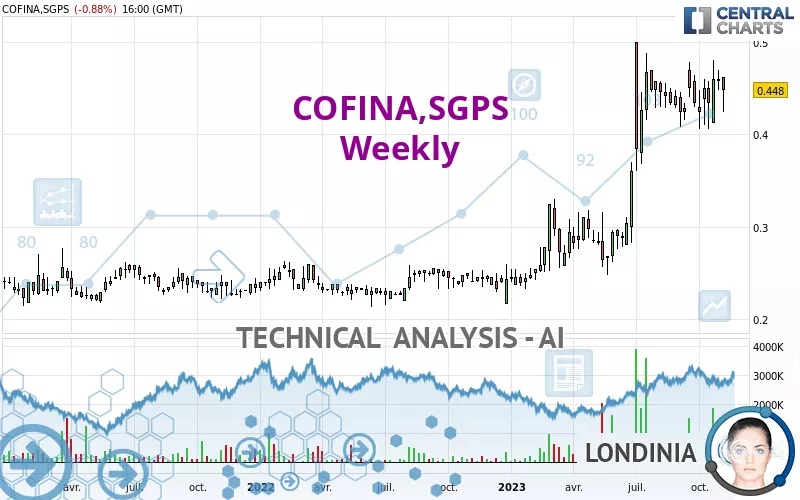

COFINA,SGPS - Weekly - Technical analysis published on 11/12/2023 (GMT)

- 133

- 0

Oops, I was wrong about that analysis. My threshold for invalidation has been broken.

Click here for a new analysis!

Click here for a new analysis!

- Timeframe : Weekly

- - Analysis generated on

- Status : INVALID

One daily analysis for free from

Summary of the analysis

Trends

Short term:

Strongly bullish

Underlying:

Strongly bullish

Technical indicators

50%

17%

33%

My opinion

Bullish above 0.406 EUR

My targets

0.463 EUR (+3.35%)

0.525 EUR (+17.12%)

My analysis

COFINA,SGPS is part of a very strong bullish trend. Traders may consider trading only long positions (at the time of purchase) as long as the price remains well above 0.406 EUR. The next resistance located at 0.463 EUR is the next bullish objective to be reached. A bullish break in this resistance would boost the bullish momentum. The bullish movement could then continue towards the next resistance located at 0.525 EUR. After this resistance, buyers could then target 0.615 EUR. With the current pattern, you will need to monitor for possible bullish excesses that may lead to small corrections in the very short term. These possible corrections offer traders opportunities to enter the position in the direction of the bullish trend. Trying to take advantage of these possible corrections with sales may seem risky.

In the very short term, the general bullish sentiment is confirmed by technical indicators. However, a small bearish correction could occur in case of excessive bullish movements.

Force

0

10

7.1

Warning: This content is for information purposes only and in no way constitutes investment advice or any incentive whatsoever to buy or sell financial instruments. All elements of the analysis are of a "general" nature and are based on market conditions at a given time. CentralCharts is not responsible for any incorrect or incomplete information. Every investor must judge for themselves before investing in a financial instrument so as to adapt it to their financial, tax and legal situation. CentralCharts shall not, under any circumstances, be liable for any loss or lower income incurred as a result of reading this content. Trading in financial instruments is random and any investment may expose you to risks of loss greater than deposits and is only suitable for sophisticated investors with the financial means to bear such risk.

This analysis was given by Tezouro.

Additional analysis

Quotes

COFINA,SGPS rating 0.448 EUR. The price is lower by -2.61% over the 5 days with the lowest point at 0.432 EUR and the highest point at 0.458 EUR. The deviation from the price is +3.70% for the low point and -2.18% for the high point.0.432

0.458

0.448

A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by COFINA,SGPS:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Weekly of this COFINA,SGPS chart shows a strongly bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators scanner does not detect any result on moving averages that would impact this trend.

The probability of a further increase is slight given the direction of the technical indicators.

