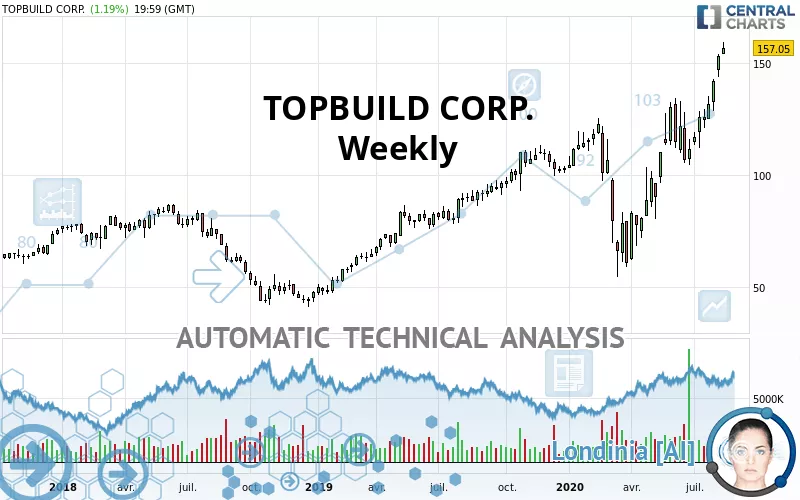

TOPBUILD CORP. - Weekly - Technical analysis published on 08/20/2020 (GMT)

- 330

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Weekly

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

TOPBUILD CORP. rating 157.05 USD. The price is up +2.78% over 5 days and has been traded over the last 5 days between 154.00 USD and 159.56 USD. This implies that the 5 day price is +1.98% from its lowest point and -1.57% from its highest point.Here is a more detailed summary of the historical variations registered by TOPBUILD CORP.:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Weekly of this TOPBUILD CORP. chart shows a strongly bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 16 technical indicators on 18 studied are currently bullish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Weekly

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Weekly

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Upside gap

Type : Bullish

Timeframe : Weekly

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 86.79 | 112.26 | 130.55 | 157.05 |

| Change (%) | -44.74% | -28.52% | -16.87% | - |

| Change | -70.26 | -44.79 | -26.50 | - |

| Level | Major | Intermediate | Major | - |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 149.14 | 152.10 | 153.65 | 156.61 | 158.16 | 161.12 | 162.67 |

| Camarilla | 153.97 | 154.38 | 154.80 | 155.21 | 155.62 | 156.04 | 156.45 |

| Woodie | 148.45 | 151.75 | 152.96 | 156.26 | 157.47 | 160.77 | 161.98 |

| Fibonacci | 152.10 | 153.82 | 154.88 | 156.61 | 158.33 | 159.39 | 161.12 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 136.12 | 139.93 | 146.68 | 150.49 | 157.24 | 161.05 | 167.80 |

| Camarilla | 150.54 | 151.50 | 152.47 | 153.44 | 154.41 | 155.38 | 156.34 |

| Woodie | 137.60 | 140.67 | 148.16 | 151.23 | 158.72 | 161.79 | 169.28 |

| Fibonacci | 139.93 | 143.96 | 146.45 | 150.49 | 154.52 | 157.01 | 161.05 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 92.75 | 102.03 | 116.98 | 126.26 | 141.21 | 150.49 | 165.44 |

| Camarilla | 125.26 | 127.48 | 129.70 | 131.92 | 134.14 | 136.36 | 138.58 |

| Woodie | 95.58 | 103.45 | 119.81 | 127.68 | 144.04 | 151.91 | 168.27 |

| Fibonacci | 102.03 | 111.29 | 117.01 | 126.26 | 135.52 | 141.24 | 150.49 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 68.40 | |

| MACD (12,26,9): | 13.0000 | |

| Directional Movement: | 23.76 | |

| AROON (14): | 100.00 | |

| DEMA (21): | 136.09 | |

| Parabolic SAR (0,02-0,02-0,2): | 119.07 | |

| Elder Ray (13): | 27.99 | |

| Super Trend (3,10): | 114.70 | |

| Zig ZAG (10): | 157.05 | |

| VORTEX (21): | 1.2200 | |

| Stochastique (14,3,5): | 97.61 | |

| TEMA (21): | 145.12 | |

| Williams %R (14): | -4.00 | |

| Chande Momentum Oscillator (20): | 42.36 | |

| Repulse (5,40,3): | 12.3400 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 1.0800 | |

| Courbe Coppock: | 96.91 |

| MA7: | 152.47 | |

| MA20: | 140.78 | |

| MA50: | 127.98 | |

| MA100: | 110.42 | |

| MAexp7: | 139.29 | |

| MAexp20: | 121.40 | |

| MAexp50: | 106.79 | |

| MAexp100: | 93.70 | |

| Price / MA7: | +3.00% | |

| Price / MA20: | +11.56% | |

| Price / MA50: | +22.71% | |

| Price / MA100: | +42.23% | |

| Price / MAexp7: | +12.75% | |

| Price / MAexp20: | +29.37% | |

| Price / MAexp50: | +47.06% | |

| Price / MAexp100: | +67.61% |

News

The last news published on TOPBUILD CORP. at the time of the generation of this analysis was as follows:

- TopBuild Corp. to Host Earnings Call

- TopBuild Acquires Canyon Insulation

- TopBuild to Present at J.P. Morgan Homebuilding & Building Products Conference Wednesday, May 17 at 1:50 p.m.

- TopBuild Reports Strong First Quarter 2017 Results

- TopBuild Acquires Superior Insulation Products

Add a comment

Comments

0 comments on the analysis TOPBUILD CORP. - Weekly