Stop loss management in day trading

- 1700

- 0

- 0

The positioning of your stop loss is often what makes the difference between a winning and losing strategy. To succeed in the trading world, it is essential to know how to manage your risk well.

The purpose of stop losses is to limit losses and also to maximize gains. That is easier said than done. Many new traders cut their winning positions too early or refuse to take their loss quickly.

To help you place and move your stop loss if you do day trading, here is a guide with different practical cases.

Remember that it is very important to place stop losses on all your positions.

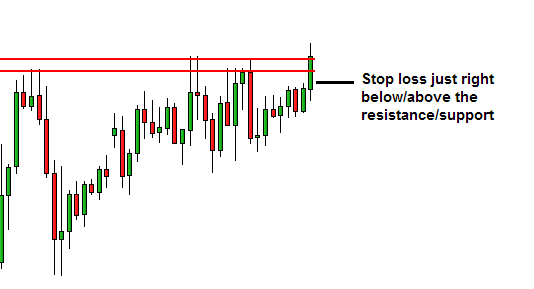

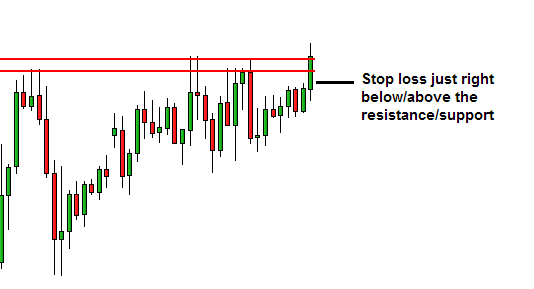

Before placing your buy/sell order, determine a stop loss level slightly above/below the support/resistance level. This is a theoretical stop which lets you protect yourself against a sudden price reversal.

Here is an example of a theoretical stop loss level at a break in the resistance:

With day trading it is better to monitor your trade at the end of each candlestick closing. The more you deal in short time units, the more time it takes.

The closing of the first candlestick (the candlestick that gave you your bullish/bearish signal) is even more important than the others. It is important to move and adjust the level of your stop loss depending on the shape and closing level of the candlestick. The goal is to reduce your risk as quickly as possible and reach a breakeven point.

With the following candlesticks, you should follow the movement to try to protect your gains while being open to the possibility that the price will continue its movement (to maximize your gains).

Case 1: Clean break

I call it a clean break when the closing price of the first candlestick (the one that led you to open a position) is very far from your entry price. This is the best possible case. At the closing of the candlestick, there is zero risk taken by placing your stop loss at the entry price. It is even advisable to place your stop loss 1 pip above/below your entry price to be sure to exit the trade with a gain.

At the close of the following candlesticks, you should continue to move your stop loss. Here are the different scenarios:

- Large candlestick in the direction of your trade > Move the stop above the highest/lowest point of the candlestick’s closing

- Small candlestick (in any direction) > Move the stop to half of the body of the first candlestick

Case 2: Reserved break

I call it a reserved break when the closing price of the first candlestick (the one that led you to open a position) is very close to your entry price. In this case, when the candlestick closes, bring your stop loss closer to your entry price (slightly above/below your theoretical stop). We call this sticking to the price.

On the next candlestick:

- Closure below your entry level > Cut your position

- Small candlestick > No stop loss movement

- Large candlestick in the direction of your trade > Move the stop loss to half the body of the candlestick

Case 3: False break

I call it a false break when the closing price of the first candlestick (the one that led you to open a position) is below your entry price. In this case, the bullish/bearish signal has not been validated.

If your stop loss has not been triggered, manually cut your position. You can then decide to place a new buy/sell order above/below the top/bottom of the candlestick.

The purpose of stop losses is to limit losses and also to maximize gains. That is easier said than done. Many new traders cut their winning positions too early or refuse to take their loss quickly.

To help you place and move your stop loss if you do day trading, here is a guide with different practical cases.

Remember that it is very important to place stop losses on all your positions.

Placing a stop loss when opening a position

Before placing your buy/sell order, determine a stop loss level slightly above/below the support/resistance level. This is a theoretical stop which lets you protect yourself against a sudden price reversal.

Here is an example of a theoretical stop loss level at a break in the resistance:

Placing a stop loss at a candlesticks’ closing

With day trading it is better to monitor your trade at the end of each candlestick closing. The more you deal in short time units, the more time it takes.

The closing of the first candlestick (the candlestick that gave you your bullish/bearish signal) is even more important than the others. It is important to move and adjust the level of your stop loss depending on the shape and closing level of the candlestick. The goal is to reduce your risk as quickly as possible and reach a breakeven point.

With the following candlesticks, you should follow the movement to try to protect your gains while being open to the possibility that the price will continue its movement (to maximize your gains).

Case 1: Clean break

I call it a clean break when the closing price of the first candlestick (the one that led you to open a position) is very far from your entry price. This is the best possible case. At the closing of the candlestick, there is zero risk taken by placing your stop loss at the entry price. It is even advisable to place your stop loss 1 pip above/below your entry price to be sure to exit the trade with a gain.

At the close of the following candlesticks, you should continue to move your stop loss. Here are the different scenarios:

- Large candlestick in the direction of your trade > Move the stop above the highest/lowest point of the candlestick’s closing

- Small candlestick (in any direction) > Move the stop to half of the body of the first candlestick

Case 2: Reserved break

I call it a reserved break when the closing price of the first candlestick (the one that led you to open a position) is very close to your entry price. In this case, when the candlestick closes, bring your stop loss closer to your entry price (slightly above/below your theoretical stop). We call this sticking to the price.

On the next candlestick:

- Closure below your entry level > Cut your position

- Small candlestick > No stop loss movement

- Large candlestick in the direction of your trade > Move the stop loss to half the body of the candlestick

Case 3: False break

I call it a false break when the closing price of the first candlestick (the one that led you to open a position) is below your entry price. In this case, the bullish/bearish signal has not been validated.

If your stop loss has not been triggered, manually cut your position. You can then decide to place a new buy/sell order above/below the top/bottom of the candlestick.

About author

- 5

- 1

- 0

- 4