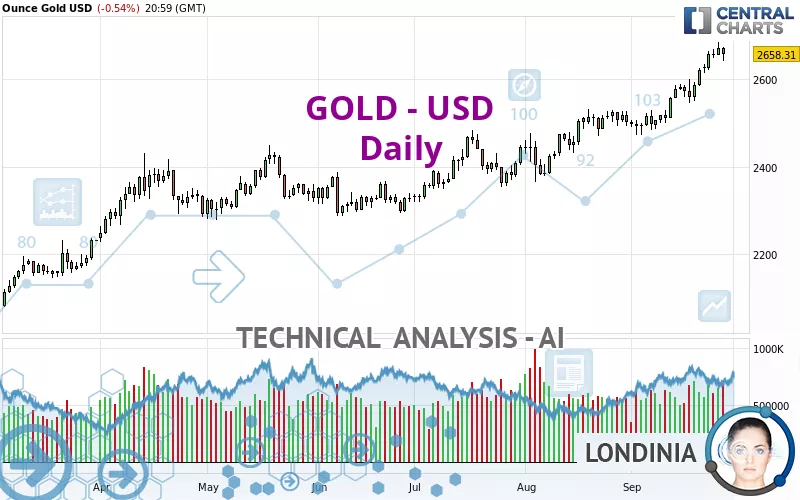

GOLD - USD - Daily - Technical analysis published on 09/29/2024 (GMT)

- 151

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

GOLD - USD rating 2,658.31 USD. The price registered a decrease of -0.54% on the session and was traded between 2,643.14 USD and 2,674.34 USD over the period. The price is currently at +0.57% from its lowest and -0.60% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of GOLD - USD indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The probability of a further increase is high given the direction of the technical indicators.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 2,294.05 | 2,362.07 | 2,525.34 | 2,658.31 |

| Change (%) | -13.70% | -11.14% | -5.00% | - |

| Change | -364.26 | -296.24 | -132.97 | - |

| Level | Intermediate | Minor | Minor | - |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,611.65 | 2,627.40 | 2,642.85 | 2,658.60 | 2,674.05 | 2,689.80 | 2,705.25 |

| Camarilla | 2,649.73 | 2,652.59 | 2,655.45 | 2,658.31 | 2,661.17 | 2,664.03 | 2,666.89 |

| Woodie | 2,611.51 | 2,627.33 | 2,642.71 | 2,658.53 | 2,673.91 | 2,689.73 | 2,705.11 |

| Fibonacci | 2,627.40 | 2,639.32 | 2,646.68 | 2,658.60 | 2,670.52 | 2,677.88 | 2,689.80 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,547.89 | 2,580.89 | 2,619.60 | 2,652.60 | 2,691.31 | 2,724.31 | 2,763.02 |

| Camarilla | 2,638.59 | 2,645.16 | 2,651.74 | 2,658.31 | 2,664.88 | 2,671.46 | 2,678.03 |

| Woodie | 2,550.75 | 2,582.32 | 2,622.46 | 2,654.03 | 2,694.17 | 2,725.74 | 2,765.88 |

| Fibonacci | 2,580.89 | 2,608.28 | 2,625.21 | 2,652.60 | 2,679.99 | 2,696.92 | 2,724.31 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,233.73 | 2,299.04 | 2,401.13 | 2,466.44 | 2,568.53 | 2,633.84 | 2,735.93 |

| Camarilla | 2,457.20 | 2,472.54 | 2,487.89 | 2,503.23 | 2,518.58 | 2,533.92 | 2,549.27 |

| Woodie | 2,252.13 | 2,308.24 | 2,419.53 | 2,475.64 | 2,586.93 | 2,643.04 | 2,754.33 |

| Fibonacci | 2,299.04 | 2,362.98 | 2,402.49 | 2,466.44 | 2,530.38 | 2,569.89 | 2,633.84 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 72.01 | |

| MACD (12,26,9): | 47.1500 | |

| Directional Movement: | 17.89 | |

| AROON (14): | 92.86 | |

| DEMA (21): | 2,644.12 | |

| Parabolic SAR (0,02-0,02-0,2): | 2,605.12 | |

| Elder Ray (13): | 48.02 | |

| Super Trend (3,10): | 2,573.85 | |

| Zig ZAG (10): | 2,658.31 | |

| VORTEX (21): | 1.2100 | |

| Stochastique (14,3,5): | 90.37 | |

| TEMA (21): | 2,662.40 | |

| Williams %R (14): | -14.72 | |

| Chande Momentum Oscillator (20): | 146.32 | |

| Repulse (5,40,3): | 0.6600 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.2200 | |

| Courbe Coppock: | 10.23 |

| MA7: | 2,640.24 | |

| MA20: | 2,568.74 | |

| MA50: | 2,498.70 | |

| MA100: | 2,428.79 | |

| MAexp7: | 2,639.19 | |

| MAexp20: | 2,585.40 | |

| MAexp50: | 2,515.49 | |

| MAexp100: | 2,437.75 | |

| Price / MA7: | +0.68% | |

| Price / MA20: | +3.49% | |

| Price / MA50: | +6.39% | |

| Price / MA100: | +9.45% | |

| Price / MAexp7: | +0.72% | |

| Price / MAexp20: | +2.82% | |

| Price / MAexp50: | +5.68% | |

| Price / MAexp100: | +9.05% |

News

The latest news and videos published on GOLD - USD at the time of the analysis were as follows:

-

Gold Declines After Record High: Forecast & Technical Analysis by Bruce Powers (September 27)

-

Gold Forecast September 30, 2024

-

Gold Continues to See Support Below: Forecast & Technical Analysis by Chris Lewis (September 27)

-

Gold Reaches New High: Forecast & Technical Analysis by Bruce Powers (September 26)

-

Gold Forecast September 27, 2024

Add a comment

Comments

0 comments on the analysis GOLD - USD - Daily