Japanese candlesticks - Separating line

- 1869

- 0

- 0

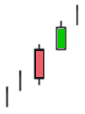

Bullish separating line

Definition: A bullish separating line structure is comprised of two Japanese candlesticks. The first is a large bearish candlestick (red) followed by a bullish candlestick (green) which opens at the same level as the previous candlestick. The two candlesticks can be of different sizes.

Illustration:

Characteristic: A bullish separating line often forms after a significant increase characterized by several large Japanese bullish (green) candlesticks.

Significance: A bullish separating line is a continuation pattern, it indicates a continuation of the bullish movement.

Note: For the structure to be validated, the next candlestick must be bullish and close above the green candlestick’s closing level.

Invalidation: If the lowest point of the bullish candlestick (green) surmounts the next candlestick, the structure can be considered invalidated.

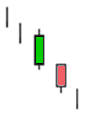

Bearish separating line

Definition: A bearish separating line structure is comprised of two Japanese candlesticks. The first is a large bullish candlestick (green) followed by a bearish candlestick (red) which opens at the same level as the previous candlestick. The two candlesticks can be of different sizes.

Illustration:

Characteristic: A bearish separating line often forms after a significant drop characterized by several large Japanese bearish (red) candlesticks.

Significance: A bearish separating line is a continuation pattern, it indicates a continuation of the bearish movement.

Note: For the structure to be validated, the next candlestick must be bearish and close below the closing level of the red candlestick.

Invalidation: If the highest point of the bearish candlestick (red) surmounts the next candlestick, the structure can be considered invalidated.

About author

- 24

- 42

- 63

- 6