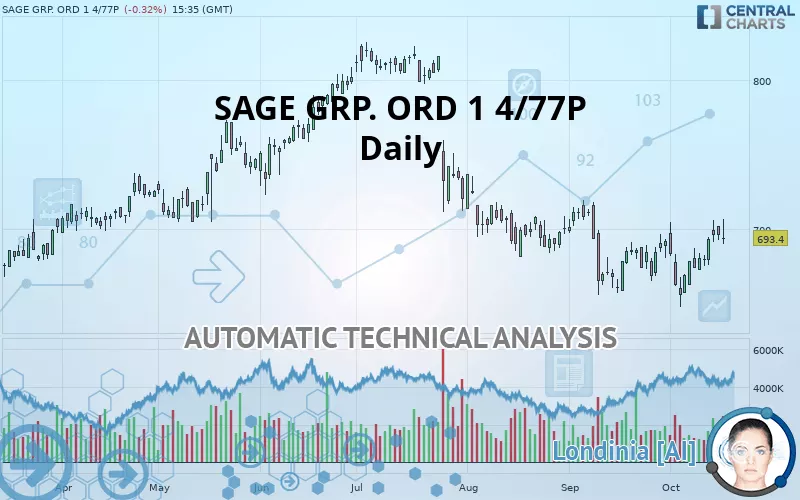

THE SAGE GRP. ORD 1 4/77P - Daily - Technical analysis published on 10/16/2019 (GMT)

- 336

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The SAGE GRP. ORD 1 4/77P price is 693.4 GBX. The price registered a decrease of -0.32% on the session and was between 689.8 GBX and 706.6 GBX. This implies that the price is at +0.52% from its lowest and at -1.87% from its highest.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Technical

Technical analysis of SAGE GRP. ORD 1 4/77P in Daily shows an overall bearish trend. 67.86% of the signals given by moving averages are bearish. Caution: the slightly bullish signals currently being given by short-term moving averages indicate that this bearish trend may be slowing down. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

An assessment of technical indicators shows a moderate bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 598.8 | 636.5 | 671.8 | 693.4 | 704.2 | 729.0 | 756.0 |

| Change (%) | -13.64% | -8.21% | -3.12% | - | +1.56% | +5.13% | +9.03% |

| Change | -94.6 | -56.9 | -21.6 | - | +10.8 | +35.6 | +62.6 |

| Level | Major | Intermediate | Major | - | Major | Intermediate | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 682.3 | 687.3 | 691.5 | 696.5 | 700.7 | 705.7 | 709.9 |

| Camarilla | 693.1 | 693.9 | 694.8 | 695.6 | 696.4 | 697.3 | 698.1 |

| Woodie | 681.8 | 687.1 | 691.0 | 696.3 | 700.2 | 705.5 | 709.4 |

| Fibonacci | 687.3 | 690.9 | 693.0 | 696.5 | 700.1 | 702.2 | 705.7 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 639.2 | 650.6 | 671.8 | 683.2 | 704.4 | 715.8 | 737.0 |

| Camarilla | 684.0 | 687.0 | 690.0 | 693.0 | 696.0 | 699.0 | 702.0 |

| Woodie | 644.1 | 653.1 | 676.7 | 685.7 | 709.3 | 718.3 | 741.9 |

| Fibonacci | 650.6 | 663.1 | 670.8 | 683.2 | 695.7 | 703.4 | 715.8 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 594.3 | 624.7 | 658.1 | 688.5 | 721.9 | 752.3 | 785.7 |

| Camarilla | 673.9 | 679.7 | 685.6 | 691.4 | 697.3 | 703.1 | 709.0 |

| Woodie | 595.7 | 625.5 | 659.5 | 689.3 | 723.3 | 753.1 | 787.1 |

| Fibonacci | 624.7 | 649.1 | 664.2 | 688.5 | 712.9 | 728.0 | 752.3 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 54.20 | |

| MACD (12,26,9): | 0.0000 | |

| Directional Movement: | 10.2 | |

| AROON (14): | 64.3 | |

| DEMA (21): | 681.7 | |

| Parabolic SAR (0,02-0,02-0,2): | 649.3 | |

| Elder Ray (13): | 13.4 | |

| Super Trend (3,10): | 706.3 | |

| Zig ZAG (10): | 693.4 | |

| VORTEX (21): | 1.1000 | |

| Stochastique (14,3,5): | 80.90 | |

| TEMA (21): | 689.9 | |

| Williams %R (14): | -22.10 | |

| Chande Momentum Oscillator (20): | 2.0 | |

| Repulse (5,40,3): | -0.8000 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.1000 | |

| Courbe Coppock: | 1.80 |

| MA7: | 687.2 | |

| MA20: | 680.9 | |

| MA50: | 688.6 | |

| MA100: | 732.5 | |

| MAexp7: | 688.6 | |

| MAexp20: | 684.0 | |

| MAexp50: | 695.4 | |

| MAexp100: | 705.4 | |

| Price / MA7: | +0.90% | |

| Price / MA20: | +1.84% | |

| Price / MA50: | +0.70% | |

| Price / MA100: | -5.34% | |

| Price / MAexp7: | +0.70% | |

| Price / MAexp20: | +1.37% | |

| Price / MAexp50: | -0.29% | |

| Price / MAexp100: | -1.70% |

News

Don"t forget to follow the news on SAGE GRP. ORD 1 4/77P. At the time of publication of this analysis, the latest news was as follows:

- Canadian Business Owners Give Current Federal Government A Thumbs-Down

- UPDATE -- New research from Sage reveals 82% of HR leaders anticipate their role will be unrecognizable in 10 years’ time

- New research from Sage reveals 82% of HR leaders anticipate their role will be unrecognizable in 10 years’ time

- New research from Sage reveals only 61% of U.S. businesses plan to invest in future tech and digital skills to increase profitability, trade potential

- Canadian Small and Medium Businesses More Productive Compared to Global Peers, Sage Research Reveals

Add a comment

Comments

0 comments on the analysis THE SAGE GRP. ORD 1 4/77P - Daily