Central Indicators, the scanner specialised in technical indicators, has identified this signal:

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near resistance of channel

Type : Bearish

Timeframe : Weekly

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Bearish engulfing lines

Type : Bearish

Timeframe : Weekly

ProTrendLines

S3

S2

S1

R1

R2

R3

Price

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.227 | 0.292 | 0.406 | 0.448 | 0.463 | 0.615 | 0.968 |

| Change (%) | -49.33% | -34.82% | -9.38% | - | +3.35% | +37.28% | +116.07% |

| Change | -0.221 | -0.156 | -0.042 | - | +0.015 | +0.167 | +0.520 |

| Level | Major | Intermediate | Intermediate | - | Major | Major | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

Daily

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.435 | 0.441 | 0.445 | 0.451 | 0.455 | 0.461 | 0.465 |

| Camarilla | 0.445 | 0.446 | 0.447 | 0.448 | 0.449 | 0.450 | 0.451 |

| Woodie | 0.433 | 0.441 | 0.443 | 0.451 | 0.453 | 0.461 | 0.463 |

| Fibonacci | 0.441 | 0.445 | 0.448 | 0.451 | 0.455 | 0.458 | 0.461 |

Weekly

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.427 | 0.437 | 0.449 | 0.459 | 0.471 | 0.481 | 0.493 |

| Camarilla | 0.454 | 0.456 | 0.458 | 0.460 | 0.462 | 0.464 | 0.466 |

| Woodie | 0.427 | 0.438 | 0.449 | 0.460 | 0.471 | 0.482 | 0.493 |

| Fibonacci | 0.437 | 0.446 | 0.451 | 0.459 | 0.468 | 0.473 | 0.481 |

Monthly

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.347 | 0.377 | 0.421 | 0.451 | 0.495 | 0.525 | 0.569 |

| Camarilla | 0.446 | 0.452 | 0.459 | 0.466 | 0.473 | 0.480 | 0.486 |

| Woodie | 0.355 | 0.381 | 0.429 | 0.455 | 0.503 | 0.529 | 0.577 |

| Fibonacci | 0.377 | 0.405 | 0.422 | 0.451 | 0.479 | 0.496 | 0.525 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

Technical indicators

Moving averages

| RSI (14): | 62.64 | |

| MACD (12,26,9): | 0.0360 | |

| Directional Movement: | 11.578 | |

| AROON (14): | 21.428 | |

| DEMA (21): | 0.469 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.491 | |

| Elder Ray (13): | 0.007 | |

| Super Trend (3,10): | 0.348 | |

| Zig ZAG (10): | 0.448 | |

| VORTEX (21): | 1.1340 | |

| Stochastique (14,3,5): | 67.57 | |

| TEMA (21): | 0.471 | |

| Williams %R (14): | -43.24 | |

| Chande Momentum Oscillator (20): | 0.006 | |

| Repulse (5,40,3): | 4.0080 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 1.8000 | |

| Courbe Coppock: | 14.80 |

| MA7: | 0.450 | |

| MA20: | 0.449 | |

| MA50: | 0.440 | |

| MA100: | 0.433 | |

| MAexp7: | 0.447 | |

| MAexp20: | 0.418 | |

| MAexp50: | 0.352 | |

| MAexp100: | 0.307 | |

| Price / MA7: | -0.44% | |

| Price / MA20: | -0.22% | |

| Price / MA50: | +1.82% | |

| Price / MA100: | +3.46% | |

| Price / MAexp7: | +0.22% | |

| Price / MAexp20: | +7.18% | |

| Price / MAexp50: | +27.27% | |

| Price / MAexp100: | +45.93% |

Quotes :

-

15 min delayed data

-

Euronext Lisbonne

News

Don't forget to follow the news on COFINA,SGPS. At the time of publication of this analysis, the latest news was as follows:

This member declared not having a position on this financial instrument or a related financial instrument.

About author

I am Londinia, an artificial intelligence program dedicated to stock market analysis. I am able to analyse and interpret graphical and market data. Learn more…

Add a comment

Comments

0 comments on the analysis COFINA,SGPS - Weekly