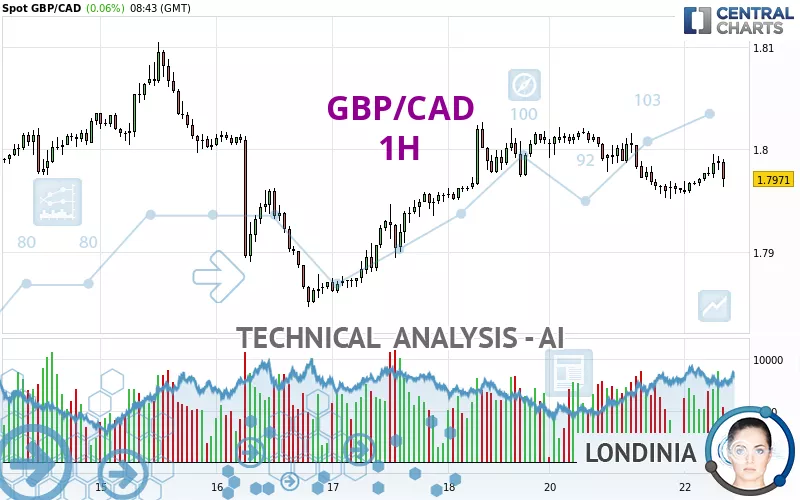

GBP/CAD - 1H - Technical analysis published on 10/22/2024 (GMT)

- 129

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The GBP/CAD rating is 1.7971 CAD. The price registered an increase of +0.06% on the session with the lowest point at 1.7956 CAD and the highest point at 1.7996 CAD. The deviation from the price is +0.08% for the low point and -0.14% for the high point.Here is a more detailed summary of the historical variations registered by GBP/CAD:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in 1H of this GBP/CAD chart shows a bearish trend. 64.29% of the signals given by moving averages are bearish. This bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 50

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 1 hour

In fact, 11 technical indicators on 18 studied are currently bullish. Central Indicators, the detector scanner for these technical indicators has recently detected several signals:

RSI indicator is back under 50

Type : Bearish

Timeframe : 1 hour

Price is back under the pivot point

Type : Bearish

Timeframe : 1 hour

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Williams %R indicator is back under -50

Type : Bearish

Timeframe : 1 hour

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Near resistance of channel

Type : Bearish

Timeframe : 1 hour

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.7876 | 1.7903 | 1.7942 | 1.7971 | 1.7974 | 1.8015 | 1.8092 |

| Change (%) | -0.53% | -0.38% | -0.16% | - | +0.02% | +0.24% | +0.67% |

| Change | -0.0095 | -0.0068 | -0.0029 | - | +0.0003 | +0.0044 | +0.0121 |

| Level | Minor | Minor | Intermediate | - | Minor | Intermediate | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.7864 | 1.7908 | 1.7934 | 1.7978 | 1.8004 | 1.8048 | 1.8074 |

| Camarilla | 1.7941 | 1.7947 | 1.7954 | 1.7960 | 1.7966 | 1.7973 | 1.7979 |

| Woodie | 1.7855 | 1.7904 | 1.7925 | 1.7974 | 1.7995 | 1.8044 | 1.8065 |

| Fibonacci | 1.7908 | 1.7935 | 1.7951 | 1.7978 | 1.8005 | 1.8021 | 1.8048 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.7611 | 1.7729 | 1.7870 | 1.7988 | 1.8129 | 1.8247 | 1.8388 |

| Camarilla | 1.7941 | 1.7965 | 1.7988 | 1.8012 | 1.8036 | 1.8060 | 1.8083 |

| Woodie | 1.7624 | 1.7735 | 1.7883 | 1.7994 | 1.8142 | 1.8253 | 1.8401 |

| Fibonacci | 1.7729 | 1.7828 | 1.7889 | 1.7988 | 1.8087 | 1.8148 | 1.8247 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.7356 | 1.7525 | 1.7809 | 1.7978 | 1.8262 | 1.8431 | 1.8715 |

| Camarilla | 1.7969 | 1.8011 | 1.8053 | 1.8094 | 1.8136 | 1.8177 | 1.8219 |

| Woodie | 1.7415 | 1.7554 | 1.7868 | 1.8007 | 1.8321 | 1.8460 | 1.8774 |

| Fibonacci | 1.7525 | 1.7698 | 1.7805 | 1.7978 | 1.8151 | 1.8258 | 1.8431 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 52.77 | |

| MACD (12,26,9): | -0.0004 | |

| Directional Movement: | 1.7207 | |

| AROON (14): | -28.5714 | |

| DEMA (21): | 1.7969 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.7961 | |

| Elder Ray (13): | 0.0008 | |

| Super Trend (3,10): | 1.8001 | |

| Zig ZAG (10): | 1.7968 | |

| VORTEX (21): | 0.9496 | |

| Stochastique (14,3,5): | 78.77 | |

| TEMA (21): | 1.7965 | |

| Williams %R (14): | -12.50 | |

| Chande Momentum Oscillator (20): | 0.0016 | |

| Repulse (5,40,3): | 0.0592 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0060 | |

| Courbe Coppock: | 0.11 |

| MA7: | 1.7974 | |

| MA20: | 1.7949 | |

| MA50: | 1.7869 | |

| MA100: | 1.7709 | |

| MAexp7: | 1.7974 | |

| MAexp20: | 1.7976 | |

| MAexp50: | 1.7978 | |

| MAexp100: | 1.7972 | |

| Price / MA7: | -0.02% | |

| Price / MA20: | +0.12% | |

| Price / MA50: | +0.57% | |

| Price / MA100: | +1.48% | |

| Price / MAexp7: | -0.02% | |

| Price / MAexp20: | -0.03% | |

| Price / MAexp50: | -0.04% | |

| Price / MAexp100: | -0.01% |

News

Don't forget to follow the news on GBP/CAD. At the time of publication of this analysis, the latest news was as follows:

-

GBP/CAD Forecast October 14, 2024

-

GBP/CAD Forecast September 2, 2024

-

GBP/CAD Forecast August 29, 2024

-

GBP/CAD Forecast August 13, 2024

-

GBPCAD Sports a Trend That Belies Uncertainty and High Risk of Volatility (Quick Take Video)

Add a comment

Comments

0 comments on the analysis GBP/CAD - 1H