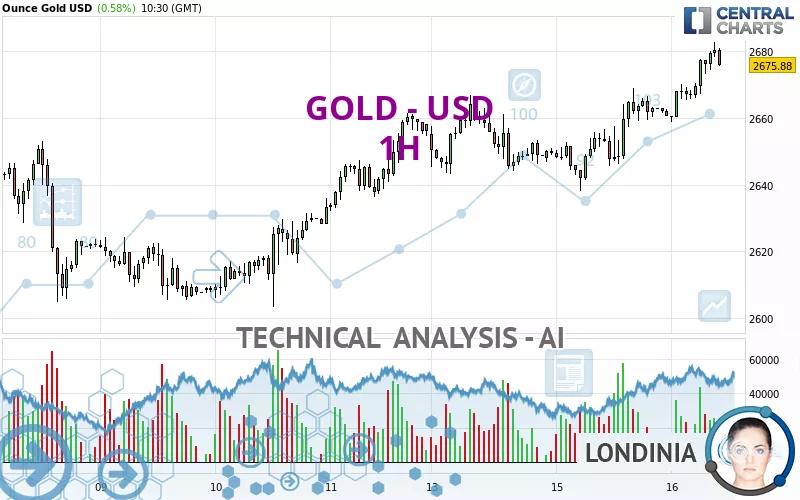

GOLD - USD - 1H - Technical analysis published on 10/16/2024 (GMT)

- 115

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

GOLD - USD rating 2,675.87 USD. On the day, this instrument gained +0.58% and was traded between 2,658.72 USD and 2,682.81 USD over the period. The price is currently at +0.65% from its lowest and -0.26% from its highest.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in 1H of this GOLD - USD chart shows a strongly bullish trend. The signals given by the moving averages are 92.86% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

In fact, 13 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

CCI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

RSI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : 1 hour

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Bearish engulfing lines

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 2,653.09 | 2,661.61 | 2,672.68 | 2,675.87 |

| Change (%) | -0.85% | -0.53% | -0.12% | - |

| Change | -22.78 | -14.26 | -3.19 | - |

| Level | Minor | Minor | Major | - |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,611.87 | 2,624.99 | 2,642.75 | 2,655.87 | 2,673.63 | 2,686.75 | 2,704.51 |

| Camarilla | 2,652.01 | 2,654.84 | 2,657.67 | 2,660.50 | 2,663.33 | 2,666.16 | 2,668.99 |

| Woodie | 2,614.18 | 2,626.15 | 2,645.06 | 2,657.03 | 2,675.94 | 2,687.91 | 2,706.82 |

| Fibonacci | 2,624.99 | 2,636.79 | 2,644.08 | 2,655.87 | 2,667.67 | 2,674.96 | 2,686.75 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,562.32 | 2,582.79 | 2,620.52 | 2,640.99 | 2,678.72 | 2,699.19 | 2,736.92 |

| Camarilla | 2,642.24 | 2,647.57 | 2,652.91 | 2,658.24 | 2,663.58 | 2,668.91 | 2,674.25 |

| Woodie | 2,570.94 | 2,587.11 | 2,629.14 | 2,645.31 | 2,687.34 | 2,703.51 | 2,745.54 |

| Fibonacci | 2,582.79 | 2,605.03 | 2,618.76 | 2,640.99 | 2,663.23 | 2,676.96 | 2,699.19 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,296.16 | 2,384.02 | 2,509.87 | 2,597.73 | 2,723.58 | 2,811.44 | 2,937.29 |

| Camarilla | 2,576.94 | 2,596.53 | 2,616.12 | 2,635.71 | 2,655.30 | 2,674.89 | 2,694.48 |

| Woodie | 2,315.15 | 2,393.52 | 2,528.86 | 2,607.23 | 2,742.57 | 2,820.94 | 2,956.28 |

| Fibonacci | 2,384.02 | 2,465.66 | 2,516.10 | 2,597.73 | 2,679.37 | 2,729.81 | 2,811.44 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 68.49 | |

| MACD (12,26,9): | 6.2600 | |

| Directional Movement: | 19.83 | |

| AROON (14): | 64.29 | |

| DEMA (21): | 2,676.00 | |

| Parabolic SAR (0,02-0,02-0,2): | 2,665.33 | |

| Elder Ray (13): | 6.62 | |

| Super Trend (3,10): | 2,665.20 | |

| Zig ZAG (10): | 2,677.05 | |

| VORTEX (21): | 1.2700 | |

| Stochastique (14,3,5): | 86.94 | |

| TEMA (21): | 2,678.95 | |

| Williams %R (14): | -23.87 | |

| Chande Momentum Oscillator (20): | 14.74 | |

| Repulse (5,40,3): | 0.0300 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0300 | |

| Courbe Coppock: | 1.00 |

| MA7: | 2,644.04 | |

| MA20: | 2,644.92 | |

| MA50: | 2,561.99 | |

| MA100: | 2,464.70 | |

| MAexp7: | 2,675.24 | |

| MAexp20: | 2,668.31 | |

| MAexp50: | 2,659.78 | |

| MAexp100: | 2,652.14 | |

| Price / MA7: | +1.20% | |

| Price / MA20: | +1.17% | |

| Price / MA50: | +4.44% | |

| Price / MA100: | +8.57% | |

| Price / MAexp7: | +0.02% | |

| Price / MAexp20: | +0.28% | |

| Price / MAexp50: | +0.60% | |

| Price / MAexp100: | +0.89% |

News

Don't forget to follow the news on GOLD - USD. At the time of publication of this analysis, the latest news was as follows:

-

Gold Breaks Out of Bull Flag: Forecast & Technical Analysis by Bruce Powers (October 15)

-

Gold Forecast October 16, 2024

-

Gold Continues to See Interest: Forecast & Technical Analysis by Chris Lewis (October 14)

-

Abu Dhabi Judo Grand Slam day two: More gold for the host nation

-

Gold Forecast October 14, 2024

Add a comment

Comments

0 comments on the analysis GOLD - USD - 1H