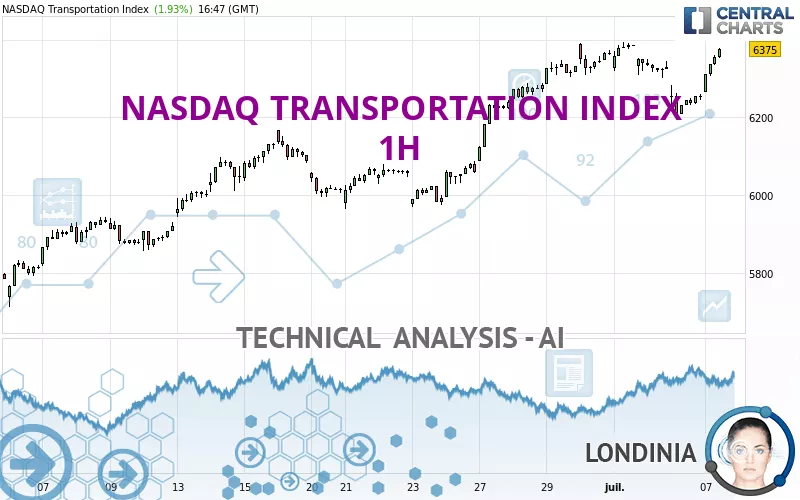

NASDAQ TRANSPORTATION INDEX - 1H - Technical analysis published on 07/07/2023 (GMT)

- 145

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The NASDAQ TRANSPORTATION INDEX price is 6,375.00 USD. On the day, this instrument gained +1.93% and was between 6,264.74 USD and 6,377.52 USD. This implies that the price is at +1.76% from its lowest and at -0.04% from its highest.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this 1H chart of NASDAQ TRANSPORTATION INDEX indicates that the overall trend is strongly bullish. The signals given by moving averages are 89.29% bullish. This strongly bullish trend seems to be running out of steam given the signals being given by short-term moving averages. The Central Indicators market scanner is currently detecting a bearish signal that could impact this trend:

Moving Average bearish crossovers : AMA20 & AMA50

Type : Bearish

Timeframe : 1 hour

In fact, according to the parameters integrated into the Central Analyzer system, 14 technical indicators out of 18 analysed are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : 1 hour

MACD indicator is back over 0

Type : Bullish

Timeframe : 1 hour

Central Patterns, the scanner specializing in chart patterns, did not identify any signals.

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Bearish harami

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 5,966.95 | 6,127.72 | 6,258.00 | 6,375.00 | 6,393.41 | 6,905.90 |

| Change (%) | -6.40% | -3.88% | -1.84% | - | +0.29% | +8.33% |

| Change | -408.05 | -247.28 | -117.00 | - | +18.41 | +530.90 |

| Level | Major | Major | Major | - | Intermediate | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 6,138.90 | 6,173.71 | 6,213.99 | 6,248.80 | 6,289.08 | 6,323.89 | 6,364.17 |

| Camarilla | 6,233.63 | 6,240.51 | 6,247.40 | 6,254.28 | 6,261.16 | 6,268.05 | 6,274.93 |

| Woodie | 6,141.65 | 6,175.08 | 6,216.74 | 6,250.17 | 6,291.83 | 6,325.26 | 6,366.92 |

| Fibonacci | 6,173.71 | 6,202.39 | 6,220.11 | 6,248.80 | 6,277.48 | 6,295.20 | 6,323.89 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5,712.42 | 5,853.92 | 6,108.10 | 6,249.60 | 6,503.78 | 6,645.28 | 6,899.46 |

| Camarilla | 6,253.46 | 6,289.73 | 6,326.00 | 6,362.27 | 6,398.54 | 6,434.81 | 6,471.08 |

| Woodie | 5,768.75 | 5,882.09 | 6,164.43 | 6,277.77 | 6,560.11 | 6,673.45 | 6,955.79 |

| Fibonacci | 5,853.92 | 6,005.07 | 6,098.45 | 6,249.60 | 6,400.75 | 6,494.13 | 6,645.28 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5,073.63 | 5,342.90 | 5,852.58 | 6,121.85 | 6,631.53 | 6,900.80 | 7,410.48 |

| Camarilla | 6,148.06 | 6,219.46 | 6,290.87 | 6,362.27 | 6,433.67 | 6,505.08 | 6,576.48 |

| Woodie | 5,193.85 | 5,403.00 | 5,972.80 | 6,181.95 | 6,751.75 | 6,960.90 | 7,530.70 |

| Fibonacci | 5,342.90 | 5,640.46 | 5,824.29 | 6,121.85 | 6,419.41 | 6,603.24 | 6,900.80 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 63.82 | |

| MACD (12,26,9): | 5.6400 | |

| Directional Movement: | 11.58 | |

| AROON (14): | 64.29 | |

| DEMA (21): | 6,313.55 | |

| Parabolic SAR (0,02-0,02-0,2): | 6,224.27 | |

| Elder Ray (13): | 52.48 | |

| Super Trend (3,10): | 6,275.27 | |

| Zig ZAG (10): | 6,371.11 | |

| VORTEX (21): | 1.0800 | |

| Stochastique (14,3,5): | 95.75 | |

| TEMA (21): | 6,301.48 | |

| Williams %R (14): | 0.00 | |

| Chande Momentum Oscillator (20): | 50.69 | |

| Repulse (5,40,3): | 1.3000 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0100 | |

| Courbe Coppock: | 1.14 |

| MA7: | 6,332.15 | |

| MA20: | 6,137.20 | |

| MA50: | 5,888.89 | |

| MA100: | 5,837.79 | |

| MAexp7: | 6,321.74 | |

| MAexp20: | 6,306.67 | |

| MAexp50: | 6,272.62 | |

| MAexp100: | 6,188.25 | |

| Price / MA7: | +0.68% | |

| Price / MA20: | +3.87% | |

| Price / MA50: | +8.25% | |

| Price / MA100: | +9.20% | |

| Price / MAexp7: | +0.84% | |

| Price / MAexp20: | +1.08% | |

| Price / MAexp50: | +1.63% | |

| Price / MAexp100: | +3.02% |

Add a comment

Comments

0 comments on the analysis NASDAQ TRANSPORTATION INDEX - 1H