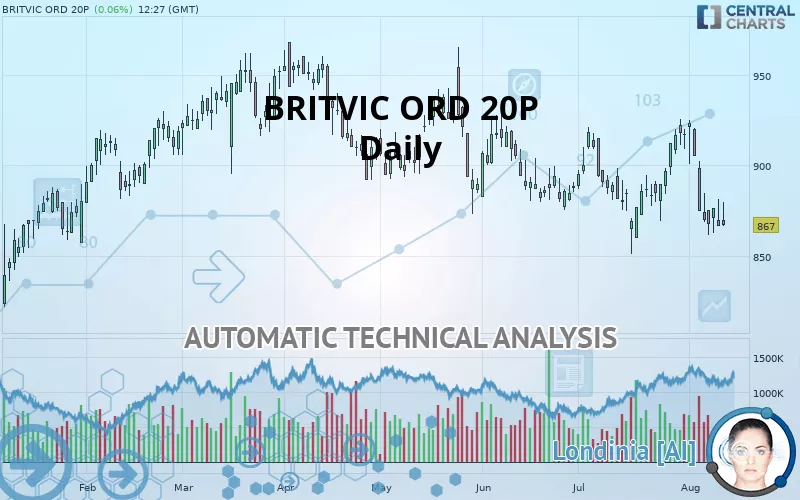

BRITVIC ORD 20P - Daily - Technical analysis published on 08/12/2019 (GMT)

- 339

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

BRITVIC ORD 20P rating 867.0 GBX. The price registered an increase of +0.06% on the session with the lowest point at 866.5 GBX and the highest point at 879.5 GBX. The deviation from the price is +0.06% for the low point and -1.42% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of BRITVIC ORD 20P in Daily shows a overall strongly bearish trend. 89.29% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 11 technical indicators on 18 studied are currently positioned bearish. Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Near support of channel

Type : Bullish

Timeframe : Daily

Near support of triangle

Type : Bullish

Timeframe : Daily

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Black gravestone / inverted hammer

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 776.6 | 804.5 | 821.5 | 867.0 | 869.0 | 891.0 | 918.5 |

| Change (%) | -10.43% | -7.21% | -5.25% | - | +0.23% | +2.77% | +5.94% |

| Change | -90.4 | -62.5 | -45.5 | - | +2.0 | +24.0 | +51.5 |

| Level | Major | Minor | Major | - | Intermediate | Intermediate | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 846.5 | 856.5 | 861.5 | 871.5 | 876.5 | 886.5 | 891.5 |

| Camarilla | 862.4 | 863.8 | 865.1 | 866.5 | 867.9 | 869.3 | 870.6 |

| Woodie | 844.0 | 855.3 | 859.0 | 870.3 | 874.0 | 885.3 | 889.0 |

| Fibonacci | 856.5 | 862.2 | 865.8 | 871.5 | 877.2 | 880.8 | 886.5 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 810.2 | 835.8 | 851.2 | 876.8 | 892.2 | 917.8 | 933.2 |

| Camarilla | 855.2 | 859.0 | 862.7 | 866.5 | 870.3 | 874.0 | 877.8 |

| Woodie | 805.0 | 833.3 | 846.0 | 874.3 | 887.0 | 915.3 | 928.0 |

| Fibonacci | 835.8 | 851.5 | 861.2 | 876.8 | 892.5 | 902.2 | 917.8 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 795.0 | 823.0 | 870.0 | 898.0 | 945.0 | 973.0 | 1,020.0 |

| Camarilla | 896.4 | 903.3 | 910.1 | 917.0 | 923.9 | 930.8 | 937.6 |

| Woodie | 804.5 | 827.8 | 879.5 | 902.8 | 954.5 | 977.8 | 1,029.5 |

| Fibonacci | 823.0 | 851.7 | 869.4 | 898.0 | 926.7 | 944.4 | 973.0 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 39.60 | |

| MACD (12,26,9): | -5.7000 | |

| Directional Movement: | -9.4 | |

| AROON (14): | -42.9 | |

| DEMA (21): | 881.2 | |

| Parabolic SAR (0,02-0,02-0,2): | 912.3 | |

| Elder Ray (13): | -10.5 | |

| Super Trend (3,10): | 919.6 | |

| Zig ZAG (10): | 867.0 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 12.90 | |

| TEMA (21): | 876.6 | |

| Williams %R (14): | -91.50 | |

| Chande Momentum Oscillator (20): | -30.0 | |

| Repulse (5,40,3): | -2.4000 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0000 | |

| Courbe Coppock: | 2.00 |

| MA7: | 875.4 | |

| MA20: | 889.5 | |

| MA50: | 893.2 | |

| MA100: | 904.8 | |

| MAexp7: | 876.6 | |

| MAexp20: | 887.0 | |

| MAexp50: | 892.9 | |

| MAexp100: | 892.2 | |

| Price / MA7: | -0.96% | |

| Price / MA20: | -2.53% | |

| Price / MA50: | -2.93% | |

| Price / MA100: | -4.18% | |

| Price / MAexp7: | -1.10% | |

| Price / MAexp20: | -2.25% | |

| Price / MAexp50: | -2.90% | |

| Price / MAexp100: | -2.82% |

News

Don"t forget to follow the news on BRITVIC ORD 20P. At the time of publication of this analysis, the latest news was as follows:

-

Britvic

-

What corporate news to watch on Wednesday: Greene King, Britvic and Sage Group

-

Britvic

-

AG Barr merger with Britvic falls flat

Add a comment

Comments

0 comments on the analysis BRITVIC ORD 20P - Daily