Investment Deal Signed with Zijin; Pathway to Kharmagtai Production

- 62

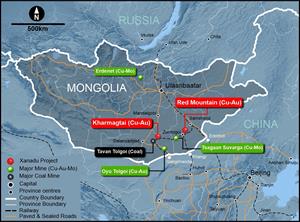

TORONTO, Dec. 21, 2022 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX:XAM) (Xanadu or the Company) is pleased to announce the execution of formal documentation for Phases 2 and 3 of the transaction with Zijin Mining Group Co., Limited (Zijin)1. This entails Zijin subscribing for additional shares in Xanadu to increase its corporate shareholding to 19.99% and the formation of a 50:50 Kharmagtai Joint Venture (Kharmagtai JV) through Xanadu’s 100% owned subsidiary Khuiten Metals Pte. Ltd. (Khuiten), which holds a 76.5% effective interest in the Kharmagtai copper-gold project (Kharmagtai).

The significant cash investment by Zijin provides funding for the Pre-Feasibility Study for Kharmagtai (Kharmagtai PFS) which will commence in early 2023 and take the project to a potential Final Investment Decision (FID) as early as 2024. These funds will also drive Xanadu’s exploration growth program, which will target high-grade mineralisation at depth, higher-grade deposit extensions, and new discoveries within the 66.5 square kilometre tenement.

Highlights

- Key documents executed include a Subscription Agreement for the placement in Xanadu (Phase 2 Placement) together with a Subscription Agreement and Joint Venture Shareholders’ Agreement with respect to Khuiten (Phase 3 JV), creating a binding partnership with Zijin, the fifth largest global copper mining company2.

- Completion of the Phase 2 Placement will raise approx. A$7.2 million for Xanadu (before costs) and increase Zijin’s shareholding in Xanadu to 19.99% with the issue of approx. 179.1 million shares at A$0.04 per share. The funds raised in the Phase 2 Placement will be used for (a) the exploration of Xanadu’s highly prospective Red Mountain project; (b) new project generation in southern Mongolia; and (c) corporate regulatory and administrative costs.

- Under the Phase 3 JV, Zijin will invest US$35 million into the Kharmagtai project in return for the formation of a 50:50 joint venture through Xanadu’s 100% owned subsidiary Khuiten. The US$35 million will be used to complete the Kharmagtai PFS, continue exploration and support associated expenditure on the project’s development.

- Upon delivery of the Kharmagtai PFS, Xanadu will have certain rights to partially or fully selldown its project interest in Kharmagtai to Zijin. These rights (structured as put options) provide flexibility for Xanadu to manage its exposure to future funding requirements of the project as well as provide optionality to potentially realise value for shareholders after the economics of the project development are better defined.

- In line with prior communications of the Strategic Partnership3:

- Xanadu will remain operator of Kharmagtai until the earlier of delivery of the Kharmagtai PFS or 18 months from completion of the Phase 3 transaction, with Zijin as operator thereafter.

- Agreements remain subject to certain People’s Republic of China regulatory approvals, and Xanadu Shareholder approval at its upcoming Extraordinary General Meeting (EGM) scheduled to be held in February 2023 and other conditions typical for transactions of this nature.

Executive Chairman & Managing Director, Colin Moorhead, said, “We are pleased to have finalised these agreements, achieving a mutually beneficial, long term partnership with Zijin, an experienced international developer and top 5 operator of large scale, open-pit copper-gold projects. Once completed, Xanadu will be in a very strong financial position, fully funded to take Kharmagtai to a decision to construct and capitalised to accelerate exploration programs across its highly prospective Kharmagtai and Red Mountain tenements. The deal structure enables us to deliver value for our shareholders in the future, irrespective of the prevailing market conditions.

We’re looking forward to unlocking the full potential of both the world-class Kharmagtai project and our exciting Red Mountain advanced exploration project, during a period when we believe prices will be well supported given the global aggressive shift to electrification to achieve decarbonisation goals.”

Strategic Partnership

Under the Strategic Partnership3, Zijin is investing at both the Xanadu corporate level and Kharmagtai project level through a series of transactions:

- Phase 1 Placement already completed; Zijin acquired a 9.84% interest in Xanadu, with the issue of 139 million shares at A$0.04/share.

- Phase 2 Placement will increase Zijin’s shareholding in Xanadu to 19.99%, with the issue of approx. 179.1 million shares at A$0.04/share (an approx. 43% premium relative to Xanadu’s share price at 19 December 2022).

