| Apertura: | - |

| Variazione: | - |

| Volumi: | - |

| Minimo: | - |

| Massimi: | - |

| Distanza Mas/Min: | - |

| Tipologia: | Azioni |

| Ticker: | NEXA |

| ISIN: | LU1701428291 |

Nexa Announces 2022 Year-End Mineral Reserves and Mineral Resources

- 88

LUXEMBOURG / ACCESSWIRE / March 20, 2023 / Nexa Resources S.A. ("Nexa Resources" or "Nexa" or the "Company") (NYSE:NEXA) announces its 2022 Year-End Mineral Reserves and Mineral Resources ("MRMR") relating to its operations and projects located in Peru and Brazil.

Commenting on the MRMR update, Ignacio Rosado, CEO of Nexa Resources, said "Our mineral exploration program in 2022 was focused on identifying new ore bodies in our operating mines including Aripuanã, where significant results from the Ambrex infill drilling program increased the mine life by three years.

As a major polymetallic and the 5th largest zinc producer worldwide, Nexa has a unique portfolio of operating mines with excellent exploration potential and a pipeline of greenfield exploration projects. In 2023, our mineral exploration program will remain focused on the replacement of Mineral Reserves and upgrading Mineral Resources through infill drilling campaigns."

2022 Year-End Mineral Reserves and Mineral Resources Highlights

Mineral Reserves

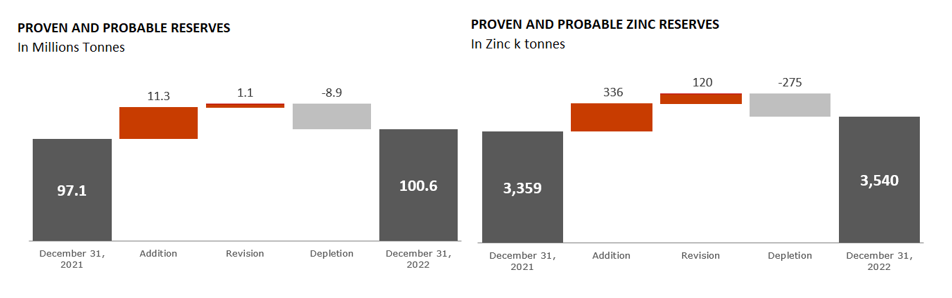

Note: "Addition" refers to new tonnages from brownfield and infill drilling and "Revision" refers to changes in Mineral Reserves due to changes in mine design, changes in economic parameters, leading to a model review and update. Reserve numbers refer to Zinc mines and projects.

- As of December 31, 2022, Proven and Probable Mineral Reserves estimates amounted to 100.6 million tonnes containing 3,540kt of zinc compared with 97.1 million tonnes containing 3,359kt of zinc as of December 31, 2021. The increase was mainly driven by infill and brownfield drilling at Aripuanã, partially offset by mining production depletion. Nexa's 2022 Year-End Mineral Reserves estimate also reflects changes in continuous refining of its geological modelling.

- The net revision of 120kt zinc was primarily due to the reduction of geotechnical restrictions at Cerro Lindo (65kt) and model updates at Vazante (41kt), and El Porvenir (14kt).

- The Proven and Probable Mineral Reserves at Cerro Lindo were estimated to total 41.43Mt at 1.57% Zn, 0.22% Pb, 0.59% Cu and 22.5 g/t Ag as of December 31, 2022, a 6% decrease from 44.0Mt at 1.43% Zn, 0.20% Pb, 0.62% Cu and 22.3 g/t Ag as of December 31, 2021. The decrease was the result of mining production depletion during 2022, balanced by the reduction of operational geotechnical restrictions. Mineral Reserve depletion during 2022 accounted for -4.89Mt containing 70.4kt of zinc.

