Gold IRA Benefits Explained by an Expert (2024 Update Released)

- 107

What are the benefits of a gold IRA? The latest guide by IRAEmpire helps consumers find answers to this question and more.

AUSTIN, TX/ ACCESSWIRE / September 10, 2024 / IRAEmpire is proud to release its guide on Gold IRA benefits. According to Ryan Paulson, Chief Editor at IRAEmpire.com, "We have noticed a strong surge in interest for gold IRAs among consumers in the last few years. Understanding the potential benefits of opening a gold IRA is vital for any interested investor."

IRAEmpire logo

IRAEmpire logologo of IRAEmpire.com

He further adds, "We are certain that our latest gold IRA benefits guide would be helpful."

Consumers interested in learning about gold IRAs can sign up for this free checklist. Ryan highlights that the checklist has already helped hundreds of investors choose reliable gold IRA companies.

Top Gold IRA Providers:

Ryan has prepared a list of the best gold IRA companies of 2024 as well. "We have reviewed over 200 gold IRA providers and ranked the best ones based on user-feedback, past reputation, product catalog, and several other factors," pointed out Ryan. Here's the brief list:

Having a well-balanced portfolio that includes a combination of both risky and safe investments is crucial for a strong investment strategy. Diversifying your assets is crucial in order to protect your investment portfolio from potential losses. In uncertain economies, the value of your portfolio can be easily affected by an unexpected downturn in the stock market or fluctuations in the value of your investments. These issues have the potential to drive down the overall value of your portfolio.

So, what options do you have to diversify your portfolio and safeguard your wealth? An investment strategy that is gaining popularity is putting money into gold. Gold's unique properties can provide a counterbalance to the losses incurred by conventional investments such as stocks and bonds.

With a wide range of gold assets available, such as gold bars, coins, and gold stocks, opening a gold individual retirement account (IRA) could prove to be highly beneficial at this time. Investing in a gold IRA offers the opportunity to include physical precious metals such as gold, silver, platinum, and palladium in a retirement account that provides tax advantages. There are significant advantages to considering this type of investment at present.

A Brief Overview of Gold IRA Benefits

Ryan says that the top benefits of a gold IRA include:

Safeguarding Your Wealth:

Investing in a gold IRA offers a significant advantage as it acts as a safeguard against economic uncertainty. Investment options such as stocks and bonds can be affected by market volatility and economic downturns, which can diminish the value of these assets.

Historically, gold has shown a tendency to move in the opposite direction of traditional financial markets. Amid periods of economic uncertainty, investors frequently turn to gold as a reliable asset, safeguarding their wealth and adding stability to a well-rounded investment portfolio.

In today's global economy, there are a number of factors that are shaping the current economic landscape. These include geopolitical tensions, persistent inflationary pressures, and other unique economic challenges. Gold's stability and intrinsic value make it an appealing option for individuals seeking to protect their retirement savings.

Ryan points out, "When you open a gold IRA, your physical gold is stored at a certified third-party storage facility. This way, you can be certain about the safety of your assets."

The IRS has strong guidelines regarding home storage gold IRA as well.

Diversifying Your Portfolio:

By diversifying your investments across various asset classes, you can lower the overall risk and increase the potential for long-term returns. Adding gold to a diversified portfolio can serve as a useful safeguard against market volatility. Gold's low correlation with traditional assets makes it a valuable diversification tool, reducing risk and enhancing the overall risk-adjusted performance of a portfolio.

Gold's unique ability to operate autonomously from other assets can assist in stabilizing the overall performance of a portfolio, particularly during times of market volatility. By including a gold IRA in your retirement savings, you can enhance your investment strategy and achieve optimal diversification. This will help create a more resilient and balanced portfolio.

Unique Tax Advantages:

Investing in a gold IRA can provide significant tax benefits that can boost the overall returns of your retirement portfolio. Traditional IRAs and 401(k)s offer the benefit of tax-deferred growth, enabling investments to increase in value without triggering immediate tax obligations. In the same vein, a gold IRA offers the advantage of tax-deferred growth and the opportunity to diversify your retirement portfolio with tangible precious metals.

Additionally, choosing a Roth gold IRA offers the potential for tax-free withdrawals during retirement. Contributions to a Roth IRA are made with after-tax dollars, but the growth and withdrawals are tax-free. This can be a significant advantage for individuals who expect to be in a higher tax bracket during retirement. An attractive option for retirement planning is a gold IRA, which offers a unique combination of tax benefits and the wealth-preserving qualities of gold.

Preservation of Your Purchasing Power:

Inflation remains a constant worry for investors as it gradually diminishes the value of money over the years. Gold is known for its ability to maintain its value over time, unlike traditional currencies that can lose value due to inflation. Throughout history, gold has consistently maintained its purchasing power and has even appreciated in value during periods of inflation. This has played a significant role in its enduring popularity.