- Phase 3 JV (or Kharmagtai JV) will result in the parties establishing a 50:50 incorporated joint venture in Khuiten, the entity currently wholly owned by Xanadu which holds a 76.5% effective interest in the Kharmagtai project, in return for Zijin injecting US$35M into Khuiten to support the Kharmagtai PFS and associated expenditure on the project’s next phase.

Zijin’s total investment in the Strategic Partnership with Xanadu is estimated at approx. A$64 million4, of which approx. A$12.8 million will be invested in Xanadu shares and approx. A$51.5 million (US$35 million) directly into Kharmagtai.

Zijin has already received approval from the Australian Foreign Investment Review Board (FIRB) in respect of the investment5. Remaining approvals include People’s Republic of China (PRC) regulatory approval and Xanadu shareholder approval, which are expected in Q1 2023.

Phase 2 - Placement

The Phase 2 Placement will involve Zijin subscribing for an additional tranche of ordinary shares in Xanadu to increase its total shareholding in Xanadu to 19.99% with the issue of approx. 179.1 million shares at an issue price of A$0.04 per share for a total investment of approx. A$7.2M. This represents an approx. 43% premium to Xanadu’s share price of A$0.028 per share as of 19 December 2022. This will give Zijin the right to appoint one Director to the Board of Xanadu Mines Ltd (subject to Zijin maintaining at least a 10% interest in Xanadu (other than a result of the dilution of Zijin by Xanadu). An existing Participation Right will also continue in circumstances where the issue of shares to a third party requires shareholder approval.

Key features of the Phase 2 Placement are described in the Appendix to this announcement.

Funds from the Phase 2 Placement will be used as follows:

- Exploration of Xanadu’s highly prospective Red Mountain project

- New project generation in southern Mongolia

- Corporate regulatory and administrative costs.

Phase 3 - Kharmagtai JV

The third and final stage of the partnership will involve Zijin and Xanadu establishing a 50:50 incorporated joint venture in Khuiten, the entity currently wholly owned by Xanadu, and which effectively owns 76.5% of the Kharmagtai project, along with 13.5% minority holder Ganbayar Lkhagvasuren (an Executive Director at Xanadu), and 10.0% minority holder QGX Ltd.

Zijin will subscribe for shares equal to 50% of Khuiten by way of a share placement for a cash payment of US$35 million to Khuiten, with Xanadu remaining the operator of the Kharmagtai JV until the earlier of delivery of the Kharmagtai PFS or 18 months from commencement of the Kharmagtai JV. Thereafter, driving towards the point of a construction decision, Zijin will then become the operator of the Kharmagtai JV and take leadership of the development and operational phase for the mine.

At that point, subject to satisfaction of certain conditions, Xanadu will also have certain rights to partially or fully sell down its project interests in the Kharmagtai project to Zijin. These rights (structured as put options as described below) provide flexibility for Xanadu to manage its exposure to the future funding requirements of the development, as well as provide optionality to potentially realise value for shareholders after the economics of the project development are better defined.

The Joint Venture Agreement is typical for transactions of this nature, with key features described in the Appendix to this announcement.

Put Options

After completion of the Kharmagtai PFS, Xanadu will have three choices available to it, enabling the Company to take an action which generates greatest value to its shareholders at the time:

- Fund its share of the project construction; or

- Sell 25% of the Kharmagtai JV to Zijin for US$25 million in cash, together with an obligation for Zijin to fund 100% of Xanadu’s share of expenditure under a loan carry (bearing interest at the 6-month Secured Overnight Financing Rate (SOFR) + 5% p.a.). This loan would cover all of Xanadu’s share of construction costs, to be repaid out of operating dividends and other payments or distributions post construction; or

- Sell Xanadu’s remaining 50% of the Kharmagtai JV to Zijin for US$50 million in cash.

For Xanadu to be entitled to be able to exercise either of the put options, the Kharmagtai PFS delivered by the Company must support an Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code, 2012) compliant Ore Reserve or National Instrument 43-101 (NI 43-101) compliant Mineral Reserve with a life of mine for the Kharmagtai Project of at least 20 years (using economic input parameters consistent with the Scoping Study conducted by the Company dated 6 April 20226 and the NI43-101 Preliminary Economic Assessment Technical Report prepared by the Company dated 20 June 20227), with an internal rate of return of at least 20% and a payback period of less than 6 years. Xanadu will also have to receive all required shareholder approvals pre-exercise of the put option.