- The Proven and Probable Mineral Reserves at Vazante were estimated to total 13.50Mt at 9.64% Zn, 0.27% Pb, and 15.2 g/t Ag as of December 31, 2022, down 15% from 15.91Mt at 8.77% Zn, 0.22% Pb and 13.7 g/t Ag as of December 31, 2021. The decrease was the result of mining production depletion during 2022, which was partially replaced by drilling and updates in Extremo Norte, Sucuri Norte and Lumiadeira areas. Mineral Reserve depletion during 2022 accounted for -1.41Mt containing 134kt of zinc. Another 1.0Mt decrease is due to a more selective mine plan with lower dilution that improved head grades and financial returns.

- The Proven and Probable Mineral Reserves at El Porvenir were estimated to total 15.50Mt at 3.60% Zn, 1.07% Pb, 0.19% Cu and 66.0 g/t Ag as of December 31, 2022, a 3% decrease from 15.91Mt at 3.57% Zn, 1.04% Pb, 0.20% Cu and 69.5 g/t Ag as of December 31, 2021. The decrease is mainly the result of mining depletion, partially offset by the addition of 56kt of zinc from infill drilling at known orebodies extensions. Mineral Reserve depletion during 2022 accounted for -2.10Mt containing 59.6kt of zinc.

- The Proven and Probable Mineral Reserves at the Aripuanã project were estimated to total 30.12Mt at 3.42% Zn, 1.25% Pb, 0.17% Cu, 32.1 g/t Ag and 0.23 g/t Au as of December 31, 2022, a 38% increase from 21.79Mt at 3.61% Zn, 1.36% Pb, 0.23% Cu, 33.5 g/t Ag and 0.30 g/t Au as of December 31, 2021. The increase of 254kt of zinc in the reserves was due to the Ambrex infill drilling program carried out during 2022. Mineral Reserve depletion during 2022 accounted for -0.45Mt containing 10.5kt of zinc, resulting in a net increase of 243kt of contained zinc.

Mineral Resources

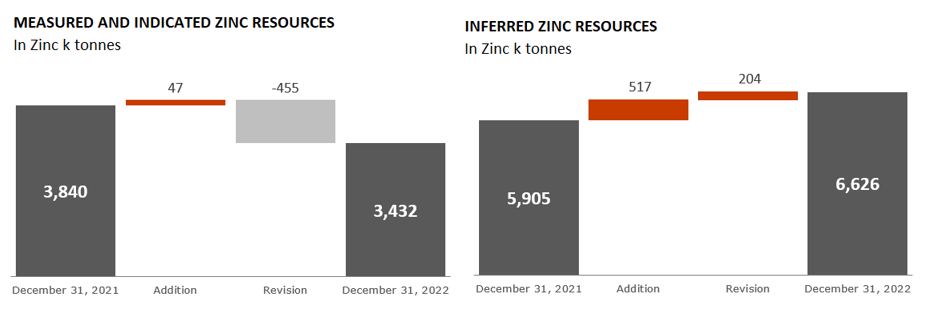

Note: "Addition" refers to new tonnages from brownfield and greenfield drilling and "Revision" refers to changes in Mineral Resources due to changes in reclassification, mine design, changes in economic parameters, leading to a model review and update. Mineral Resource numbers refer to Zinc mines and projects. After a careful assessment and prioritization of our exploration project portfolio, we have decided to not move forward with certain projects, including Caçapava do Sul, located in Brazil, as well as Pukaqaqa and Shalipayco, located in Peru. As a result, 2021 Mineral Resources was updated to maintain the same comparative basis as the 2022 data.

- As of December 31, 2022, Nexa estimated Measured and Indicated Mineral Resources (exclusive of mineral Reserves) were 3,432kt of contained zinc compared with 3,840kt as of December 31, 2021. The Addition and Revision accounted for a net decrease of -408kt of contained zinc mostly due to model reclassification revision.

- The addition from brownfield drilling accounted for 53kt of contained zinc at Hilarión South, and the model revision at Hilarión reduced -412kt of contained zinc in Mineral Resource reclassification to the Inferred Mineral Resource category. At Vazante Aroeira tailings, a block model update resulted in reclassification from Inferred Mineral Resource to Indicated Mineral Resource category, accounting for an increase of 108kt of contained zinc in the Indicated Mineral Resources. At Atacocha underground a topographic revision accounted for a -72kt reduction in contained zinc.

