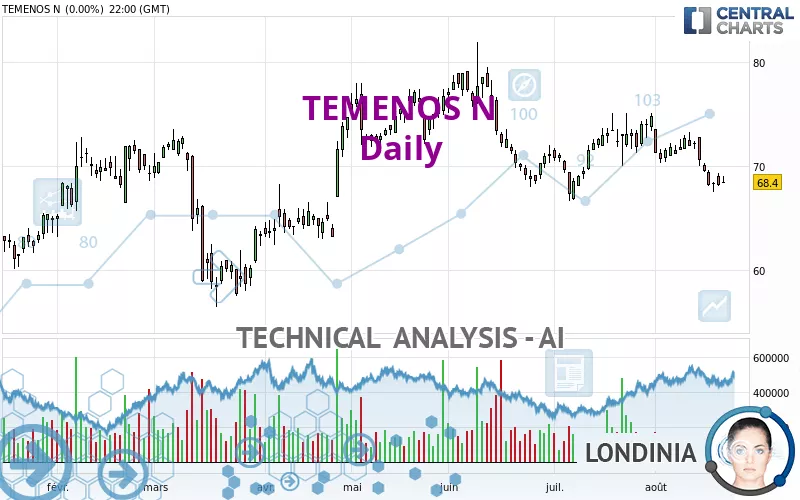

TEMENOS N - Daily - Technical analysis published on 08/23/2023 (GMT)

- 163

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The TEMENOS N price is 68.3200 CHF. The price registered a decrease of -0.12% on the session with the lowest point at 67.7400 CHF and the highest point at 68.8400 CHF. The deviation from the price is +0.86% for the low point and -0.76% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this TEMENOS N chart shows a bearish trend. 78.57% of the signals given by moving averages are bearish. The overall trend is reinforced by the strong bearish signals from short-term moving averages. An assessment of moving averages reveals a bearish signal that could impact this trend:

Moving Average bearish crossovers : MA50 & MA100

Type : Bearish

Timeframe : Daily

In fact, 12 technical indicators on 18 studied are currently bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near support of channel

Type : Bullish

Timeframe : Daily

Near support of triangle

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 57.6400 | 63.1480 | 67.3000 | 68.3200 | 72.6322 | 76.3720 | 78.9800 |

| Change (%) | -15.63% | -7.57% | -1.49% | - | +6.31% | +11.79% | +15.60% |

| Change | -10.6800 | -5.1720 | -1.0200 | - | +4.3122 | +8.0520 | +10.6600 |

| Level | Intermediate | Minor | Intermediate | - | Major | Minor | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 67.3867 | 67.8533 | 68.1267 | 68.5933 | 68.8667 | 69.3333 | 69.6067 |

| Camarilla | 68.1965 | 68.2643 | 68.3322 | 68.4000 | 68.4678 | 68.5357 | 68.6035 |

| Woodie | 67.2900 | 67.8050 | 68.0300 | 68.5450 | 68.7700 | 69.2850 | 69.5100 |

| Fibonacci | 67.8533 | 68.1360 | 68.3107 | 68.5933 | 68.8760 | 69.0507 | 69.3333 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 60.9733 | 64.2267 | 66.2733 | 69.5267 | 71.5733 | 74.8267 | 76.8733 |

| Camarilla | 66.8625 | 67.3483 | 67.8342 | 68.3200 | 68.8058 | 69.2917 | 69.7775 |

| Woodie | 60.3700 | 63.9250 | 65.6700 | 69.2250 | 70.9700 | 74.5250 | 76.2700 |

| Fibonacci | 64.2267 | 66.2513 | 67.5021 | 69.5267 | 71.5513 | 72.8021 | 74.8267 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 60.7533 | 63.7067 | 69.2333 | 72.1867 | 77.7133 | 80.6667 | 86.1933 |

| Camarilla | 72.4280 | 73.2053 | 73.9827 | 74.7600 | 75.5373 | 76.3147 | 77.0920 |

| Woodie | 62.0400 | 64.3500 | 70.5200 | 72.8300 | 79.0000 | 81.3100 | 87.4800 |

| Fibonacci | 63.7067 | 66.9460 | 68.9473 | 72.1867 | 75.4260 | 77.4273 | 80.6667 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 36.31 | |

| MACD (12,26,9): | -1.0300 | |

| Directional Movement: | -11.4142 | |

| AROON (14): | -35.7143 | |

| DEMA (21): | 69.1942 | |

| Parabolic SAR (0,02-0,02-0,2): | 71.0295 | |

| Elder Ray (13): | -1.4623 | |

| Super Trend (3,10): | 72.6270 | |

| Zig ZAG (10): | 68.0600 | |

| VORTEX (21): | 0.8163 | |

| Stochastique (14,3,5): | 12.61 | |

| TEMA (21): | 68.4206 | |

| Williams %R (14): | -89.93 | |

| Chande Momentum Oscillator (20): | -3.7600 | |

| Repulse (5,40,3): | -2.7995 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.1110 | |

| Courbe Coppock: | 9.37 |

| MA7: | 68.7371 | |

| MA20: | 71.0230 | |

| MA50: | 71.1744 | |

| MA100: | 71.2486 | |

| MAexp7: | 68.9038 | |

| MAexp20: | 70.3391 | |

| MAexp50: | 71.1679 | |

| MAexp100: | 70.6019 | |

| Price / MA7: | -0.61% | |

| Price / MA20: | -3.81% | |

| Price / MA50: | -4.01% | |

| Price / MA100: | -4.11% | |

| Price / MAexp7: | -0.85% | |

| Price / MAexp20: | -2.87% | |

| Price / MAexp50: | -4.00% | |

| Price / MAexp100: | -3.23% |

News

Don't forget to follow the news on TEMENOS N. At the time of publication of this analysis, the latest news was as follows:

- Temenos Completes Certification for Federal Reserve’s New Instant Payment Service

- Canadian Tire Bank Expands Relationship with Temenos and Moves to Temenos Banking Cloud

- Global Payments Leader, Convera Chooses Temenos to Modernize Payments in the Cloud

- IBS Intelligence recognizes Temenos as the #1 best-selling banking software across eight categories; the highest awarded to any technology provider

- Temenos Recognized as a Leader in the Omdia Digital Banking Platforms Report

Add a comment

Comments

0 comments on the analysis TEMENOS N - Daily