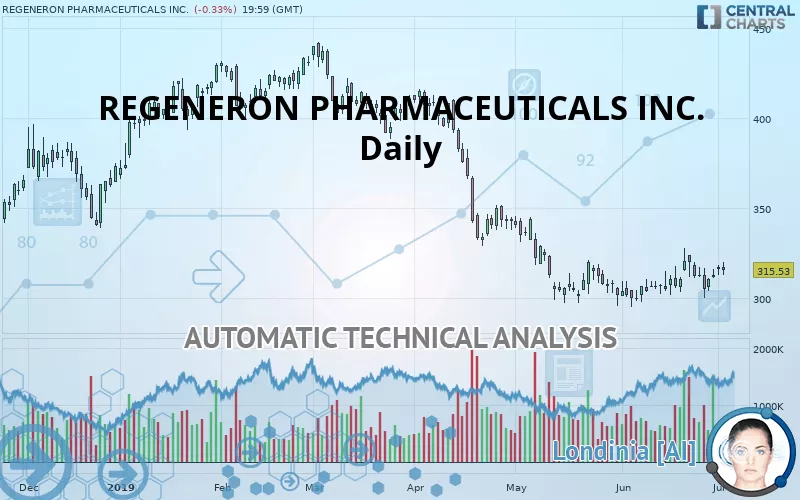

REGENERON PHARMACEUTICALS INC. - Daily - Technical analysis published on 07/03/2019 (GMT)

- 401

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The REGENERON PHARMACEUTICALS INC. price is 315.53 USD. The price registered a decrease of -0.33% on the session and was between 313.00 USD and 320.42 USD. This implies that the price is at +0.81% from its lowest and at -1.53% from its highest.A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of REGENERON PHARMACEUTICALS INC. in Daily shows an overall bearish trend. The signals given by moving averages are 71.43% bearish. This bearish trend could slow down given the neutral signals currently being given by short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

The probability of a further increase is slight given the direction of the technical indicators.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near resistance of triangle

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 187.74 | 284.40 | 299.60 | 315.53 | 333.12 | 382.83 | 408.51 |

| Change (%) | -40.50% | -9.87% | -5.05% | - | +5.57% | +21.33% | +29.47% |

| Change | -127.79 | -31.13 | -15.93 | - | +17.59 | +67.30 | +92.98 |

| Level | Minor | Major | Major | - | Major | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 308.16 | 310.66 | 313.61 | 316.10 | 319.05 | 321.55 | 324.50 |

| Camarilla | 315.06 | 315.56 | 316.06 | 316.56 | 317.06 | 317.56 | 318.06 |

| Woodie | 308.39 | 310.77 | 313.84 | 316.22 | 319.28 | 321.66 | 324.73 |

| Fibonacci | 310.66 | 312.74 | 314.02 | 316.10 | 318.18 | 319.47 | 321.55 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 282.44 | 291.48 | 302.24 | 311.28 | 322.04 | 331.08 | 341.84 |

| Camarilla | 307.55 | 309.37 | 311.18 | 313.00 | 314.82 | 316.63 | 318.45 |

| Woodie | 283.30 | 291.91 | 303.10 | 311.71 | 322.90 | 331.51 | 342.70 |

| Fibonacci | 291.48 | 299.04 | 303.72 | 311.28 | 318.84 | 323.52 | 331.08 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 52.05 | |

| MACD (12,26,9): | -0.7800 | |

| Directional Movement: | 3.48 | |

| AROON (14): | -28.57 | |

| DEMA (21): | 309.64 | |

| Parabolic SAR (0,02-0,02-0,2): | 325.71 | |

| Elder Ray (13): | 4.48 | |

| Super Trend (3,10): | 329.80 | |

| Zig ZAG (10): | 315.53 | |

| VORTEX (21): | 1.0300 | |

| Stochastique (14,3,5): | 53.13 | |

| TEMA (21): | 316.28 | |

| Williams %R (14): | -45.04 | |

| Chande Momentum Oscillator (20): | 10.29 | |

| Repulse (5,40,3): | -1.2700 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.0900 | |

| Courbe Coppock: | 5.37 |

| MA7: | 312.33 | |

| MA20: | 309.58 | |

| MA50: | 316.47 | |

| MA100: | 361.24 | |

| MAexp7: | 313.44 | |

| MAexp20: | 312.04 | |

| MAexp50: | 323.87 | |

| MAexp100: | 343.78 | |

| Price / MA7: | +1.02% | |

| Price / MA20: | +1.92% | |

| Price / MA50: | -0.30% | |

| Price / MA100: | -12.65% | |

| Price / MAexp7: | +0.67% | |

| Price / MAexp20: | +1.12% | |

| Price / MAexp50: | -2.58% | |

| Price / MAexp100: | -8.22% |

News

Don"t forget to follow the news on REGENERON PHARMACEUTICALS INC.. At the time of publication of this analysis, the latest news was as follows:

- Libtayo® (cemiplimab) Approved for Advanced Cutaneous Squamous Cell Carcinoma in the European Union

- CHMP Recommends Approval of Dupixent® (dupilumab) for Moderate-to-Severe Atopic Dermatitis in Adolescents

- FDA Approves Dupixent® (dupilumab) for Chronic Rhinosinusitis with Nasal Polyposis

- Regeneron and Sanofi Announce Positive Topline Phase 2 Results for IL-33 Antibody in Asthma

- Regeneron CD20xCD3 Bispecific REGN1979 Shows Positive Results in Patients with Relapsed or Refractory B-cell Non-Hodgkin Lymphoma, including in CAR-T Failures

Add a comment

Comments

0 comments on the analysis REGENERON PHARMACEUTICALS INC. - Daily