Radisson exploration drilling suggests potential fourth high-grade mineralized trend, 1,200 m east of the old O’Brien Mine, with multiple intercepts including 31.56 g/t Au over 2.00 m and 13.83 g/t Au over 2.40 m

- 68

ROUYN-NORANDA, Quebec, Jan. 12, 2022 (GLOBE NEWSWIRE) -- Radisson Mining Resources Inc. (TSX-V: RDS, OTC: RMRDF): (“Radisson” or the “Company") is pleased to announce significant high-grade gold intercepts from the ongoing 130,000 m exploration drill program at its 100% owned O’Brien gold project located along the Larder-Lake-Cadillac Break (see location map 1 and location map 2), halfway between Rouyn-Noranda and Val-d’Or in Quebec, Canada.

Key highlights

- Significant intercepts from exploration drilling along new high-grade trend #4

- OB-21-241: 31.56 g/t Au over 2.00 m including 60.80 g/t Au over 1.00 m

- OB-21-228: Multiple high-grade intercepts including,

- 13.83 g/t Au over 2.40 m including 29.30 g/t Au over 1.10 m

- 9.30 g/t Au over 1.90 m including 17.55 g/t Au over 1.00 m

- 5.66 g/t Au over 2.00 m including 10.35 g/t Au over 1.00 m

- OB-21-229: 5.14 g/t Au over 2.00 m and 5.95 g/t Au over 2.20 m

- OB-21-244: 4.03 g/t Au over 2.15 m and 4.70 g/t Au over 2.00 m

- New results along with historical drilling suggests a fourth potential high-grade mineralized vector (trend #4) approximately 1,200 m east of the old O’Brien Mine

- This sector does not contribute meaningfully to current resources. Drilling has traced mineralization down to a vertical depth of 330 m in this area which remains open for expansion over 750 m laterally and at depth.

- Significant intercepts from resource expansion drilling along high-grade trend #3

- OB-21-255: 15.68 g/t Au over 2.00 m including 25.10 g/t Au over 1.00 m

- OB-21-256: 11.75 g/t Au over 2.50 m including 24.30 g/t Au over 1.00 m

- Drilling to date has traced mineralization to a depth of 500 m in this sector where current resources are largely limited to a vertical depth of 240 m.

- 130,000 m drill program underway at O’Brien

- 116,000 m completed thus far with results pending for 34,000 m

- Cash balance of approx. $11.0 million

“In addition to targeting resource expansion along previously defined high-grade trends 1, 2 and 3, we are also stepping out to define additional O’Brien-like mineralized trends to the east of trend #3 and to the west of the historic O’Brien Mine. We are very pleased to report recent results including 13.83 g/t over 2.40 m (OB-21-228) and 31.56 g/t Au over 2.00 (OB-21-241) that appear to confirm a potential fourth high-grade mineralized vector further east of trend #3 and 1,200 m east of the old O’Brien Mine. Current and historical intercepts have now traced mineralization down to a vertical depth of 330 m in this sector that does not meaningfully contribute to current resources. In addition, drilling continues to highlight resource expansion potential along high-grade trend #3, with notable new intercepts including 15.68 g/t Au over 2.00 m (OB-21-255) and 11.75 g/t Au over 2.50 m (OB-21-256).

While results thus far cover only 1.2 km of strike to the east of the O’Brien Mine, today’s results re-affirm the potential upside from the more than 5 km of prospective strike that we control along the Cadillac Break. Results are pending from 34,000 m of drilling in 74 holes, of which 33 holes have visible gold occurrences. This includes an initial 5,700 m exploration drill program completed to the west of the O’Brien Mine and 28,300 additional meters completed on Trend 0, 1, 2 and 3. In addition, we are currently drilling high priority targets below previously encountered mineralization in trend #1 and #2. We expect a significant amount of news flows in the weeks and months ahead as these results become available.” commented Rahul Paul, President and Chief Executive Officer.

