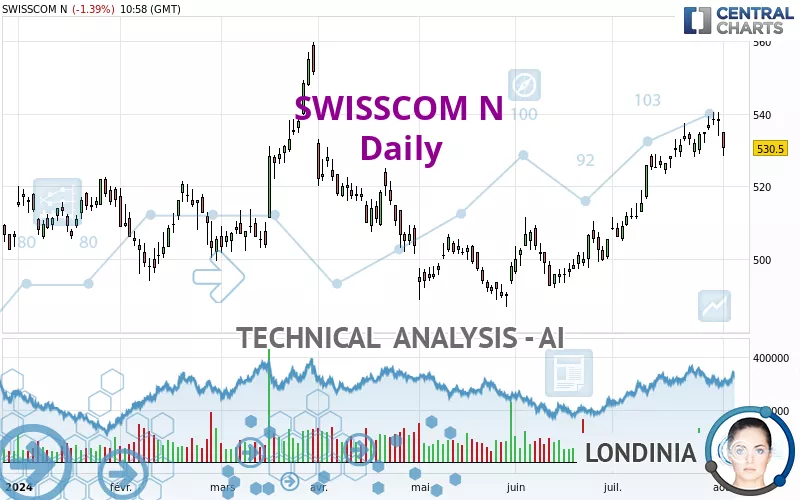

SWISSCOM N - Daily - Technical analysis published on 09/02/2024 (GMT)

- 151

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

SWISSCOM N rating 543.0 CHF. The price has increased by +1.21% since the last closing with the lowest point at 537.5 CHF and the highest point at 543.0 CHF. The deviation from the price is +1.02% for the low point and 0% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by SWISSCOM N:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of SWISSCOM N in Daily shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators scanner detects a bullish signal on moving averages that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : Daily

The probability of a further increase is high given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 525.8 | 532.5 | 538.5 | 543.0 | 553.7 | 586.6 | 619.4 |

| Change (%) | -3.17% | -1.93% | -0.83% | - | +1.97% | +8.03% | +14.07% |

| Change | -17.2 | -10.5 | -4.5 | - | +10.7 | +43.6 | +76.4 |

| Level | Minor | Intermediate | Intermediate | - | Major | Intermediate | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 530.7 | 532.8 | 534.7 | 536.8 | 538.7 | 540.8 | 542.7 |

| Camarilla | 535.4 | 535.8 | 536.1 | 536.5 | 536.9 | 537.2 | 537.6 |

| Woodie | 530.5 | 532.8 | 534.5 | 536.8 | 538.5 | 540.8 | 542.5 |

| Fibonacci | 532.8 | 534.4 | 535.3 | 536.8 | 538.4 | 539.3 | 540.8 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 528.2 | 530.8 | 533.7 | 536.3 | 539.2 | 541.8 | 544.7 |

| Camarilla | 535.0 | 535.5 | 536.0 | 536.5 | 537.0 | 537.5 | 538.0 |

| Woodie | 528.3 | 530.9 | 533.8 | 536.4 | 539.3 | 541.9 | 544.8 |

| Fibonacci | 530.8 | 532.9 | 534.2 | 536.3 | 538.4 | 539.7 | 541.8 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 494.0 | 503.5 | 520.0 | 529.5 | 546.0 | 555.5 | 572.0 |

| Camarilla | 529.4 | 531.7 | 534.1 | 536.5 | 538.9 | 541.3 | 543.7 |

| Woodie | 497.5 | 505.3 | 523.5 | 531.3 | 549.5 | 557.3 | 575.5 |

| Fibonacci | 503.5 | 513.4 | 519.6 | 529.5 | 539.4 | 545.6 | 555.5 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 66.30 | |

| MACD (12,26,9): | 3.8000 | |

| Directional Movement: | 13.0 | |

| AROON (14): | 100.0 | |

| DEMA (21): | 537.4 | |

| Parabolic SAR (0,02-0,02-0,2): | 524.7 | |

| Elder Ray (13): | 5.9 | |

| Super Trend (3,10): | 526.1 | |

| Zig ZAG (10): | 542.5 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 84.30 | |

| TEMA (21): | 537.7 | |

| Williams %R (14): | -3.10 | |

| Chande Momentum Oscillator (20): | 14.0 | |

| Repulse (5,40,3): | 0.7000 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.1000 | |

| Courbe Coppock: | 4.30 |

| MA7: | 536.8 | |

| MA20: | 530.2 | |

| MA50: | 524.9 | |

| MA100: | 513.7 | |

| MAexp7: | 536.8 | |

| MAexp20: | 532.5 | |

| MAexp50: | 525.5 | |

| MAexp100: | 520.2 | |

| Price / MA7: | +1.15% | |

| Price / MA20: | +2.41% | |

| Price / MA50: | +3.45% | |

| Price / MA100: | +5.70% | |

| Price / MAexp7: | +1.15% | |

| Price / MAexp20: | +1.97% | |

| Price / MAexp50: | +3.33% | |

| Price / MAexp100: | +4.38% |

News

Don't forget to follow the news on SWISSCOM N. At the time of publication of this analysis, the latest news was as follows:

- EchoStar Mobile and Actility Expand LoRaWAN IoT Coverage for Swisscom

- EchoStar Mobile and Actility Expand LoRaWAN IoT Coverage for Swisscom

- Neo Medical closes Swisscom Ventures-lead USD $20.6M financing round

- Swisscom Joins FreeMove

- Artificial Solutions and Swisscom Announce Partnership

Add a comment

Comments

0 comments on the analysis SWISSCOM N - Daily