Behavioural finance and financial markets

- 1964

- 0

- 0

Definition of behavioural finance

Behavioural finance relates to financial markets developing according to investor psychology. It tries to show that the various market participants do not act rationally but rather according to their emotions. Effectively, each investor has a different investor profile that leads him to make a particular investment decision.

Behavioural finance explains that these various behaviours tend to come together due to mimicry and that they therefore have a strong influence on market developments. An investor's profile includes risk aversion, the concept of regret and various reactions to gains and losses.

Behavioural finance vs Market efficiency

Behavioural finance is in opposition to market efficiency theory (MET), which claims that investors have the ability to analyse the information received in a rational way. This theory is based on the fact that the information is properly disseminated to all market participants. Market movements follow a random course, depending on the information disseminated to market participants. Prices of the various assets are therefore fair and aptly reflect economic reality. This hypothesis was put forward in the 1950s and 1960s.

However, with the various stock market crashes and speculative bubbles that have occurred over time, the market efficiency theory has been challenged. Its advocates agreed that there were several degrees of efficiency (strong - semi-strong - weak) and that behavioural finance explained irrational movements. No matter how important it is, behavioural finance is now globally recognized. The question is therefore whether or not we believe in the participants’ (traders, hedge funds, etc.) rationality and its impact on price movements.

Behavioural finance studies

-

Study by Thaler and Bondt

: This study showed that securities with low returns for 3 consecutive years outperformed securities with high returns in subsequent years over the same period. This is a powerful argument against the strong market efficiency theory as it proves that market participants do not act rationally. Investor psychology actually plays a role in decision-making.Several conclusions were drawn from this study:

- The market value of a security rarely reflects its fundamental value. An asset’s price is not determined solely by relevant information. Participants overreact to minor events.

- Market anomalies occur continuously due to certain factors.

Behavioural finance and its consequences therefore tend to amplify those market movements which are due to poor information analysis and the effect of emotions in decision-making. Thaler and Bondt in their study refer to an informational efficiency anomaly.

-

Study by Kahneman and Tversky

: These two economists developed the theory of prospects, emotions and the gain or loss situation in which investors find themselves. In their study they talk about loss aversion. An investor does not like to lose and has difficulty cutting his losses. On the other hand, in the event of a gain, he often takes his profits too early. Investors therefore act irrationally and let themselves be guided by emotions. Who has never said to himself one day about a losing trade "the market will eventually prove me right and turn around"? Losing investments are therefore retained while winners are not kept in the portfolio to offset some of the losses. It is often said on our forum that to succeed in trading, you have to "Cut your losses and let your winnings run".Factors leading to market anomalies

-

Cognitive

: These are the factors related to the acquisition of knowledge. On one side, there is understanding. Due to the different levels of intelligence and education of each market participant, the interpretation of the information may vary. Interpretation is also linked to the duration of holding the trade. Information can have a negative impact in the short term and a positive impact in the long term. As a result, market players act differently.The second influential element is memory. First of all, there is what is called mental anchoring, which is the difficulty for an individual to question his first impression. To do this, the individual must accept that he was wrong in the beginning. There is also memory in the sense of experience. Our past experiences have a significant impact on our decision-making. For example, an individual may refuse to invest in a security that has cost him money in the past.

The third factor is emotions. These are all the elements that constitute a person's character (fears, desires, admiration, repulsion, pride, etc.). For example, some people are more likely to take risks in return for a higher probability of gain. Others, on the other hand, play it safe. This partly depends on the investor's age, gender and family situation. For example, a family man takes little risk on the financial markets. Another example of the impact of emotions on investment is the fact that people are more likely to invest in securities which appear in their daily lives (goods that they own, a close relative working in the company, etc.).

