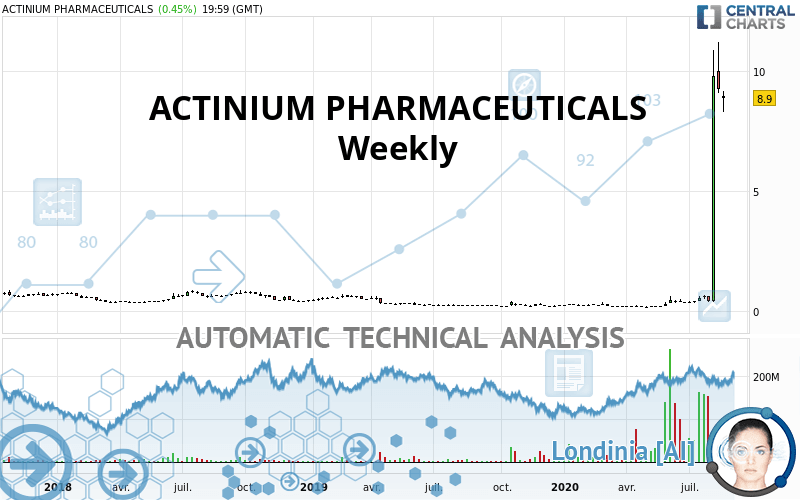

ACTINIUM PHARMACEUTICALS - Weekly - Technical analysis published on 08/26/2020 (GMT)

- 259

- 1

- Who voted?

- Timeframe : Weekly

- - Analysis generated on

- Status : WITHOUT TARGET

Summary of the analysis

Additional analysis

Quotes

ACTINIUM PHARMACEUTICALS rating 8.90 USD. The price is lower by -7.58% over the 5 days and has been traded over the last 5 days between 8.31 USD and 9.18 USD. This implies that the 5 day price is +7.10% from its lowest point and -3.05% from its highest point.Here is a more detailed summary of the historical variations registered by ACTINIUM PHARMACEUTICALS:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of this Weekly chart of ACTINIUM PHARMACEUTICALS indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators scanner does not detect any result on moving averages that would impact this trend.

In fact, according to the parameters integrated into the Central Analyzer system, 17 technical indicators out of 18 analysed are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 90

Type : Neutral

Timeframe : Weekly

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Weekly

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : Weekly

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Weekly

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Bearish doji star

Type : Bearish

Timeframe : Weekly

Long black line

Type : Bearish

Timeframe : Weekly

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 0.82 | 1.31 | 1.58 | 8.90 |

| Change (%) | -90.79% | -85.28% | -82.25% | - |

| Change | -8.08 | -7.59 | -7.32 | - |

| Level | Intermediate | Minor | Intermediate | - |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 7.74 | 8.02 | 8.44 | 8.73 | 9.15 | 9.44 | 9.85 |

| Camarilla | 8.67 | 8.73 | 8.80 | 8.86 | 8.93 | 8.99 | 9.05 |

| Woodie | 7.80 | 8.06 | 8.51 | 8.76 | 9.21 | 9.47 | 9.92 |

| Fibonacci | 8.02 | 8.29 | 8.46 | 8.73 | 9.00 | 9.17 | 9.44 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 6.38 | 7.74 | 8.51 | 9.87 | 10.64 | 12.01 | 12.78 |

| Camarilla | 8.69 | 8.89 | 9.08 | 9.28 | 9.48 | 9.67 | 9.87 |

| Woodie | 6.08 | 7.59 | 8.21 | 9.72 | 10.35 | 11.86 | 12.48 |

| Fibonacci | 7.74 | 8.55 | 9.06 | 9.87 | 10.69 | 11.19 | 12.01 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.03 | 0.17 | 0.37 | 0.51 | 0.71 | 0.85 | 1.06 |

| Camarilla | 0.48 | 0.51 | 0.55 | 0.58 | 0.61 | 0.64 | 0.67 |

| Woodie | 0.06 | 0.19 | 0.41 | 0.53 | 0.75 | 0.87 | 1.09 |

| Fibonacci | 0.17 | 0.30 | 0.38 | 0.51 | 0.64 | 0.72 | 0.85 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 88.20 | |

| MACD (12,26,9): | 1.7200 | |

| Directional Movement: | 65.79 | |

| AROON (14): | 92.86 | |

| DEMA (21): | 4.46 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.38 | |

| Elder Ray (13): | 5.07 | |

| Super Trend (3,10): | 6.40 | |

| Zig ZAG (10): | 8.90 | |

| VORTEX (21): | 1.5200 | |

| Stochastique (14,3,5): | 83.68 | |

| TEMA (21): | 5.98 | |

| Williams %R (14): | -21.14 | |

| Chande Momentum Oscillator (20): | 8.60 | |

| Repulse (5,40,3): | 29.9200 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 26.6300 | |

| Courbe Coppock: | 4,019.03 |

| MA7: | 9.65 | |

| MA20: | 5.56 | |

| MA50: | 2.47 | |

| MA100: | 1.35 | |

| MAexp7: | 5.53 | |

| MAexp20: | 2.67 | |

| MAexp50: | 1.33 | |

| MAexp100: | 0.91 | |

| Price / MA7: | -7.77% | |

| Price / MA20: | +60.07% | |

| Price / MA50: | +260.32% | |

| Price / MA100: | +559.26% | |

| Price / MAexp7: | +60.94% | |

| Price / MAexp20: | +233.33% | |

| Price / MAexp50: | +569.17% | |

| Price / MAexp100: | +878.02% |

News

Don"t forget to follow the news on ACTINIUM PHARMACEUTICALS. At the time of publication of this analysis, the latest news was as follows:

-

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-11-2020

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-11-2020

-

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-07-2020

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-07-2020

-

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-06-2020

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 08-06-2020

-

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 07-28-2020

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 07-28-2020

-

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 07-27-2020

Actinium Pharmaceuticals, Inc. - ATNM Stock Chart Technical Analysis for 07-27-2020

Add a comment

Comments

1 comments on the analysis ACTINIUM PHARMACEUTICALS - Weekly