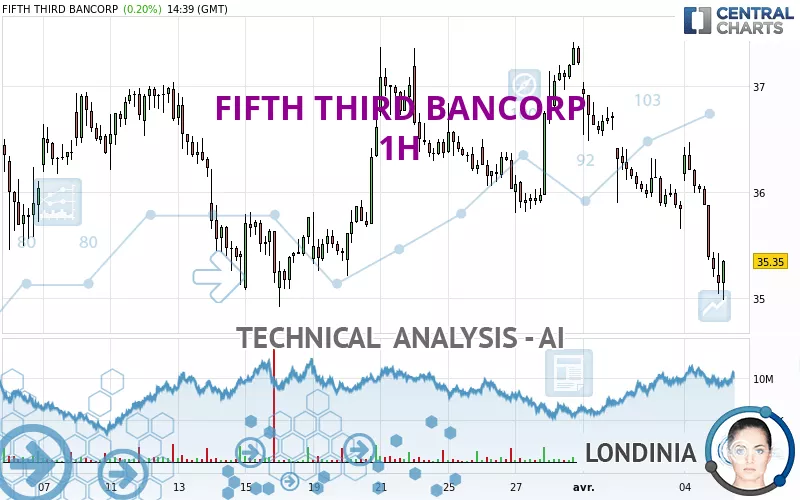

FIFTH THIRD BANCORP - 1H - Technical analysis published on 04/05/2024 (GMT)

- 175

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

FIFTH THIRD BANCORP rating 35.23 USD. The price is lower by -0.14% since the last closing and was between 34.99 USD and 35.43 USD. This implies that the price is at +0.69% from its lowest and at -0.56% from its highest.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this 1H chart of FIFTH THIRD BANCORP indicates that the overall trend is bearish. 75.00% of the signals given by moving averages are bearish. The overall trend is reinforced by the strong bearish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The probability of a further decline is moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : 1 hour

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : 1 hour

RSI indicator: bullish divergence

Type : Bullish

Timeframe : 1 hour

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 1 hour

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near horizontal support

Type : Bullish

Timeframe : 1 hour

Support of channel is broken

Type : Bearish

Timeframe : 1 hour

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 33.15 | 34.16 | 34.58 | 35.23 | 35.69 | 37.00 | 37.41 |

| Change (%) | -5.90% | -3.04% | -1.85% | - | +1.31% | +5.02% | +6.19% |

| Change | -2.08 | -1.07 | -0.65 | - | +0.46 | +1.77 | +2.18 |

| Level | Minor | Minor | Major | - | Major | Minor | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 33.56 | 34.38 | 34.83 | 35.65 | 36.10 | 36.92 | 37.37 |

| Camarilla | 34.93 | 35.05 | 35.16 | 35.28 | 35.40 | 35.51 | 35.63 |

| Woodie | 33.38 | 34.29 | 34.65 | 35.56 | 35.92 | 36.83 | 37.19 |

| Fibonacci | 34.38 | 34.87 | 35.17 | 35.65 | 36.14 | 36.44 | 36.92 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 34.39 | 35.04 | 36.12 | 36.77 | 37.85 | 38.50 | 39.58 |

| Camarilla | 36.73 | 36.89 | 37.05 | 37.21 | 37.37 | 37.53 | 37.69 |

| Woodie | 34.62 | 35.15 | 36.35 | 36.88 | 38.08 | 38.61 | 39.81 |

| Fibonacci | 35.04 | 35.70 | 36.11 | 36.77 | 37.43 | 37.84 | 38.50 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 30.18 | 31.66 | 34.44 | 35.92 | 38.70 | 40.18 | 42.96 |

| Camarilla | 36.04 | 36.43 | 36.82 | 37.21 | 37.60 | 37.99 | 38.38 |

| Woodie | 30.82 | 31.99 | 35.08 | 36.25 | 39.34 | 40.51 | 43.60 |

| Fibonacci | 31.66 | 33.29 | 34.30 | 35.92 | 37.55 | 38.56 | 40.18 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 30.42 | |

| MACD (12,26,9): | -0.2600 | |

| Directional Movement: | -26.54 | |

| AROON (14): | -50.00 | |

| DEMA (21): | 35.54 | |

| Parabolic SAR (0,02-0,02-0,2): | 36.32 | |

| Elder Ray (13): | -0.57 | |

| Super Trend (3,10): | 35.95 | |

| Zig ZAG (10): | 35.20 | |

| VORTEX (21): | 0.7100 | |

| Stochastique (14,3,5): | 9.51 | |

| TEMA (21): | 35.33 | |

| Williams %R (14): | -85.81 | |

| Chande Momentum Oscillator (20): | -0.77 | |

| Repulse (5,40,3): | -0.8000 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0700 | |

| Courbe Coppock: | 2.91 |

| MA7: | 36.14 | |

| MA20: | 35.93 | |

| MA50: | 34.69 | |

| MA100: | 33.02 | |

| MAexp7: | 35.50 | |

| MAexp20: | 35.85 | |

| MAexp50: | 36.05 | |

| MAexp100: | 35.94 | |

| Price / MA7: | -2.52% | |

| Price / MA20: | -1.95% | |

| Price / MA50: | +1.56% | |

| Price / MA100: | +6.69% | |

| Price / MAexp7: | -0.76% | |

| Price / MAexp20: | -1.73% | |

| Price / MAexp50: | -2.27% | |

| Price / MAexp100: | -1.98% |

News

The latest news and videos published on FIFTH THIRD BANCORP at the time of the analysis were as follows:

- SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Fifth Third Bancorp - FITB

- SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Fifth Third Bancorp - FITB

- ROSEN, A LEADING LAW FIRM, Encourages Fifth Third Bancorp Investors to Inquire About Securities Class Action Investigation - FITB

- SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Fifth Third Bancorp - FITB

- SHAREHOLDER ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Fifth Third Bancorp - FITB

Add a comment

Comments

0 comments on the analysis FIFTH THIRD BANCORP - 1H