Including gold in a retirement portfolio can provide a safeguard against the detrimental impact of inflation on your savings. Gold's intrinsic value, along with its scarcity and widespread acceptance, makes it a powerful asset for safeguarding purchasing power in the long run.

Possession of a Tangible Asset:

One of the main benefits of a gold IRA is the fact that the assets are physical and tangible. Gold and other precious metals held in a gold IRA offer a unique advantage over traditional paper investments like stocks and bonds - they are physical assets that you can physically touch and possess. Having a physical component adds a level of reassurance and personal connection that surpasses the virtual representation of financial assets.

Having ownership of physical gold grants you a direct claim on a valuable and universally recognized asset. In times of financial uncertainty, the stability and tangible nature of gold offer reassurance to investors, making it an appealing distinction.

How to Open a Gold IRA:

Opening a Gold IRA involves several key steps that allow investors to diversify their retirement savings with precious metals. Here's how to get started:

1. Choose a Gold IRA Company

The first crucial step is selecting a reputable gold IRA company to guide you through the process. Look for companies with strong track records, positive customer reviews, and transparent fee structures. Well-known options include Augusta Precious Metals and Goldco.

2. Select a Self-Directed IRA Custodian

Your chosen gold IRA company will help you open an account with a self-directed IRA custodian. These specialized financial institutions are authorized to hold alternative assets like precious metals in retirement accounts.

3. Fund Your Account

There are two main ways to fund a Gold IRA:

- Roll over or transfer funds from an existing retirement account like a 401(k) or traditional IRA.

- Make a direct contribution, subject to IRS annual limits ($6,500 for 2023, $7,000 for 2024, with an additional $1,000 catch-up contribution for those 50 and older).

4. Choose Your Precious Metals

Work with your gold IRA company to select IRS-approved precious metals for your account. Options typically include gold, silver, platinum, and palladium in various forms like coins and bars. Be aware that the IRS has specific purity requirements:

- Gold must be 99.5% pure

- Silver must be 99.9% pure

- Platinum and palladium must be 99.95% pure

5. Arrange Secure Storage

Unlike traditional IRAs, you cannot personally hold the precious metals in a Gold IRA. Your custodian will arrange for storage in an IRS-approved depository. This ensures the security of your investment and compliance with IRS regulations.

6. Complete the Transaction

Once you've made your selections, your gold IRA custodian will handle the purchase and transfer of the precious metals to the secure storage facility.

It's important to note that Gold IRAs often come with higher fees than traditional IRAs due to the specialized nature of the investment and storage requirements. These may include setup fees, annual maintenance fees, storage fees, and transaction costs.

While Gold IRAs can offer portfolio diversification and a hedge against inflation, experts generally recommend limiting precious metals exposure to around 5-15% of your overall retirement savings. As with any investment decision, it's advisable to consult with a financial advisor to determine if a Gold IRA aligns with your long-term financial goals and risk tolerance.

Tax Benefits Unique to Gold IRA:

Based on the search results, there are indeed several tax benefits specific to gold IRAs:

1. Tax-deferred growth: Similar to traditional IRAs, gold IRAs offer tax-deferred growth. This means you don't pay taxes on the earnings in your account until you make withdrawals in retirement.

2. Potential tax deductions: Contributions to traditional gold IRAs may be tax-deductible in the year you make them, reducing your taxable income for that year.

3. Tax-free withdrawals with Roth gold IRAs: While contributions to Roth gold IRAs are made with after-tax dollars, withdrawals in retirement are tax-free, provided the account has been open for at least five years and you're over 59½ years old.

4. Tax-free rollovers: You can roll over funds from a traditional IRA or 401(k) into a gold IRA without incurring taxes, as long as the transfer is done directly between custodians.

5. Lower taxes for heirs: If you leave a Roth gold IRA to beneficiaries, they likely won't pay taxes on their distributions. For traditional gold IRAs, beneficiaries will pay taxes at their income tax rate, but may get a deduction for estate taxes already paid.

6. No Required Minimum Distributions (RMDs) for Roth gold IRAs: Unlike traditional IRAs, Roth gold IRAs don't require minimum distributions during the owner's lifetime, providing more flexibility in managing withdrawals and tax planning.

7. Higher contribution limits for SEP gold IRAs: Self-employed individuals or small business owners can open SEP gold IRAs, which have higher contribution limits than traditional or Roth IRAs.

It's important to note that while these tax benefits can be advantageous, gold IRAs also come with specific rules and potential drawbacks, such as higher fees and storage requirements. As with any investment decision, it's advisable to consult with a financial advisor to determine if a gold IRA aligns with your individual financial goals and circumstances.

