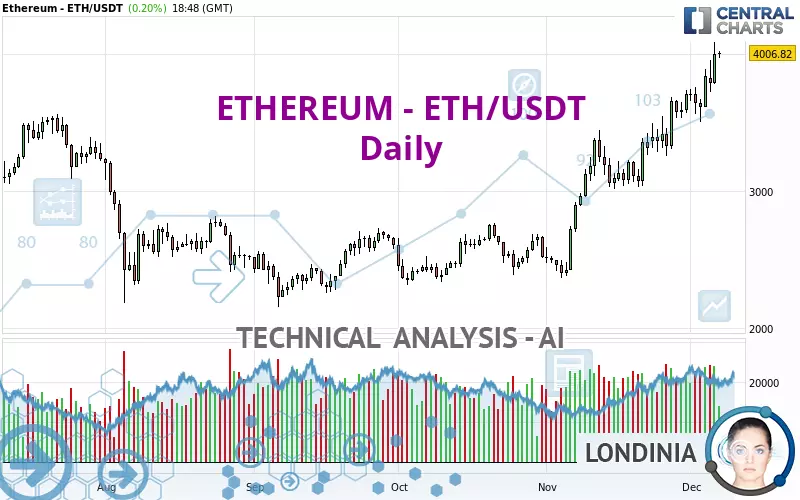

ETHEREUM - ETH/USDT - Daily - Technical analysis published on 12/07/2024 (GMT)

- 416

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The ETHEREUM - ETH/USDT rating is 4,006.82 USDT. On the day, this instrument gained +0.20% and was between 3,968.68 USDT and 4,024.03 USDT. This implies that the price is at +0.96% from its lowest and at -0.43% from its highest.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of ETHEREUM - ETH/USDT indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

In fact, 14 technical indicators on 18 studied are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found this result:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | |

|---|---|---|---|---|---|

| ProTrendLines | 3,367.75 | 3,531.03 | 3,894.17 | 4,006.82 | 4,064.95 |

| Change (%) | -15.95% | -11.87% | -2.81% | - | +1.45% |

| Change | -639.07 | -475.79 | -112.65 | - | +58.13 |

| Level | Intermediate | Intermediate | Intermediate | - | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3,513.64 | 3,646.01 | 3,822.49 | 3,954.86 | 4,131.34 | 4,263.71 | 4,440.19 |

| Camarilla | 3,914.03 | 3,942.34 | 3,970.65 | 3,998.96 | 4,027.27 | 4,055.58 | 4,083.89 |

| Woodie | 3,535.69 | 3,657.04 | 3,844.54 | 3,965.89 | 4,153.39 | 4,274.74 | 4,462.24 |

| Fibonacci | 3,646.01 | 3,763.99 | 3,836.88 | 3,954.86 | 4,072.84 | 4,145.73 | 4,263.71 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2,905.96 | 3,079.42 | 3,391.59 | 3,565.05 | 3,877.22 | 4,050.68 | 4,362.85 |

| Camarilla | 3,570.20 | 3,614.72 | 3,659.23 | 3,703.75 | 3,748.27 | 3,792.78 | 3,837.30 |

| Woodie | 2,975.31 | 3,114.10 | 3,460.94 | 3,599.73 | 3,946.57 | 4,085.36 | 4,432.20 |

| Fibonacci | 3,079.42 | 3,264.93 | 3,379.54 | 3,565.05 | 3,750.56 | 3,865.17 | 4,050.68 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1,417.64 | 1,888.77 | 2,796.26 | 3,267.39 | 4,174.88 | 4,646.01 | 5,553.50 |

| Camarilla | 3,324.63 | 3,451.00 | 3,577.38 | 3,703.75 | 3,830.12 | 3,956.50 | 4,082.87 |

| Woodie | 1,635.82 | 1,997.86 | 3,014.44 | 3,376.48 | 4,393.06 | 4,755.10 | 5,771.68 |

| Fibonacci | 1,888.77 | 2,415.40 | 2,740.76 | 3,267.39 | 3,794.02 | 4,119.38 | 4,646.01 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 72.11 | |

| MACD (12,26,9): | 240.2900 | |

| Directional Movement: | 23.55 | |

| AROON (14): | 71.43 | |

| DEMA (21): | 3,879.36 | |

| Parabolic SAR (0,02-0,02-0,2): | 3,685.87 | |

| Elder Ray (13): | 300.67 | |

| Super Trend (3,10): | 3,430.61 | |

| Zig ZAG (10): | 3,994.37 | |

| VORTEX (21): | 1.2200 | |

| Stochastique (14,3,5): | 84.75 | |

| TEMA (21): | 3,954.19 | |

| Williams %R (14): | -10.95 | |

| Chande Momentum Oscillator (20): | 581.12 | |

| Repulse (5,40,3): | 4.8600 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 1.0000 | |

| Courbe Coppock: | 33.10 |

| MA7: | 3,797.85 | |

| MA20: | 3,532.85 | |

| MA50: | 3,070.91 | |

| MA100: | 2,771.20 | |

| MAexp7: | 3,825.29 | |

| MAexp20: | 3,568.83 | |

| MAexp50: | 3,213.34 | |

| MAexp100: | 3,009.43 | |

| Price / MA7: | +5.50% | |

| Price / MA20: | +13.42% | |

| Price / MA50: | +30.48% | |

| Price / MA100: | +44.59% | |

| Price / MAexp7: | +4.75% | |

| Price / MAexp20: | +12.27% | |

| Price / MAexp50: | +24.69% | |

| Price / MAexp100: | +33.14% |

Add a comment

Comments

0 comments on the analysis ETHEREUM - ETH/USDT - Daily