- As of December 31, 2022, Nexa estimated Inferred Mineral Resources of 6,626kt of contained zinc, compared with the total of 5,905kt at the end of 2021. The addition of 517kt of contained zinc was incorporated through exploration and infill drilling. The net revision increases of 204kt of contained zinc is mostly due to model revisions and reclassification.

- Notable additions from exploration drilling to Inferred Mineral Resources included:

- 408kt from Vazante brownfield, including 318kt from BDMG acquisition;

- 446kt from Hilarión South;

- -422kt from Aripuanã mostly due to conversion to Probable Mineral Reserves.

A total of 374kt of contained zinc was added to the Inferred Mineral Resource category at the Hilarión project as a result of Mineral Resource reclassification from Measured and Indicated Mineral Resources. There was a decrease in Inferred Mineral Resources of -102kt from reclassification at Vazante Aroeira due to a reclassification to Measured and Indicated Mineral Resources.

Exploration Outlook

Nexa's exploration strategy for 2023 will remain focused on Mineral Resource expansion through brownfield and infill drilling near operating mines and extension drilling on advanced projects.

A total of 78,185 meters of drilling is planned for 2023, including 45,000 meters in Peru (57%), 25,685 meters in Brazil (33%) and the remaining 7,500 meters in Namibia (10%).

At Cerro Lindo, we plan to drill a total of 32,000 meters including extension drilling at Pucasalla, Puca Punta, Mesa Rumi and Festejo targets, located in the northern side of the Cerro Lindo mine and Orebody 8B, located southeast of known mineralized bodies of the mine. At El Porvenir, we plan to drill 6,000 meters at the Integración target to extend the mineralized hydrothermal breccia to upper levels of the deposit. At Hilarión, we plan to drill 3,000 meters within two targets: El Padrino in the northwestern part of the Hilarión deposit and Chaupijanca to the southeast aiming to test a potential copper mineralization system and extend zinc mineralization in those areas. We will resume our drilling campaigns in Florida Canyon, with an expected 4,000 meters of drilling focused on expanding the Florida Canyon mineralization to the South on Florida Sur target.

At Aripuanã, the strategy is to drill 4,400 meters to extend the Babaçu body to the northwest and to test the mineralization gap between Link and Ambrex. An additional 11,200 meters of infill drilling is planned for Mineral Resources reclassification at Babaçu. At Vazante, we plan to carry out 10,085 meters of brownfield drilling at known orebody extensions.

In Namibia, we plan to drill 7,500 meters to continue investigating copper mineralization in Namibia North along the Deblin and Tsumeb trends.

We expect to continue advancing our drilling campaigns and developing our pipeline of projects, prioritizing belts for exploratory drilling and Mineral Resource expansion to consolidate our Zinc and Copper portfolio with optimized investments between them.