Rules About Gold IRAs:

Gold IRAs adhere to the same regulations as traditional retirement accounts and can be established as pre-tax IRAs, Roth IRAs, or simplified employee pension (SEP) IRAs. Investors who have traditional pre-tax and SEP IRAs will be subject to the same contribution limits, penalties for early withdrawals, and required minimum distributions once they reach the age of 73.

Just like with traditional pre-tax IRAs, investors who make qualified withdrawals from gold IRAs are also subject to income tax on capital gains. It is worth noting that the tax rate for physical gold can be higher compared to other assets that have been held for a long time. The IRS considers gold as a collectible and taxes it accordingly, with rates that can go as high as 28%.

Ryan points out that IRS rules for IRAs state that precious metal IRAs can only contain gold, silver, platinum, and palladium bullion products. Additionally, these precious metals must be shipped directly from the dealer to the depository. The purity of the metal must fall within the range of 99.5% to 99.9%, depending on the specific type.

The IRS maintains a stringent approach when it comes to enforcing its regulations on storage and purity standards. Furthermore, violations of either rule are seen as prohibited transactions and result in a taxable event.

Are There Any Risks of Opening a Gold IRA?

While gold IRAs have gained popularity as a way to diversify retirement portfolios, investors should be aware of several key risks before diving in. These specialized individual retirement accounts, which allow holders to invest in physical gold and other precious metals, come with unique challenges that could impact long-term financial goals.

High Costs and Fees

One of the most significant drawbacks of gold IRAs is the higher cost structure compared to traditional retirement accounts. Investors face a barrage of fees, including setup charges, annual maintenance costs, storage expenses, and insurance premiums. These additional costs, which can eat into investment returns over time, stem from the complexities of handling and securing physical precious metals.

Liquidity Concerns

Unlike stocks or bonds that can be quickly sold on the open market, liquidating assets from a gold IRA can be a more cumbersome and time-consuming process. This lack of liquidity could pose challenges for investors who may need rapid access to their funds, especially in emergency situations.

Market Volatility

While often touted as a hedge against economic uncertainty, gold prices can be highly volatile. The precious metal's value can fluctuate significantly based on global events, economic conditions, and investor sentiment. This volatility could lead to substantial losses if an investor needs to sell during a market downturn.

Regulatory Risks

Gold IRAs are subject to strict IRS regulations, including specific requirements for the purity of gold and approved storage facilities. Failure to comply with these rules could result in severe penalties and the loss of the account's tax-advantaged status. Investors must navigate a complex regulatory landscape to ensure ongoing compliance.

Opportunity Cost

By allocating a significant portion of retirement savings to gold, investors may miss out on potentially higher returns from other asset classes. Historically, the stock market has outperformed gold over long periods, and gold does not provide dividends or interest payments like stocks and bonds.

Storage and Security Risks

While IRS-approved depositories are required to be insured, there's always a risk of theft or loss associated with physical assets. Additionally, investors must rely on third-party custodians to manage and secure their gold, introducing an element of counterparty risk.

Lack of Income Generation

Unlike dividend-paying stocks or interest-bearing bonds, gold does not generate income. This means the only opportunity for profit comes from price appreciation, which may not be sufficient to fund retirement needs.

In conclusion, while gold IRAs offer a unique way to diversify retirement savings, they come with a complex set of risks that investors must carefully consider. Financial experts generally advise limiting gold and other precious metals to a small portion of one's overall retirement portfolio, typically 5% to 15%, to balance potential benefits with the inherent risks. As with any significant financial decision, consulting with a qualified financial advisor is recommended before opening a gold IRA.

Is a Gold IRA Worth It?

Ryan says, "Whether a gold IRA is worth it or not depends on your individual requirements and goals. Precious metals hold a unique place among alternative investments due to their historic performance and reliability."

He also says, "When looking for a reliable gold IRA provider, it's always best to check their online reviews, BBB rating and their overall reputation." Ryan recommends enquiring about the fees of the gold IRA provider before proceeding with the account set up as well.

A good way to ensure you're working with a reliable company is to opt for one of the top-rated gold IRA companies, said Ryan.

It's always best to do your own research. Staying well-informed is vital for every investor, Ryan Paulson.