Use of Funds

Funds received from the Phase 3 JV subscription will enable completion of the Kharmagtai PFS and continued exploration and development activities, including:

- PFS studies leading towards the FID and decision to construct;

- Infill drilling (approximately 30,000 metres) to support a JORC Code, 2012 compliant Ore Reserve and to support geotechnical, geometallurgical and sterilisation studies under the PFS;

- Metallurgical test work and studies to reduce risk and explore upside opportunities identified in the Kharmagtai Scoping Study;

- Mongolian permitting and regulatory approvals;

- Exploration drilling program targeting higher-grade mineralisation at depth, higher-grade deposit extensions, and new discovery on the Kharmagtai tenement; and

- Associated project development activities.

Advisors

Xanadu is being advised by Jefferies Australia Pty Ltd (Jefferies) as its financial adviser and HopgoodGanim Lawyers as its legal adviser for this series of transactions.

About Zijin Mining Group

Zijin is a multinational mining group dedicated to exploration and development of gold, copper, zinc and other mineral resources globally, as well as associated refining, processing, trading and other businesses. Its operations include projects and operations in 14 provinces in the People’s Republic of China (PRC) as well as 13 overseas countries across Europe, Central Asia, Africa, Oceania and South America. It is one of the largest Chinese mining companies distinguished by its significant domestic and international copper and gold resource, reserves and production.

| Zijin’s Mining Operations in China | Zijin’s Global Mining Operations |

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae782dfd-6b1d-4b72-a33c-2b5231d30c18 | https://www.globenewswire.com/NewsRoom/AttachmentNg/0100f4c9-6087-4857-9c87-2c16b2789e3f |

About the Kharmagtai Copper-Gold Project

Kharmagtai is Xanadu’s flagship project, located in the South Gobi region of Mongolia and has a Mineral Resource Estimate8 of 1.1 billion tonnes, containing 3 million tonnes of copper and 8 million ounces of gold. Xanadu recently released its Kharmagtai Scoping Study9, using a conventional and low risk open pit mine and sulphide process plant, which demonstrated a US$630 million net present value (NPV), 20% investment rate of return (IRR) project, with a 4-year payback, operating as a first quartile costs producer for its first five years of operation. Multiple upside opportunities were reported for evaluation during future studies, and gating to pre-feasibility stage was approved by the Board pending funding.

The next step of development at Kharmagtai will complete the Kharmagtai PFS, including delivery of a JORC Code, 2012 Compliant Ore Reserve and all Mongolian permitting and regulatory approvals to commence construction. This is anticipated to require 18 months and cost US$20 million to complete.

https://www.globenewswire.com/NewsRoom/AttachmentNg/973197c5-1d3f-468d-b5d2-95547df2c59a

For further information, please contact:

| Colin Moorhead | Spencer Cole |

| Executive Chairman & Managing Director | Chief Financial Officer & Chief Development Officer |

| E: [email protected] | E: [email protected] |

| P: +61 2 8280 7497 | |

| W: www.xanadumines.com |

This Announcement was authorised for release by Xanadu’s Board of Directors.

All dollar amounts are in Australian dollars unless otherwise indicated.

Appendix - Key Features of Agreements

Phase 2 Placement

Completion of the Phase 2 Placement is subject to the following conditions:

a) Xanadu shareholder approval under ASX Listing Rule 7.1 and for all other purposes (and any other regulatory approvals as required);

b) Zijin obtaining PRC regulatory approvals as required (noting that FIRB approval has already been obtained);

c) no breaches of warranties by Xanadu prior to completion;

d) no material adverse change in respect of Xanadu and its business prior to completion; and

e) the parties entering into the subscription agreement for the Phase 3 JV and the Company obtaining any shareholder approval required by ASX under that agreement.

These conditions must be satisfied on or before 4 months from execution of the subscription agreement for the Phase 2 Placement and the Phase 2 Placement will complete 10 Business Days after all approvals have been obtained.

On completion of the Phase 2 Placement, Zijin is to be provided the following rights:

(a) a right to appoint one director to the Board of Xanadu. The nominee must be reasonably acceptable to the Board in terms of being of good character or repute and holding appropriate experience to be a director of a listed public company; and

(b) continuation of the Limited and Conditional Participation Right granted to Zijin under the Phase 1 Placement and summarised in the ASX/TSX Announcement dated 19 April 2022 (Participation Right). After completion of the Phase 2 Placement, Zijin will be notified on a strictly confidential basis of Xanadu’s intention to undertake any issue of shares to a third party which requires shareholder approval, and Zijin will have a 5-business day period in which to indicate whether it wishes to participate in that capital raising on the basis of, and subject to shareholder approval (and subject to receipt of any relevant FIRB, PRC or other required regulatory approvals). This Participation Right is subject to compliance with ASX Listing Rules and ceases where Zijin’s interest falls below 5% and remains below that threshold for more than 20 consecutive days on which the ASX is open for trading.