-

Mimicry

: This is at the root of stock market crashes and speculative bubbles. The quote "It is better to be wrong with others than to be right alone" sums up this phenomenon well. When bad news spreads, a panic movement can set in and cause stock markets to fall. This fall is then fuelled by investors’ mimicry, they replicate what other investors are doing, for no reason. This mechanism is the same at the time of purchase. We often talk about euphoric or depressed markets. Seeing other investors act in the same way is reassuring, it takes away some of the anxiety felt by the investor when investing. Moreover, he can use this to justify his actions to his friends and relatives. It is always easier to admit to a mistake that others have made at the same time as you.-

Self-fulfilling prophecies

: Investors often base their investment decisions on the various analyses or advice they can read on the net, hear on the radio or TV, or a friend's advice. An investor buys an asset because he has heard that it will rise. This investor distributes the information to other investors and the investment eventually rises. On a larger scale, we can cite the analyses distributed by banks or financial institutions. This affects a large number of investors (including the bank's clients), which increases the asset price if several analyses go in the same direction.External influencing factors in behavioural finance

-

The weather

: A study conducted by E.M. SAUNDERS jnr. has shown that the rate of sunshine has an impact on the stock markets. To quantify the meteorological data, the author created a scale from 0 to 10, enabling him to evaluate the rate of cloud cover over one day, 0 being a totally clear day and 10 a cloudy, dark day. The study showed that very sunny days had a positive impact on the market. On the other hand, very cloudy days had a negative impact. It should be noted, however, that only extreme days really had an impact on the markets. Indeed, they are the only ones that have a significant impact on our mood.-

Weekends

: The effect of weekends is similar to the weather study. An individual's mood affects his investment decisions. Before leaving for the weekend on Friday, investors are in a good mood as the end of the working week approaches. They therefore tend to buy more on this day of the week. Conversely, Monday is a historically bearish day, with investors being pessimistic. This is what the K.R. FRENCH study showed in 1980. For this, he studied the differences between Friday evening and Monday morning over several periods and compared them with the differences observed on the other days of the week.-

Sociability

: A study by H. HONG, J.D. KUBIK and J.C. STEIN showed that a person's sociability has an impact on their inclination to invest. In general, the more sociable an individual is (friends, parties, etc.), the less reluctant he is to invest. His risk aversion is therefore less pronounced than in other individuals. He is also in a better mood. Studies have shown that it is friends that make people happy. An unsociable individual is by nature more anxious. Novelty represents danger to him and the unknown frightens him.-

The impact of Forex on financial markets

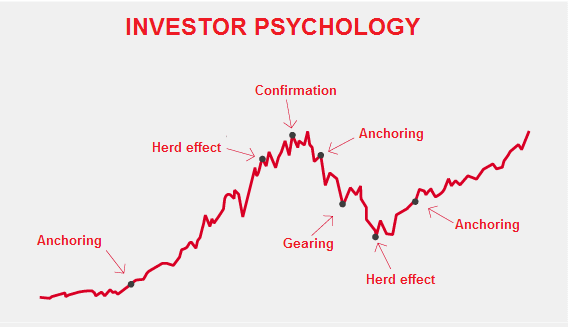

: On the financial markets, the influence of behavioural finance is reflected in several stages, as shown in the graph below:

- Anchoring: An individual by nature has difficulty challenging his first impression. This is mental anchoring. So, if an investor thought that the market was bearish at a particular moment, it takes some time before he can change his position even in the event of a market downturn. Few investors buy in the trough or at the top of the wave, depending on whether the market is in a bullish or bearish trend.

-

Herd effect

: The majority of investors act by mimicry. We saw this concept above. It is this phenomenon that gives a trend strength and accentuates the upward or downward movements in the financial markets.-

Confirmation

: This happens at a high or low point in the market. It’s the moment when the investor is most confident and never questions his investment. The investor says to himself "I was right" and his ego is then flattered.-

Gearing

: This scenario only occurs in a bearish market. Investors have difficulty accepting the loss and do not cut their positions. They think that the market will eventually turn around.About author

- 5

- 1

- 0

- 4