Notable drill results

| Hole | Zone | From (m) | To (m) | Core Length (m) | Au (g/t) - Uncut | Comments | |

| OB-21-228 | Trend #4 | ||||||

| 171.10 | 173.00 | 1.90 | 9.30 | Pontiac Sediments | |||

| Including | 172.00 | 173.00 | 1.00 | 17.55 | |||

| AND | 394.90 | 397.30 | 2.40 | 13.83 | Southern porphyry | ||

| Including | 394.90 | 396.00 | 1.10 | 29.30 | |||

| AND | 442.30 | 444.30 | 2.00 | 5.66 | Northern porphyry | ||

| Including | 442.30 | 443.30 | 1.00 | 10.35 | |||

| OB-21-229 | Trend #4 | ||||||

| 77.00 | 79.00 | 2.00 | 5.14 | Pontiac Sediments | |||

| AND | 152.80 | 155.00 | 2.20 | 5.95 | Pontiac Sediments *VG | ||

| OB-21-241 | Trend #4 | ||||||

| 145.00 | 147.00 | 2.00 | 31.56 | Southern Porphyry *VG | |||

| Including | 146.00 | 147.00 | 1.00 | 60.80 | |||

| OB-21-244 | Trend #4 | ||||||

| 36.00 | 38.15 | 2.15 | 4.03 | Pontiac Sediments*VG | |||

| AND | 153.80 | 155.80 | 2.00 | 4.70 | Pontiac Sediments*VG | ||

| OB-21-255 | Trend #3 | ||||||

| 352.00 | 354.00 | 2.00 | 15.68 | Southern Mafic Volcanic*VG | |||

| Including | 353.00 | 354.00 | 1.00 | 25.10 | |||

| OB-21-256 | Trend #3 | ||||||

| 416.00 | 418.50 | 2.50 | 11.75 | Northern Porphyry | |||

| Including | 417.30 | 418.50 | 1.20 | 24.30 | |||

- VG denotes the presence of visible gold

- True widths estimated at 70%to 80% of core length. Unless otherwise relevant, primary intercepts reflect minimum mining width (1.50 m true width) at a 5.00 g/t cut-off grade consistent with assumptions used in the 2019 MRE.

- Assay grades shown uncapped. A capping factor of 60 g/t Au was used in the 2019 resource estimate

- Table includes only intercepts that meet 5 g/t Au cut-off and minimum mining width constraints used in the 2019 MRE. For a full listing of drill results from current drilling program click here.

Drilling at O’Brien continues to validate the litho-structural model while highlighting resource growth potential laterally and at depth

Drilling to date has continued to define and expand four high-grade mineralized trends, located approximately 300 m, 600 m, 900 m and 1,200 m respectively to the east of the old O’Brien Mine. Mineralized trends identified bear similarities with structures previously mined at O’Brien down to a depth of 1,100 m (historical production of 587 koz grading 15.25 g/t).

Drilling so far has demonstrated continuity of mineralization well below the boundary of defined resources in all three trends, which remain open for expansion laterally and at depth. In trend #1, drilling has highlighted continuity of mineralization down to a vertical depth of 950 m, while current resources are mostly limited to a vertical depth of approximately 600 m. In trend #2, drilling has highlighted continuity of mineralization down to a vertical depth of over 800 m, while current resources are mostly within 400 m from surface. We are currently drilling a series of deeper holes below 950 m in trend #1 and 800 m in trend #2, in order to test high potential targets at depth in these sectors. In trend #3, drilling has traced mineralization down to 500 m vertical depth from surface. Current resources are mostly confined to within a vertical depth of 240 m. While trend #4 does not materially contribute to current resources, drilling thus far has traced mineralization to a vertical depth of 330 m.

Results released thus far from the ongoing campaign cover a strike length of approximately 1.2 km to the east of the old O’Brien mine, representing only a small portion of more than 5.2 km of prospective strike that Radisson controls along the Cadillac Break. Given current geological understanding, the ongoing validation of the litho-structural model, the company estimates there is strong exploration for additional high-grade gold trends along the whole 5.2 km prospective land package on the prolific Larder-Lake Cadillac Break.

116,000 m of drilling completed to date with results pending for approx. 34,000 m

This release represents approximately 5,391 m of drilling in 16 drill holes. Results are pending for approximately 34,000 m in 74 holes including 33 holes with visible gold occurrences. Released results to date (since the commencement of drilling in August 2019) represent approximately 63% of the 130,000 m planned thus far. The company remains well funded with approximately $11.0 m in cash as of December 31, 2021.

