Chart pattern: V Top

- 8724

- 0

- 0

What is a V top?

A V top is an inverted V-shaped peak as its name suggests. The peak is very sharp. Investor irrationality leads to a sudden price rise, then a complete retracement of the bullish movement in the aftermath. A V top often occurs in a bullish trend and announces a trend reversal. However, it may also form in a bearish trend. A V top regularly appears after an economic announcement that has taken investors by surprise. This is a sign of high volatility.

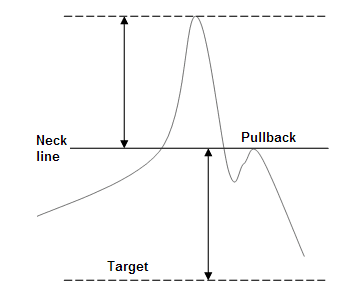

The pattern’s neck line is formed by the low point preceding the formation of the inverted V

The pattern’s theoretical objective is the distance between the neck line and the highest point of the inverted V that is plotted on the neck line.

Several criteria make it possible to identify a V top:

- The highest point of the inverted V is often formed by a single candlestick (often with a large high wick, which indicates the investors' desire for a reversal)

- The sudden bullish movement that forms the inverted V is driven by a very steep bullish trend line. The price hardly pauses during the movement.

- The angle of the bearish line leading to the bearish reversal must be almost identical to the angle of the bullish line that led to the bullish movement.

Graphical representation of a V Top

Notes on V Tops

- It is very difficult to anticipate a V top

- The interest of the pattern lies in its potential to reverse the trend

- V-tops often appear in a channel

- The bearish movement continues in most cases once the pattern is completed, but with the trend.

Trading strategies with V Tops

The traditional strategy:

Entry: Open a short position at the break of the neck line

Stop loss: The stop loss is placed above the neck line

Objective: Theoretical objective of the pattern

Advantage: The bearish movement very often continues after the break in the neck line

Disadvantage: It is difficult to place a stop loss correctly because the only real last highest point is the one on the top of the V top.

The aggressive strategy:

Entry: Open a long position if the angle on the bearish line that drives the bearish movement appears to be identical to the angle of the bullish line that drove the bullish movement

Stop loss: The stop is placed under the last highest one

Objective: Return to the neck line

Advantage: The increase can be very fast.

Disadvantage: The pattern is not yet confirmed and the bullish movement following the V top’s low point could be a simple correction.

For your information: A V Top is a reversal chart pattern. Its opposite is a V Bottom.

About author

- 26

- 42

- 45

- 6