Mineral Reserves and Mineral Resources Tables

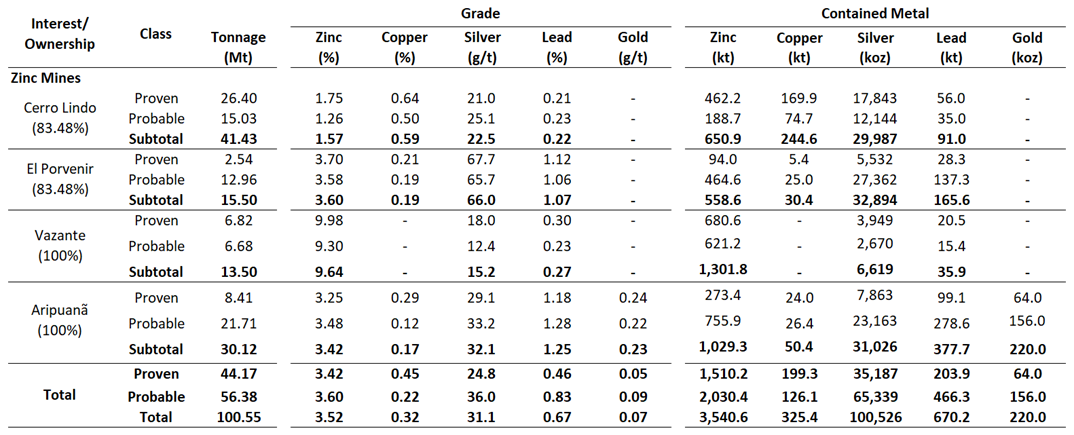

MINERAL RESERVES

The following table shows our estimates of Mineral Reserves prepared with an effective date of December 31, 2022 (except as indicated below).

Table 2. Nexa Year-End Mineral Reserves as of December 31, 2022 (except as indicated below) for Zinc operating mines.

NOTES TO MINERAL RESERVES TABLE

Mineral Reserves are expressed on a 100% basis. The Qualified Persons for the estimation of the Mineral Reserves for Cerro Lindo is Cristovao Teofilo dos Santos, B.Eng., a Nexa employee, El Porvenir and Vazante is Vitor Marcos Teixeira de Aguilar, B.Eng., a Nexa employee, and for Aripuanã is SLR Consulting (Canada) Ltd.

Mineral Reserves have an effective date of December 31, 2022, for Cerro Lindo, El Porvenir, Vazante and Aripuanã mines.

2014 CIM Definition Standards were followed for Mineral Reserves, which are consistent with definitions

used under Subpart 1300 of Regulation S-K.

Mineral Reserves are reported within engineered stope outlines assuming the following underground mining methods: El Porvenir and Vazante - SLS and C&F; Cerro Lindo - SLS; and Aripuanã - longitudinal longhole retreat (bench stopping) and transverse longhole mining (VRM). Dilution and mining recovery are considered.

At Cerro Lindo, Mineral Reserves are estimated at an NSR break-even cut-off value of US$42.65/t processed. Some incremental material with values between US$35.14/t and US$38.84/t was included. At El Porvenir Mineral Reserves are estimated at NSR break-even cut-off values ranging from US$57.99/t to US$62.37/t depending on the zone and mining method. At Vazante Mineral Reserves are estimated at NSR break-even cut-off value of US$60.61/t. At Aripuanã Mineral Reserves are estimated at an NSR break-even cut-off value of US$48.11/t processed. Some incremental material with values between US$38.05/t and US$47.91/t was included.

Metallurgical recoveries are accounted for in the NSR calculations based on historical processing data and are variable as a function of head grade. Forecast long-term metal prices used for the NSR calculation are Zn: US$2,826.35/t (US$1.28/lb); Pb: US$2,043.95/t (US$0.93/lb); Cu: US$7,398.47/t (US$3.36/lb); Ag: US$19.93/oz, and Au: US$1,474.88/oz for Aripuanã.

For Vazante and Aripuanã, a 4.0 m minimum mining width was applied. For Cerro Lindo and for El Porvenir a minimum mining width of 5.0 m was applied. Bulk density at Cerro Lindo and Aripuanã varies depending on mineralization domain. At Vazante the default density is 2.8 t/m³ and El Porvenir is 2.94 t/m³.

Numbers may not add due to rounding.

