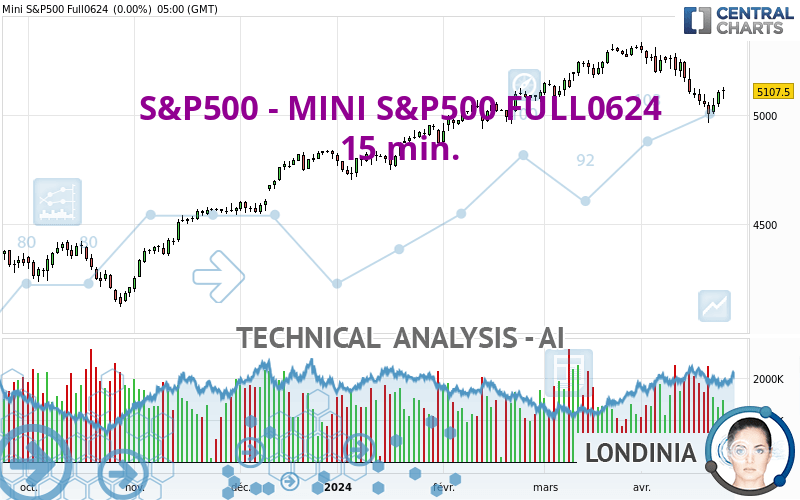

S&P500 - MINI S&P500 FULL0624 - 15 min. - Technical analysis published on 04/25/2024 (GMT)

- 62

- 0

- Timeframe : 15 min.

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

S&P500 - MINI S&P500 FULL0624 rating 5,070.00 USD. The price is lower by -0.73% since the last closing and was between 5,022.25 USD and 5,082.50 USD. This implies that the price is at +0.95% from its lowest and at -0.25% from its highest.The Central Gaps scanner detects a bearish gap which is a sign that the sellers have taken the lead in the very short term.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by S&P500 - MINI S&P500 FULL0624:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of S&P500 - MINI S&P500 FULL0624 in 15 min. shows an overall slightly bearish trend. Only 60.71% of the signals given by moving averages are bearish. This slightly bearish trend could turn neutral or reverse given the slightly bullish signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : 15 minutes

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 15 minutes

In fact, 12 technical indicators on 18 studied are currently positioned bullish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 15 minutes

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 15 minutes

Pivot points : price is under support 1

Type : Neutral

Timeframe : 15 minutes

MACD indicator is back over 0

Type : Bullish

Timeframe : 15 minutes

Ichimoku - Bullish crossover : Tenkan & Kijun

Type : Bullish

Timeframe : 15 minutes

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 4,963.50 | 5,006.00 | 5,047.75 | 5,070.00 | 5,073.75 | 5,124.25 | 5,150.00 |

| Change (%) | -2.10% | -1.26% | -0.44% | - | +0.07% | +1.07% | +1.58% |

| Change | -106.50 | -64.00 | -22.25 | - | +3.75 | +54.25 | +80.00 |

| Level | Intermediate | Intermediate | Minor | - | Major | Major | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5,020.42 | 5,046.33 | 5,076.92 | 5,102.83 | 5,133.42 | 5,159.33 | 5,189.92 |

| Camarilla | 5,091.96 | 5,097.14 | 5,102.32 | 5,107.50 | 5,112.68 | 5,117.86 | 5,123.04 |

| Woodie | 5,022.75 | 5,047.50 | 5,079.25 | 5,104.00 | 5,135.75 | 5,160.50 | 5,192.25 |

| Fibonacci | 5,046.33 | 5,067.92 | 5,081.25 | 5,102.83 | 5,124.42 | 5,137.75 | 5,159.33 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,657.33 | 4,810.42 | 4,907.08 | 5,060.17 | 5,156.83 | 5,309.92 | 5,406.58 |

| Camarilla | 4,935.07 | 4,957.96 | 4,980.86 | 5,003.75 | 5,026.64 | 5,049.54 | 5,072.43 |

| Woodie | 4,629.13 | 4,796.31 | 4,878.88 | 5,046.06 | 5,128.63 | 5,295.81 | 5,378.38 |

| Fibonacci | 4,810.42 | 4,905.82 | 4,964.76 | 5,060.17 | 5,155.57 | 5,214.51 | 5,309.92 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,964.25 | 5,045.75 | 5,170.50 | 5,252.00 | 5,376.75 | 5,458.25 | 5,583.00 |

| Camarilla | 5,238.53 | 5,257.44 | 5,276.34 | 5,295.25 | 5,314.16 | 5,333.06 | 5,351.97 |

| Woodie | 4,985.88 | 5,056.56 | 5,192.13 | 5,262.81 | 5,398.38 | 5,469.06 | 5,604.63 |

| Fibonacci | 5,045.75 | 5,124.54 | 5,173.21 | 5,252.00 | 5,330.79 | 5,379.46 | 5,458.25 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 53.55 | |

| MACD (12,26,9): | -0.4600 | |

| Directional Movement: | 2.86 | |

| AROON (14): | 85.72 | |

| DEMA (21): | 5,051.59 | |

| Parabolic SAR (0,02-0,02-0,2): | 5,035.79 | |

| Elder Ray (13): | 6.53 | |

| Super Trend (3,10): | 5,037.68 | |

| Zig ZAG (10): | 5,061.50 | |

| VORTEX (21): | 0.9400 | |

| Stochastique (14,3,5): | 87.18 | |

| TEMA (21): | 5,057.64 | |

| Williams %R (14): | -15.70 | |

| Chande Momentum Oscillator (20): | 28.75 | |

| Repulse (5,40,3): | 0.1400 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0100 | |

| Courbe Coppock: | 0.86 |

| MA7: | 5,063.46 | |

| MA20: | 5,167.48 | |

| MA50: | 5,181.94 | |

| MA100: | 5,041.56 | |

| MAexp7: | 5,061.45 | |

| MAexp20: | 5,054.78 | |

| MAexp50: | 5,061.48 | |

| MAexp100: | 5,070.99 | |

| Price / MA7: | +0.13% | |

| Price / MA20: | -1.89% | |

| Price / MA50: | -2.16% | |

| Price / MA100: | +0.56% | |

| Price / MAexp7: | +0.17% | |

| Price / MAexp20: | +0.30% | |

| Price / MAexp50: | +0.17% | |

| Price / MAexp100: | -0.02% |

Add a comment

Comments

0 comments on the analysis S&P500 - MINI S&P500 FULL0624 - 15 min.