NASDAQ100 INDEX

-

USD

(-)

- 15 min delayed data - NASDAQ US Indices

| Open: | - |

| Change: | - |

| Volume: | - |

| Low: | - |

| High: | - |

| High / Low range: | - |

| Type: | Indices |

| Ticker: | NDX |

| ISIN: |

NASDAQ100 INDEX - US Payroll revision may spur another rally. - 08/22/2024 (GMT)

- 342

- 0

- 08/22/2024 - 06:10

- Who voted?

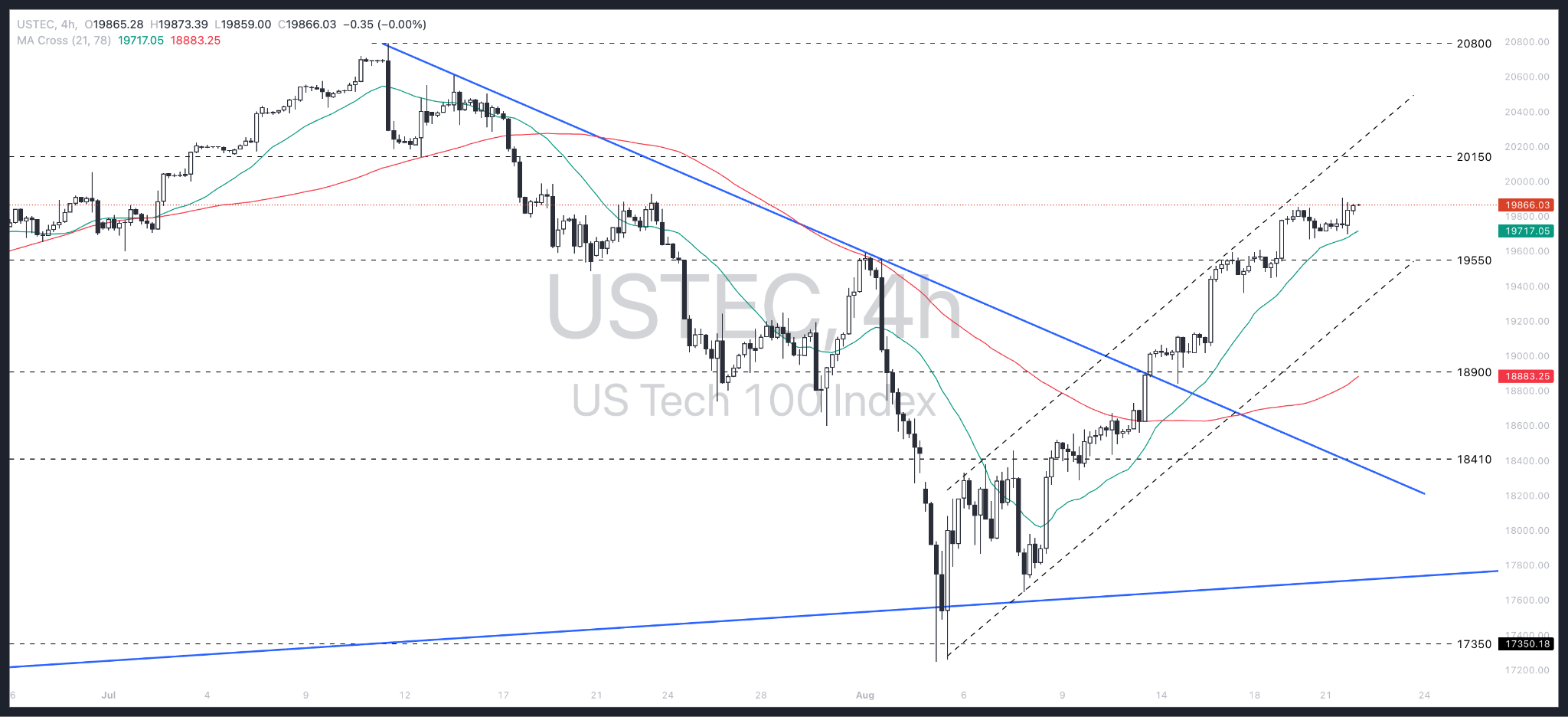

- Timeframe : 4H

NASDAQ100 INDEX Chart

The stock market experienced gains after the release of dovish Federal Reserve minutes and a significant downward revision of US payroll data, which bolstered expectations that policymakers will cut interest rates in September. Traders are increasingly pricing in over 1.00% of rate cuts by the end of 2024, with the first reduction expected in September. As Jerome Powell's upcoming speech in Jackson Hole approaches, the market is focused on the Fed's latest policy meeting minutes, which indicated a strong case for cutting rates in July, though the decision was to keep them steady.The key question now is not whether the Fed will cut rates in September, but by how much. Market sentiment currently leans towards a 25 basis-point cut, although a 50 basis-point cut is seen as a potential outcome if the August jobs report meets expectations. The recent revision by the Bureau of Labor Statistics, indicating that US job growth was weaker than initially reported, adds pressure on the Fed to move towards easing monetary policy.

On technical perspective, the index rose after testing the EMA21. The index remains above both EMAs, indicating solid upward momentum. If stays above the EMA21, the index may retest its resistance and channel’s upper bound at 20150. Conversely, may retrace to around 18900 if the index breaks below the 19500 support and channel’s lower bound.

On technical perspective, the index rose after testing the EMA21. The index remains above both EMAs, indicating solid upward momentum. If stays above the EMA21, the index may retest its resistance and channel’s upper bound at 20150. Conversely, may retrace to around 18900 if the index breaks below the 19500 support and channel’s lower bound.

This member declared not having a position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis NASDAQ100 INDEX - 4H