Here are some statistics highlighting the growth of gold in the last few years:

1. Current price (as of September 2024):

- Gold price is around $2,470-$2,490 per troy ounce

2. Price changes:

- From January 2024 to September 2024: Increased by about 20.48% (gain of $422.49 per troy ounce)

- Year-over-year change (September 2023 to September 2024): Increased by approximately 28-29%

3. Historical highs:

- All-time high of $2,531.70 per troy ounce reached in August 2024

4. Price trends:

- 2020: Average price was Rs.48,651 per 10 grams (in India)

- 2021: Average price was Rs.48,720 per 10 grams (in India)

- 2022: Average price was Rs.52,670 per 10 grams (in India)

- 2023: Average price was Rs.58,385 per 10 grams (in India)

5. Price in major currencies (as of July 2024):

- USD: $2,398.20 per troy ounce

- This represented a 3.08% increase from the previous month

- And a 22.92% increase from one year prior

6. Long-term growth:

- Average growth rate of 7.73% (based on monthly data)

These statistics show a general upward trend in gold prices over the past few years, with significant gains in 2023 and 2024. The precious metal has reached new all-time highs, driven by factors such as economic uncertainty, inflation concerns, and geopolitical tensions.

"Keep in mind that past performance doesn't guarantee future returns. You should always consult with a financial advisor before making any major decisions regarding your retirement funds," cautions Ryan.

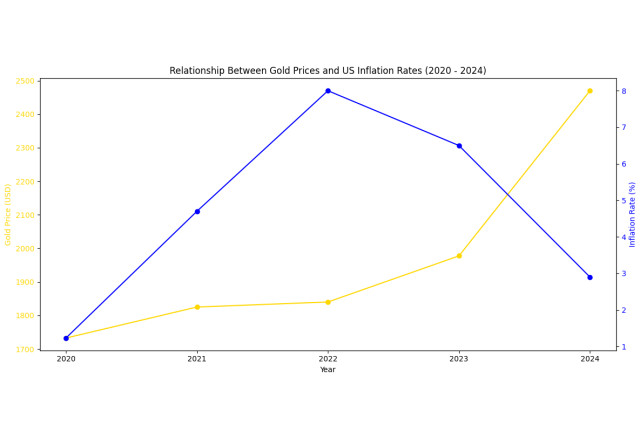

How Inflation is Related to Gold Prices

Here's a chart showcasing the relation between inflation and gold prices in recent years:

1. Safe haven asset: During periods of high inflation, investors often turn to gold as a safe haven asset to preserve their wealth. As inflation erodes the purchasing power of fiat currencies, demand for gold tends to increase as people seek to protect the value of their money.

2. Hedge against inflation: Gold is widely viewed as an effective hedge against inflation. Historical data shows that gold prices have often risen substantially during periods of high inflation. For example, the World Gold Council found that gold returned 15% per year on average during periods when inflation exceeded 3%.

3. Loss of confidence in fiat currencies: Rising inflation typically corresponds with decreasing trust in fiat currencies. This loss of confidence in paper money drives increased demand for hard assets like gold.

4. Preservation of purchasing power: As inflation reduces the purchasing power of currencies, investors look to gold as a stable store of value to maintain their purchasing power over time.

5. Central bank demand: During inflationary periods, central banks may increase their gold reserves to diversify away from devalued currencies, further boosting demand.

6. Anticipatory buying: Even the expectation of future inflation can drive up gold demand, as investors buy gold in anticipation of rising prices.

7. Inverse relationship with the US dollar: Gold prices are generally inversely related to the value of the US dollar. As inflation weakens the dollar, it tends to increase gold prices and demand.

8. Economic uncertainty: Inflation often creates economic uncertainty, which further increases the appeal of gold as a safe haven asset.

9. Industrial and jewelry demand: While investment demand is a key driver during inflation, gold also sees increased demand for jewelry and industrial uses as a hedge against rising prices.

Key observations:

There's a general positive correlation between gold prices and inflation rates from 2020 to 2022, supporting the notion of gold as a hedge against inflation.

However, the relationship becomes less clear in 2023 and 2024, where gold prices continue to rise despite decreasing inflation rates.

The sharp increase in gold prices in 2024 despite lower inflation suggests other factors beyond inflation are driving gold prices, such as economic uncertainty, geopolitical tensions, or changes in monetary policy.

The data demonstrates that while inflation can influence gold prices, it's not the only factor, and the relationship is not always straightforward or immediate.

Contact Information

Ryan Paulson

Chief Editor

[email protected]

+18024878205

Related Images

|

SOURCE: IRAEmpire.com

View the original press release on accesswire.com

- Panini S.p.A. lance une version étendue de sa suite de solutions BioCred en Europe à l'occasion du Future Identity Festival

- SYNERGIE : Déclaration mensuelle des droits de vote au 31 octobre 2024

- Mise à disposition du rapport financier annuel 2023/2024

- Le projet Palm Jebel Ali prend de l'ampleur en 2024 : Des étapes franchies en un temps record pour le projet de développement le plus attendu de Dubaï

- Point de Marché - Emission par Bull SA d’une action de préférence au profit de l’Etat français dans le cadre des droits de protection accordés à l’Etat français sur les activités souveraines et sensibles

- La Conférence internationale sur la critique cinématographique a été lancée à Riyad