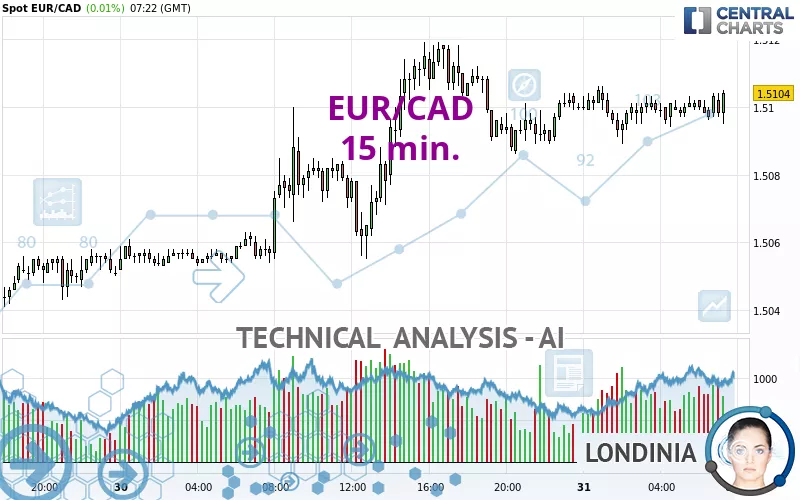

EUR/CAD - 15 min. - Technical analysis published on 10/31/2024 (GMT)

- 65

- 0

Click here for a new analysis!

- Timeframe : 15 min.

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

EUR/CAD rating 1.5103 CAD. The price has increased by +0.01% since the last closing and was between 1.5089 CAD and 1.5106 CAD. This implies that the price is at +0.09% from its lowest and at -0.02% from its highest.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of EUR/CAD in 15 min. shows a strongly overall bullish trend. 85.71% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. An assessment of moving averages reveals a bearish signal that could impact this trend:

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : 15 minutes

In fact, only 8 technical indicators out of 18 studied are currently bullish. Central Indicators, the scanner specialised in technical indicators, has identified this signal:

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near resistance of channel

Type : Bearish

Timeframe : 15 minutes

Near resistance of triangle

Type : Bearish

Timeframe : 15 minutes

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.4986 | 1.5045 | 1.5074 | 1.5103 | 1.5119 | 1.5151 | 1.5909 |

| Change (%) | -0.77% | -0.38% | -0.19% | - | +0.11% | +0.32% | +5.34% |

| Change | -0.0117 | -0.0058 | -0.0029 | - | +0.0016 | +0.0048 | +0.0806 |

| Level | Intermediate | Intermediate | Major | - | Intermediate | Intermediate | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4998 | 1.5025 | 1.5064 | 1.5091 | 1.5130 | 1.5157 | 1.5196 |

| Camarilla | 1.5084 | 1.5090 | 1.5096 | 1.5102 | 1.5108 | 1.5114 | 1.5120 |

| Woodie | 1.5003 | 1.5028 | 1.5069 | 1.5094 | 1.5135 | 1.5160 | 1.5201 |

| Fibonacci | 1.5025 | 1.5051 | 1.5066 | 1.5091 | 1.5117 | 1.5132 | 1.5157 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4776 | 1.4831 | 1.4914 | 1.4969 | 1.5052 | 1.5107 | 1.5190 |

| Camarilla | 1.4958 | 1.4971 | 1.4983 | 1.4996 | 1.5009 | 1.5021 | 1.5034 |

| Woodie | 1.4789 | 1.4838 | 1.4927 | 1.4976 | 1.5065 | 1.5114 | 1.5203 |

| Fibonacci | 1.4831 | 1.4884 | 1.4917 | 1.4969 | 1.5022 | 1.5055 | 1.5107 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4641 | 1.4766 | 1.4914 | 1.5039 | 1.5187 | 1.5312 | 1.5460 |

| Camarilla | 1.4988 | 1.5013 | 1.5038 | 1.5063 | 1.5088 | 1.5113 | 1.5138 |

| Woodie | 1.4654 | 1.4772 | 1.4927 | 1.5045 | 1.5200 | 1.5318 | 1.5473 |

| Fibonacci | 1.4766 | 1.4870 | 1.4934 | 1.5039 | 1.5143 | 1.5207 | 1.5312 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 52.89 | |

| MACD (12,26,9): | 0.0000 | |

| Directional Movement: | 2.6504 | |

| AROON (14): | 71.4285 | |

| DEMA (21): | 1.5099 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.5093 | |

| Elder Ray (13): | 0.0001 | |

| Super Trend (3,10): | 1.5088 | |

| Zig ZAG (10): | 1.5099 | |

| VORTEX (21): | 1.0825 | |

| Stochastique (14,3,5): | 48.15 | |

| TEMA (21): | 1.5099 | |

| Williams %R (14): | -60.00 | |

| Chande Momentum Oscillator (20): | 0.0002 | |

| Repulse (5,40,3): | -0.0213 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0002 | |

| Courbe Coppock: | 0.02 |

| MA7: | 1.5027 | |

| MA20: | 1.4995 | |

| MA50: | 1.5012 | |

| MA100: | 1.4953 | |

| MAexp7: | 1.5099 | |

| MAexp20: | 1.5099 | |

| MAexp50: | 1.5097 | |

| MAexp100: | 1.5089 | |

| Price / MA7: | +0.51% | |

| Price / MA20: | +0.72% | |

| Price / MA50: | +0.61% | |

| Price / MA100: | +1.00% | |

| Price / MAexp7: | +0.03% | |

| Price / MAexp20: | +0.03% | |

| Price / MAexp50: | +0.04% | |

| Price / MAexp100: | +0.09% |

News

The last news published on EUR/CAD at the time of the generation of this analysis was as follows:

-

EUR/CAD Forecast August 22, 2024

-

EUR/CAD Forecast August 5, 2024

-

EUR/CAD Forecast July 11, 2024

-

EUR/CAD Forecast June 4, 2024

-

Forex Analysis: EUR/USD, GBP/USD, EUR/CAD - Amana Capital

Add a comment

Comments

0 comments on the analysis EUR/CAD - 15 min.