The right for Zijin to nominate a director to the Board will continue for as long as Zijin retains not less than a 10% interest in Xanadu or where its interest falls below 10% because of either:

(a) an issue of shares by Xanadu other than in accordance with the Participation Right; or

(b) an issue of shares by Xanadu to a third party pending a further issue of shares to Zijin as a result of exercising its Participation Right.

Phase 3 Kharmagtai JV

Completion of the Phase 3 JV is subject to the following conditions:

(a) the parties entering into the subscription agreement for the Phase 2 Placement and the Company obtaining shareholder approval under that agreement (and any other regulatory approvals as required);

(b) Zijin obtaining PRC regulatory approvals as required;

(c) the issuance to the Company of shares in Khuiten in full and final satisfaction of the aggregate total of all shareholder loans made by the Company to Khuiten. These loans represent all exploration related expenditure at Kharmagtai subsequent to project acquisition in 2013 (being a current amount of approximately A$59.7 million) (Xanadu Loan Conversion);

(d) no breaches of warranties by Xanadu or Khuiten prior to completion; and

(e) no material adverse change in respect of Xanadu, Khuiten or their businesses prior to completion.

These conditions must be satisfied on or before the same date as for the Phase 2 Placement, being 4 months from execution of the subscription agreement for the Phase 3 JV and the Phase 3 JV will complete 10 Business Days after all approvals have been obtained and Xanadu has completed the Xanadu Loan. This is expected to occur on or shortly after completion of the Phase 2 Placement.

Xanadu and Zijin have entered into a Joint Venture Shareholders' Agreement typical for transactions of this nature, the key features of which include:

- commencement from the date of completion of the subscription agreement for the Phase 3 JV;

- the primary objective for Xanadu to use reasonable endeavours to deliver the Kharmagtai PFS within 18 months from commencement of the joint venture;

- funding to be paid from the payment made by Zijin to subscribe for its 50% interest and thereafter to be borne by shareholders in their respective proportions. Where a party fails to meet its funding obligations, the other party will be entitled to meet that shortfall in return for the issue of additional shares (resulting in the dilution of the defaulting shareholder);

- agreement on an initial development plan and budget for the first 18 months from commencement of the Joint Venture Agreement (which is expected to take the joint venture through to delivery of the Kharmagtai PFS). After that, approval of annual budgets and development plans will require special majority approval of the board of Khuiten;

- appointment of Xanadu in the role of the operator of the joint venture from commencement of the joint venture until the earlier of delivery of the Kharmagtai PFS or 18 months from the commencement of the joint venture, after which Zijin will assume the role of operator;

- the initial appointment of two directors from each of Xanadu and Zijin to the board of Khuiten (one for each 25% interest held);

- a right for Xanadu to appoint the initial chairperson of the Khuiten board through until the earlier of delivery of the Kharmagtai PFS or 18 months from the commencement of the joint venture. Xanadu’s Executive Chairman and Managing Director, Colin Moorhead, will be the initial appointee as chairperson. Zijin will have the right to appoint the chairperson after the lapse of that initial period;

- a right for Xanadu to appoint the initial General Manager for Khuiten through until the earlier of delivery of the Kharmagtai PFS or 18 months from the commencement of the joint venture, with the Deputy General Manager to be appointed by Zijin. After that initial period has lapsed, these rights will reverse (provided that Xanadu must retain at least a 25% interest to preserve its right to appoint the Deputy General Manager);

- equal voting rights from commencement for Xanadu and Zijin at Khuiten board meetings subject to any changes in shareholdings (voting rights based upon respective proportionate shareholdings), with the chairperson not having a casting vote;

- identified critical business matters, including certain expenditure or transactions with a value above US$1,000,000, increasing to US$10,000,000 after the earlier of delivery of the Kharmagtai PFS or 18 months from the commencement of the joint venture, will require a special majority approval by the board of Khuiten (being greater than 67% of votes which may be cast);

- deadlocks at a board or shareholder meeting for Khuiten, the following process will be instigated:

- the conduct of a further meeting as soon as possible to consider the same resolution;

- where there is a continuing deadlock, negotiations must be conducted between the senior representatives of Xanadu and Zijin to resolve the dispute;

- where the deadlock continues and relates to technical or accounting matters, then the dispute is to be referred to an appropriately qualified independent expert as appointed by the board; and

- if a deadlock is unable to be resolved, the board will be taken to have determined that no action is to be taken on that resolution;

