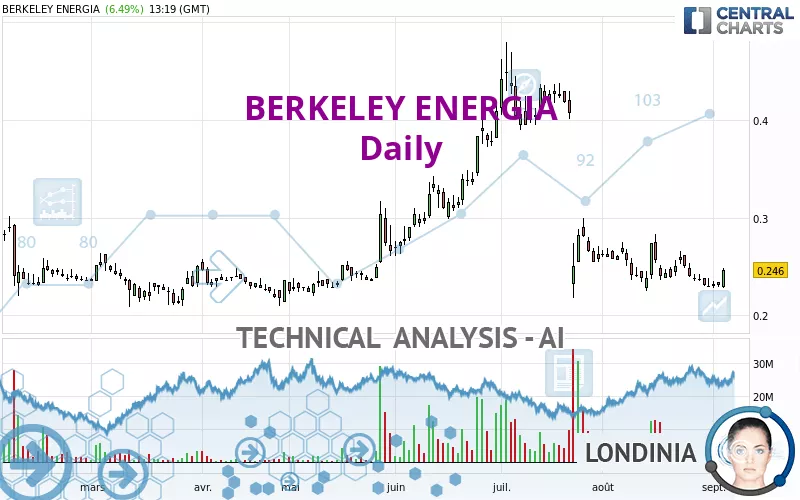

BERKELEY ENERGIA - Daily - Technical analysis published on 09/05/2023 (GMT)

- 162

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The BERKELEY ENERGIA rating is 0.2460 EUR. The price has increased by +6.49% since the last closing with the lowest point at 0.2275 EUR and the highest point at 0.2485 EUR. The deviation from the price is +8.13% for the low point and -1.01% for the high point.The Central Gaps scanner detects the formation of a bearish gap marking the strong presence of sellers ahead of buyers at the opening. This formed a quotation gap.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BERKELEY ENERGIA:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of BERKELEY ENERGIA indicates that the overall trend is bearish. The signals given by moving averages are at 71.43% bearish. This bearish trend shows slight signs of slowing down given the slightly bearish signals of short-term moving averages. The Central Indicators market scanner is currently detecting a bullish signal that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

On the 18 technical indicators analysed, 8 are bullish, 6 are neutral and 4 are bearish. Other results related to technical indicators were also found by the Central Indicators scanner:

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Near support of channel

Type : Bullish

Timeframe : Daily

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of this bullish pattern in Japanese candlesticks:

Bullish engulfing lines

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.0940 | 0.1616 | 0.2102 | 0.2460 | 0.2521 | 0.3040 | 0.4027 |

| Change (%) | -61.79% | -34.31% | -14.55% | - | +2.48% | +23.58% | +63.70% |

| Change | -0.1520 | -0.0844 | -0.0358 | - | +0.0061 | +0.0580 | +0.1567 |

| Level | Minor | Intermediate | Major | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.2238 | 0.2267 | 0.2288 | 0.2317 | 0.2338 | 0.2367 | 0.2388 |

| Camarilla | 0.2296 | 0.2301 | 0.2305 | 0.2310 | 0.2315 | 0.2319 | 0.2324 |

| Woodie | 0.2235 | 0.2265 | 0.2285 | 0.2315 | 0.2335 | 0.2365 | 0.2385 |

| Fibonacci | 0.2267 | 0.2286 | 0.2298 | 0.2317 | 0.2336 | 0.2348 | 0.2367 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.2120 | 0.2200 | 0.2260 | 0.2340 | 0.2400 | 0.2480 | 0.2540 |

| Camarilla | 0.2282 | 0.2294 | 0.2307 | 0.2320 | 0.2333 | 0.2346 | 0.2359 |

| Woodie | 0.2110 | 0.2195 | 0.2250 | 0.2335 | 0.2390 | 0.2475 | 0.2530 |

| Fibonacci | 0.2200 | 0.2254 | 0.2287 | 0.2340 | 0.2394 | 0.2427 | 0.2480 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.1510 | 0.1880 | 0.2090 | 0.2460 | 0.2670 | 0.3040 | 0.3250 |

| Camarilla | 0.2141 | 0.2194 | 0.2247 | 0.2300 | 0.2353 | 0.2406 | 0.2460 |

| Woodie | 0.1430 | 0.1840 | 0.2010 | 0.2420 | 0.2590 | 0.3000 | 0.3170 |

| Fibonacci | 0.1880 | 0.2102 | 0.2238 | 0.2460 | 0.2682 | 0.2818 | 0.3040 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 43.35 | |

| MACD (12,26,9): | -0.0161 | |

| Directional Movement: | -4.0332 | |

| AROON (14): | -100.0000 | |

| DEMA (21): | 0.2247 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.2869 | |

| Elder Ray (13): | -0.0028 | |

| Super Trend (3,10): | 0.2716 | |

| Zig ZAG (10): | 0.2430 | |

| VORTEX (21): | 0.8742 | |

| Stochastique (14,3,5): | 17.66 | |

| TEMA (21): | 0.2268 | |

| Williams %R (14): | -54.55 | |

| Chande Momentum Oscillator (20): | -0.0005 | |

| Repulse (5,40,3): | 3.7754 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -1.0601 | |

| Courbe Coppock: | 9.69 |

| MA7: | 0.2346 | |

| MA20: | 0.2426 | |

| MA50: | 0.3093 | |

| MA100: | 0.2887 | |

| MAexp7: | 0.2369 | |

| MAexp20: | 0.2486 | |

| MAexp50: | 0.2757 | |

| MAexp100: | 0.2791 | |

| Price / MA7: | +4.86% | |

| Price / MA20: | +1.40% | |

| Price / MA50: | -20.47% | |

| Price / MA100: | -14.79% | |

| Price / MAexp7: | +3.84% | |

| Price / MAexp20: | -1.05% | |

| Price / MAexp50: | -10.77% | |

| Price / MAexp100: | -11.86% |

Add a comment

Comments

0 comments on the analysis BERKELEY ENERGIA - Daily