Technical analysis published on 06/12/2024 (GMT)

- 158

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

AUTODESK INC. rating 222.91 USD. The price has increased by +5.40% since the last closing and was traded between 214.51 USD and 223.11 USD over the period. The price is currently at +3.92% from its lowest and -0.09% from its highest.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of AUTODESK INC. in 1H shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

In fact, 14 technical indicators on 18 studied are currently positioned bullish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : 1 hour

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

Resistance of triangle is broken

Type : Bullish

Timeframe : 1 hour

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 214.79 | 218.60 | 221.67 | 222.91 | 227.19 | 234.04 | 247.42 |

| Change (%) | -3.64% | -1.93% | -0.56% | - | +1.92% | +4.99% | +11.00% |

| Change | -8.12 | -4.31 | -1.24 | - | +4.28 | +11.13 | +24.51 |

| Level | Minor | Minor | Major | - | Minor | Intermediate | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 197.05 | 201.45 | 206.48 | 210.88 | 215.91 | 220.31 | 225.34 |

| Camarilla | 208.91 | 209.77 | 210.64 | 211.50 | 212.36 | 213.23 | 214.09 |

| Woodie | 197.36 | 201.61 | 206.79 | 211.04 | 216.22 | 220.47 | 225.65 |

| Fibonacci | 201.45 | 205.06 | 207.28 | 210.88 | 214.49 | 216.71 | 220.31 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 194.99 | 201.66 | 208.86 | 215.53 | 222.73 | 229.40 | 236.60 |

| Camarilla | 212.24 | 213.51 | 214.78 | 216.05 | 217.32 | 218.59 | 219.86 |

| Woodie | 195.25 | 201.79 | 209.12 | 215.66 | 222.99 | 229.53 | 236.86 |

| Fibonacci | 201.66 | 206.96 | 210.24 | 215.53 | 220.83 | 224.11 | 229.40 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 163.96 | 179.64 | 190.62 | 206.30 | 217.28 | 232.96 | 243.94 |

| Camarilla | 194.27 | 196.71 | 199.16 | 201.60 | 204.04 | 206.49 | 208.93 |

| Woodie | 161.61 | 178.47 | 188.27 | 205.13 | 214.93 | 231.79 | 241.59 |

| Fibonacci | 179.64 | 189.82 | 196.12 | 206.30 | 216.48 | 222.78 | 232.96 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 66.87 | |

| MACD (12,26,9): | 0.8600 | |

| Directional Movement: | 16.34 | |

| AROON (14): | 50.00 | |

| DEMA (21): | 216.47 | |

| Parabolic SAR (0,02-0,02-0,2): | 206.77 | |

| Elder Ray (13): | 5.78 | |

| Super Trend (3,10): | 213.53 | |

| Zig ZAG (10): | 222.62 | |

| VORTEX (21): | 1.0900 | |

| Stochastique (14,3,5): | 99.00 | |

| TEMA (21): | 216.66 | |

| Williams %R (14): | -0.82 | |

| Chande Momentum Oscillator (20): | 5.55 | |

| Repulse (5,40,3): | 2.6600 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0100 | |

| Courbe Coppock: | 0.48 |

| MA7: | 216.13 | |

| MA20: | 214.88 | |

| MA50: | 220.17 | |

| MA100: | 238.69 | |

| MAexp7: | 217.60 | |

| MAexp20: | 215.63 | |

| MAexp50: | 214.45 | |

| MAexp100: | 214.01 | |

| Price / MA7: | +3.14% | |

| Price / MA20: | +3.74% | |

| Price / MA50: | +1.24% | |

| Price / MA100: | -6.61% | |

| Price / MAexp7: | +2.44% | |

| Price / MAexp20: | +3.38% | |

| Price / MAexp50: | +3.94% | |

| Price / MAexp100: | +4.16% |

News

Don't forget to follow the news on AUTODESK INC.. At the time of publication of this analysis, the latest news was as follows:

- ADSK Investors Have Opportunity to Lead Autodesk, Inc. Securities Fraud Lawsuit

- AUTODESK, INC. ANNOUNCES FISCAL 2025 FIRST QUARTER RESULTS

- ADSK Investors Have Opportunity to Lead Autodesk, Inc. Securities Fraud Lawsuit

- Autodesk files Forms 10-K and 10-Q and announces financial results conference call

- Autodesk, Inc. Class Action: The Gross Law Firm Reminds Autodesk Investors of the Pending Class Action Lawsuit with a Lead Plaintiff Deadline of June 24, 2024 - ADSK

Add a comment

Comments

0 comments on the analysis AUTODESK INC. - 1H