- the grant of the two put options to Xanadu to require Zijin to acquire from Xanadu either a further 25% interest in Khuiten (25% Option) or the whole of Xanadu’s 50% interest in Khuiten (50% Option). The key terms relating to the exercise of these options are:

- purchase price payable by Zijin is US$25,000,000 for the 25% Option and US$50,000,000 for the 50% Option;

- the right to exercise either put option only arises if Xanadu delivers the Kharmagtai PFS. This PFS:

- must constitute a comprehensive prefeasibility study of the viability of the Kharmagtai Project including:

- a comparison of options and selecting a single path forward for mining method, processing and infrastructure;

- a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be classified as a mineral reserve under the JORC Code, 2012 or NI 43-101;

- must support a JORC Code, 2012 compliant Ore Reserve or NI43-101 compliant Mineral Reserve:

- with a life of mine of at least 20 years (using economic input parameters consistent with the Scoping Study dated 6 April 2022 and the NI43-101 Preliminary Economic Assessment Technical Report dated 20 June 2022);

- with an internal rate of return of at least 20%; and

- a payback period of less than 6 years .

- must constitute a comprehensive prefeasibility study of the viability of the Kharmagtai Project including:

- once the Kharmagtai PFS is delivered, Xanadu will have a 6 month period to exercise either option, including first obtaining any shareholder, ASX, TSX or other regulatory approvals which may be necessary as a precondition to Xanadu being able to exercise the relevant option;

- completion will take place two months after the exercise of an option by Xanadu; and

- Xanadu will only be able to exercise either one of these options (i.e., the 50% Option will lapse if the 25% Option is exercised);

- if Xanadu exercises the 25% Option, it will remain liable for its respective proportion of the funding for the progression of the joint venture until commencement of commercial production at the Kharmagtai Project. This would be funded by way of a loan from Zijin (Funding Loan) on the following key terms:

- interest will be payable on the Funding Loan at SOFR (based on a 6 month term) + 5% per annum);

- the Funding Loan will rank in priority to distributions to shareholders;

- 90% of all the amounts of dividends and distributions due to Xanadu will be directed to Zijin and applied as repayment of the Funding Loan (interest before principal);

- repayment of the Funding Loan due 10 years from the date of the commencement of the commercial production of the Kharmagtai Project or upon earlier termination of the joint venture or earlier default by the Company; and

- interest will be capitalised monthly and payable on the Repayment Date.

- pre-emptive rights for the issue of additional shares in Khuiten, such that new shares will be first offered to all shareholders in their respective proportions. Additional shares which have not been accepted by a shareholder will then be offered to the other shareholders. Any additional shares which have still not been accepted can then be offered to third parties (at no lower issue price);

- pre-emptive rights for the acquisition of shares held in Khuiten proposed to be disposed of by a shareholder to a third party. Notice and details of the proposed sale must be provided to the other shareholders and be open for acceptance, in their respective proportions, for 20 business days. Offers not initially accepted by a shareholder must be offered to other shareholders. Remaining unsold shares can be sold to a third party within 3 months after this process on terms no more advantageous than those offered to the shareholders; and

- drag along and tag along rights apply to a proposed sale of shares held in Khuiten by either a single shareholder holding at least 51% or multiple shareholders holding at least 75% in aggregate – on terms the same as (drag right) or no less favourable than (tag rights) the terms on which the seller proposes to sell its shares to a proposed purchaser.

_____________________________________

1 ASX/TSX Announcement 19 April 2022 - Strategic Partnership with Zijin Mining and Placement

2 Kitco - https://www.kitco.com/news/2022-09-26/Top-10-largest-copper-mining-companies-in-Q2-2022-report.html

3 ASX/TSX Announcement 19 April 2022 - Strategic Partnership with Zijin Mining and Placement

4 Completed A$5.6M for Phase 1; Remaining A$7.2M for Phase 2 and US$35M for Phase 3; using 0.68 USD / AUD exchange rate

5 ASX/TSX Announcement 22 August 2022 - Foreign Investment Review Board Approves Zijin Investment in Xanadu

6 ASX/TSX Announcement 6 April 2022 - Scoping Study - Kharmagtai Copper-Gold Project

7 ASX/TSX Announcement 20 June 2022 - NI 43-101 Preliminary Economic Assessment Technical Report

8 ASX/TSX Announcement - 8 December 2021 - Kharmagtai Resource Grows to 1.1 billion Tonnes.

9 ASX/TSX Announcement 6 April 2022 - Scoping Study Kharmagtai Copper-Gold Project

GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases, financial disclosures and multimedia content to media, investors, and consumers worldwide.