J.P. Morgan Asset Management Launches Groundbreaking Guide to ETFs

- 85

PR Newswire

NEW YORK, Sept. 12, 2024

A new flagship publication set to revolutionize ETF education, featuring expert analysis and highlighting key investment trends.

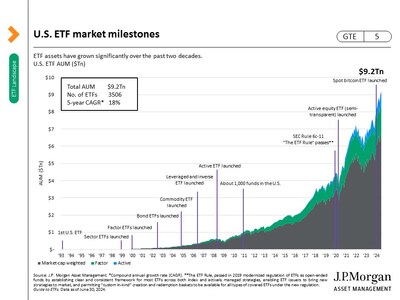

NEW YORK, Sept. 12, 2024 /PRNewswire/ -- J.P. Morgan Asset Management has launched the inaugural edition of its quarterly "Guide to ETFs," a new resource designed to provide clarity and insight into the fast-moving ETF landscape. The Guide to ETFs is the cornerstone of the firm's broader ETF Insights program, a new global initiative providing actionable thought leadership and resources to financial professionals and investors.

Despite the popularity of ETFs, there is still demand for information on the structure of the vehicle and market dynamics, and the Guide to ETFs helps meet that need with in-depth analysis, performance metrics and investing trends. Led by Chief ETF Strategist Jon Maier and his team, the Guide will help educate advisers and their clients on opportunities in the sector.

"ETFs have become an indispensable investment structure for both individual investors and financial professionals, and the Guide to ETFs underscores our unwavering commitment to leading the conversation and driving innovation in the ETF industry," said Jed Laskowitz, Chief Investment Officer and Global Head of Asset Management Solutions at J.P. Morgan Asset Management. "Our Guide to ETFs will be a game-changer, providing advisors with the critical insights needed to fully capitalize on the opportunities that the ETF vehicle offers."

The Guide covers topics such as active ETFs, the fixed income ETF ecosystem, and other emerging trends. It also highlights the role ETFs can play in enhancing diversified portfolios and details the what and how of their potential tax efficiency benefits—a critical area of focus for advisors and their clients. As a leader in the active ETF industry, J.P. Morgan's Guide to ETFs explores dynamic trends that are shaping the space.

Below are a few key takeaways of the Guide to ETFs:

- ETFs are a staple of the broader market: ETFs have consistently made up about 28% of exchange volume over the past 15 years, acting as crucial shock absorbers during crises like COVID-19 by providing market liquidity.1 ETFs may also enhance liquidity in less liquid markets and may be used as price discovery vehicles particularly during periods of market stress.

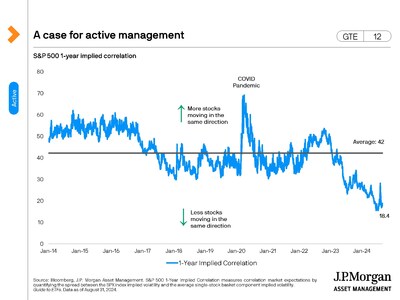

- Active fixed income ETFs: Rates have peaked, making it an ideal time for fixed income. Passive indexes have limitations; investors should consider active management, as a significant percentage of active managers consistently outperform core passive benchmarks over time. ETFs seek to offer transparency, liquidity, and a diversified way to access fixed income, avoiding the complexities and risks of individual bonds.

- ETF tax-efficiency advantage: ETFs, with their on-exchange trading and in-kind securities transfers, offer tax advantages compared to other investment structures. In 2023, only 61 out of 1,297 active ETFs distributed capital gains2, with those funds that distributed gains averaging around one percent, highlighting the tax efficiency of the ETF structure.

"ETF adoption is growing at a rapid pace, and our Guide to ETFs provides insights and practical knowledge that helps investors to make better-informed investment decisions," added Jon Maier. "By addressing key trends and innovations, the Guide to ETFs aims to equip investors with the tools needed to optimize their portfolios by leveraging the ETF structure."

ETF Insights joins a suite of investor programs from J.P. Morgan Asset Management, including Portfolio Insights, Retirement Insights and Market Insights, which is celebrating its 20th year as the industry standard in keeping investors informed of the latest economic and investing trends. ETF assets have grown to about $160 billion over the past five years.3 J.P. Morgan Asset Management ranks second in active ETF AUM and eighth overall.4

For more information about the Guide to ETFs and to access the full report, please visit its dedicated website.

About J.P. Morgan Asset Management

J.P. Morgan Asset Management, with assets under management of $3.3 trillion, as of June 30, 2024, is a global leader in investment management. J.P. Morgan Asset Management's clients include institutions, retail investors and high net worth individuals in every major market throughout the world. J.P. Morgan Asset Management offers global investment management in equities, fixed income, real estate, hedge funds, private equity and liquidity. For more information: www.jpmorganassetmanagement.com. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co., and its affiliates worldwide.

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America ("U.S."), with operations worldwide. JPMorgan Chase had $4.1 trillion in assets and $341 billion in stockholders' equity as of June 30, 2024. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world's most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

Important Information

This is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purpose. Any examples used are generic, hypothetical and for illustration purposes only. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor's own situation.

1 J.P. Morgan Asset Management Guide to ETFs, as of August 31, 2024

2 J.P. Morgan Asset Management Guide to ETFs, as of August 31, 2024

3 J.P. Morgan Asset Management Guide to ETFs, as of August 31, 2024

4 According to Bloomberg, as of September 9, 2024

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jp-morgan-asset-management-launches-groundbreaking-guide-to-etfs-302246657.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jp-morgan-asset-management-launches-groundbreaking-guide-to-etfs-302246657.html

SOURCE J.P. Morgan Asset Management

PR Newswire es un distribuidor de comunicados de prensa con sede en la ciudad de Nueva York. El servicio se creó en 1954 para permitir que las empresas envíen comunicados de prensa electrónicamente a las organizaciones de noticias, al principio utilizando teleimpresores.