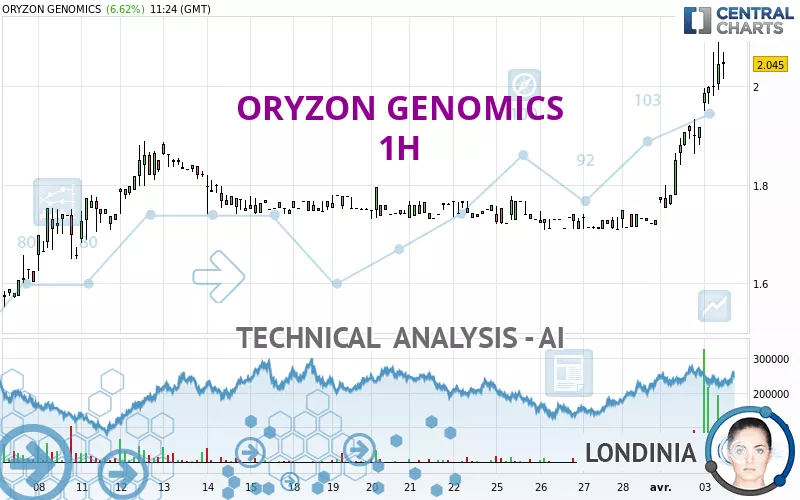

ORYZON GENOMICS - 1H - Technical analysis published on 04/03/2024 (GMT)

- 162

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

ORYZON GENOMICS rating 2.060 EUR. The price has increased by +7.40% since the last closing with the lowest point at 1.950 EUR and the highest point at 2.090 EUR. The deviation from the price is +5.64% for the low point and -1.44% for the high point.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Technical

A technical analysis in 1H of this ORYZON GENOMICS chart shows a strongly bullish trend. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 15 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 80

Type : Neutral

Timeframe : 1 hour

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.861 | 1.890 | 2.040 | 2.060 | 2.130 | 2.213 | 2.608 |

| Change (%) | -9.66% | -8.25% | -0.97% | - | +3.40% | +7.43% | +26.60% |

| Change | -0.199 | -0.170 | -0.020 | - | +0.070 | +0.153 | +0.548 |

| Level | Intermediate | Minor | Major | - | Minor | Intermediate | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.623 | 1.689 | 1.803 | 1.869 | 1.983 | 2.049 | 2.163 |

| Camarilla | 1.869 | 1.885 | 1.902 | 1.918 | 1.935 | 1.951 | 1.968 |

| Woodie | 1.648 | 1.701 | 1.828 | 1.881 | 2.008 | 2.061 | 2.188 |

| Fibonacci | 1.689 | 1.757 | 1.800 | 1.869 | 1.937 | 1.980 | 2.049 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.621 | 1.665 | 1.691 | 1.735 | 1.761 | 1.805 | 1.831 |

| Camarilla | 1.699 | 1.705 | 1.712 | 1.718 | 1.724 | 1.731 | 1.737 |

| Woodie | 1.613 | 1.661 | 1.683 | 1.731 | 1.753 | 1.801 | 1.823 |

| Fibonacci | 1.665 | 1.691 | 1.708 | 1.735 | 1.761 | 1.778 | 1.805 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.212 | 1.382 | 1.550 | 1.720 | 1.888 | 2.058 | 2.226 |

| Camarilla | 1.625 | 1.656 | 1.687 | 1.718 | 1.749 | 1.780 | 1.811 |

| Woodie | 1.211 | 1.382 | 1.549 | 1.720 | 1.887 | 2.058 | 2.225 |

| Fibonacci | 1.382 | 1.511 | 1.591 | 1.720 | 1.849 | 1.929 | 2.058 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 84.66 | |

| MACD (12,26,9): | 0.0780 | |

| Directional Movement: | 36.701 | |

| AROON (14): | 92.857 | |

| DEMA (21): | 1.985 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.959 | |

| Elder Ray (13): | 0.109 | |

| Super Trend (3,10): | 1.899 | |

| Zig ZAG (10): | 2.070 | |

| VORTEX (21): | 1.2120 | |

| Stochastique (14,3,5): | 84.38 | |

| TEMA (21): | 2.035 | |

| Williams %R (14): | -14.88 | |

| Chande Momentum Oscillator (20): | 0.286 | |

| Repulse (5,40,3): | 0.7160 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.4410 | |

| Courbe Coppock: | 29.05 |

| MA7: | 1.798 | |

| MA20: | 1.752 | |

| MA50: | 1.825 | |

| MA100: | 1.932 | |

| MAexp7: | 1.988 | |

| MAexp20: | 1.893 | |

| MAexp50: | 1.816 | |

| MAexp100: | 1.788 | |

| Price / MA7: | +14.57% | |

| Price / MA20: | +17.58% | |

| Price / MA50: | +12.88% | |

| Price / MA100: | +6.63% | |

| Price / MAexp7: | +3.62% | |

| Price / MAexp20: | +8.82% | |

| Price / MAexp50: | +13.44% | |

| Price / MAexp100: | +15.21% |

News

Don't forget to follow the news on ORYZON GENOMICS. At the time of publication of this analysis, the latest news was as follows:

- ORYZON Reports Financial Results and Corporate Update for Quarter Ended December 31, 2023

- ORYZON to Provide Corporate Progress Updates at Several Events in February-March

- ORYZON to Host KOL Event on Phase IIb PORTICO Topline Study Results of Vafidemstat in Borderline Personality Disorder on January 25, 2024

- ORYZON Announces Topline Results from Phase IIb PORTICO Study of Vafidemstat in Borderline Personality Disorder (BPD)

- ORYZON to Provide Corporate Progress Updates at Several Events in January

Add a comment

Comments

0 comments on the analysis ORYZON GENOMICS - 1H