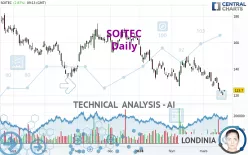

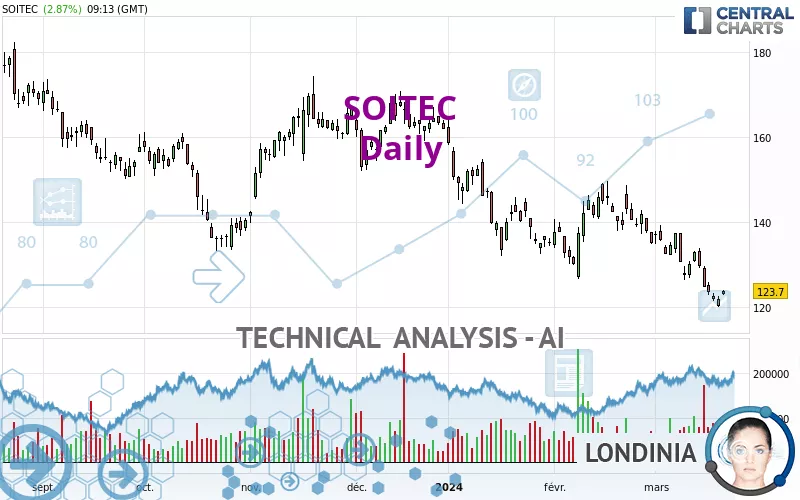

SOITEC - Daily - Technical analysis published on 03/21/2024 (GMT)

- 207

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

SOITEC rating 123.70 EUR. The price registered an increase of +2.87% on the session with the lowest point at 122.85 EUR and the highest point at 124.10 EUR. The deviation from the price is +0.69% for the low point and -0.32% for the high point.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by SOITEC:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this SOITEC chart shows a sharp bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The technical indicators are generally neutral. They do not provide relevant information on the direction of future price movements.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Daily

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 76.48 | 106.30 | 121.40 | 123.70 | 136.05 | 142.93 | 169.01 |

| Change (%) | -38.17% | -14.07% | -1.86% | - | +9.98% | +15.55% | +36.63% |

| Change | -47.22 | -17.40 | -2.30 | - | +12.35 | +19.23 | +45.31 |

| Level | Minor | Minor | Major | - | Intermediate | Major | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 116.85 | 118.45 | 119.35 | 120.95 | 121.85 | 123.45 | 124.35 |

| Camarilla | 119.56 | 119.79 | 120.02 | 120.25 | 120.48 | 120.71 | 120.94 |

| Woodie | 116.50 | 118.28 | 119.00 | 120.78 | 121.50 | 123.28 | 124.00 |

| Fibonacci | 118.45 | 119.41 | 120.00 | 120.95 | 121.91 | 122.50 | 123.45 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 112.60 | 118.70 | 121.75 | 127.85 | 130.90 | 137.00 | 140.05 |

| Camarilla | 122.28 | 123.12 | 123.96 | 124.80 | 125.64 | 126.48 | 127.32 |

| Woodie | 111.08 | 117.94 | 120.23 | 127.09 | 129.38 | 136.24 | 138.53 |

| Fibonacci | 118.70 | 122.20 | 124.36 | 127.85 | 131.35 | 133.51 | 137.00 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 101.65 | 114.15 | 124.65 | 137.15 | 147.65 | 160.15 | 170.65 |

| Camarilla | 128.83 | 130.93 | 133.04 | 135.15 | 137.26 | 139.37 | 141.48 |

| Woodie | 100.65 | 113.65 | 123.65 | 136.65 | 146.65 | 159.65 | 169.65 |

| Fibonacci | 114.15 | 122.94 | 128.36 | 137.15 | 145.94 | 151.36 | 160.15 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 38.35 | |

| MACD (12,26,9): | -4.6500 | |

| Directional Movement: | -11.83 | |

| AROON (14): | -85.72 | |

| DEMA (21): | 124.71 | |

| Parabolic SAR (0,02-0,02-0,2): | 127.73 | |

| Elder Ray (13): | -4.36 | |

| Super Trend (3,10): | 133.03 | |

| Zig ZAG (10): | 123.70 | |

| VORTEX (21): | 0.7600 | |

| Stochastique (14,3,5): | 9.04 | |

| TEMA (21): | 122.67 | |

| Williams %R (14): | -80.94 | |

| Chande Momentum Oscillator (20): | -8.90 | |

| Repulse (5,40,3): | -2.3300 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.3700 | |

| Courbe Coppock: | 18.41 |

| MA7: | 125.34 | |

| MA20: | 131.92 | |

| MA50: | 136.54 | |

| MA100: | 147.98 | |

| MAexp7: | 124.88 | |

| MAexp20: | 130.38 | |

| MAexp50: | 137.19 | |

| MAexp100: | 143.19 | |

| Price / MA7: | -1.31% | |

| Price / MA20: | -6.23% | |

| Price / MA50: | -9.40% | |

| Price / MA100: | -16.41% | |

| Price / MAexp7: | -0.94% | |

| Price / MAexp20: | -5.12% | |

| Price / MAexp50: | -9.83% | |

| Price / MAexp100: | -13.61% |

News

Don't forget to follow the news on SOITEC. At the time of publication of this analysis, the latest news was as follows:

- Information Relating to the Total Number of Voting Rights and Shares Forming the Share Capital

- Soitec: Half-Year Statement on the Implementation of the Liquidity Contract as of December 31, 2023

- INFORMATION RELATING TO THE TOTAL NUMBER OF VOTING RIGHTS AND SHARES FORMING THE SHARE CAPITAL

- AVAILABILITY OF 2023-2024 HALF-YEAR FINANCIAL REPORT

- SOITEC REPORTS SECOND QUARTER REVENUE AND FIRST HALF RESULTS OF FISCAL YEAR 2024

Add a comment

Comments

0 comments on the analysis SOITEC - Daily