Table 1. Breakdown of drilling planned, completed and pending results

| Zone | Allocated drilling (m) | Drilled - Results published (m) | Drilled - Results pending (m) | To be drilled (m) |

| Trend 0 | 18,300 | 6,600 | 11,700 | 0 |

| Trend 1 | 40,700 | 27,900 | 6,800 | 6,000 |

| Trend 2 | 38,500 | 25,200 | 4,300 | 9,000 |

| Trend 3 | 15,700 | 10,200 | 5,500 | 0 |

| Trend 4 / Eastern Exploration | 11,000 | 11,000 | 0 | 0 |

| O'Brien West | 5,700 | 0 | 5,700 | 0 |

| Total | 129,900 | 80,900 | 34,000 | 15,000 |

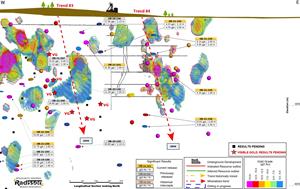

Figure 1. Au Grade Distribution: OB-21-228, OB-21-229, OB-21-241, OB-21-244, OB-21-255, OB-21-256

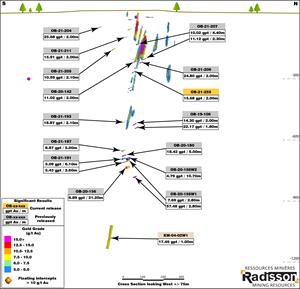

Figure 3. O’Brien Gold Project: Trend #3 and #4 – Longitudinal section

Figure 4. O’Brien Gold Project: Trend #3 – Cross section

Figure 5. O’Brien Gold Project: Trend #4 – Cross section

Figure 6. Visible gold in OB-21-229, OB-21-241, OB-21-244 and OB-21-255

QA/QC

All drill cores in this campaign are NQ in size. Assays were completed on sawn half-cores, with the second half kept for future reference. The samples were analyzed using standard fire assay procedures with Atomic Absorption (AA) finish at ALS Laboratory Ltd, in Val-d’Or, Quebec. Samples yielding a grade higher than 5 g/t Au were analyzed a second time by fire assay with gravimetric finish at the same laboratory. Samples containing visible gold were analyzed with metallic sieve procedure. Standard reference materials, blank samples and duplicates were inserted prior to shipment for quality assurance and quality control (QA/QC) program.

Qualified Person

Nicolas Guivarch, M. Sc., P.Geo., Manager, Exploration and Technical Services is the qualified person pursuant to the requirements of NI 43-101, and has reviewed and approved the technical disclosure in this press release.

Radisson mining resources Inc.

Radisson is a gold exploration company focused on its 100% owned O’Brien project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Quebec. The Bousquet-Cadillac mining camp has produced over 21,000,000 ounces of gold over the last 100 years. The project hosts the former O’Brien Mine, considered to have been the Quebec’s highest-grade gold producer during its production (1,197,147 metric tons at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; Kenneth Williamson 3DGeo-Solution, July 2019). For more information on Radisson, visit our website at www.radissonmining.com or contact:

On behalf of the board of directors

Rahul Paul

President and CEO

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Hubert Parent-Bouchard

Chief Financial Officer

819-763-9969

[email protected]

Forward-Looking Statements

All statements, other than statements of historical fact, contained in this press release including, but not limited to, those relating to the intended use of proceeds of the Offering, the development of the O’Brien project and generally, the above “About Radisson Mining Resources Inc.” paragraph which essentially describes the Corporation’s outlook, constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws, and are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Corporation as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements and future events, could differ materially from those anticipated in such statements. A description of assumptions used to develop such forward-looking information and a description of risk factors that may cause actual results to differ materially from forward looking information can be found in Radisson’s disclosure documents on the SEDAR website at www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management’s endeavours to develop the O’Brien project and, more generally, its expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. All of the forward-looking statements made in this press release are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Figure 1

Au Grade Distribution: OB-21-228, OB-21-229, OB-21-241, OB-21-244, OB-21-255, OB-21-256

Figure 2

O’Brien Gold Project: Resource Block Model @ 5.0 g/t cut-off; Longitudinal section looking North

Figure 3

O’Brien Gold Project: Trend #3 and #4 – Longitudinal section

Figure 4

O’Brien Gold Project: Trend #3 – Cross section

Figure 5

O’Brien Gold Project: Trend #4 – Cross section

Figure 6

Visible gold in OB-21-229, OB-21-241, OB-21-244 and OB-21-255

GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases, financial disclosures and multimedia content to media, investors, and consumers worldwide.