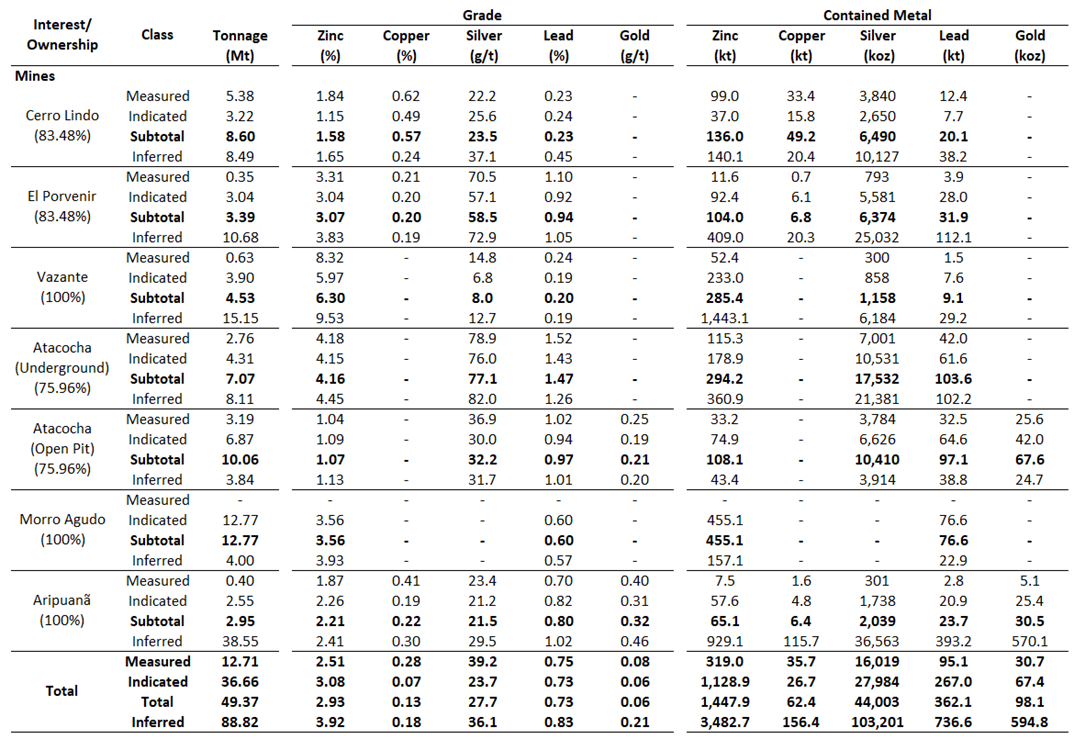

MINERAL RESOURCES

The following table shows our estimates of Mineral Resources (exclusive of Mineral Reserves) in operating mines prepared with an effective date of December 31, 2022 (except as indicated below).

Table 3. Nexa Year-End Mineral Resources as of December 31, 2022 (except as indicated below) for Zinc operating mines.

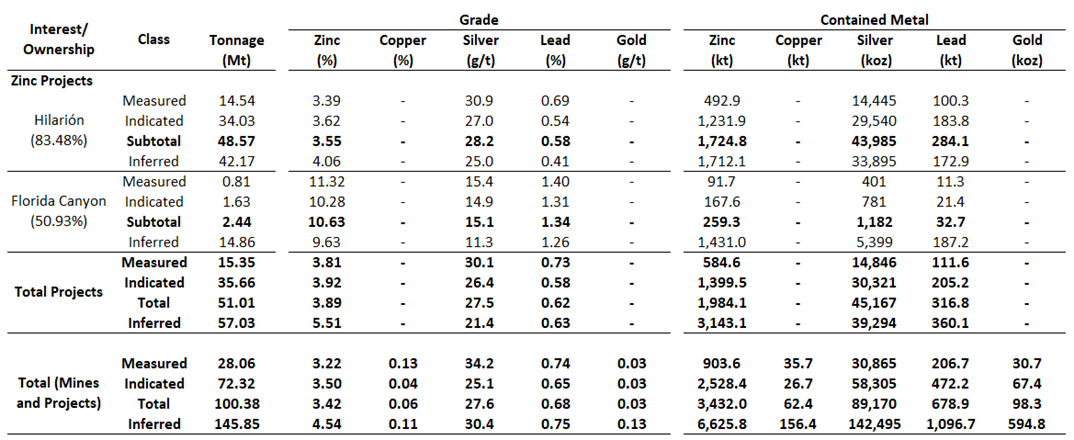

The following table shows our estimates of Mineral Resources (exclusive of Mineral Reserves) for our zinc exploration projects prepared with an effective date of December 31, 2022 (except as indicated below).

Table 4. Nexa Year-End Mineral Resources as of December 31, 2022 (except as indicated below) for Zinc projects.

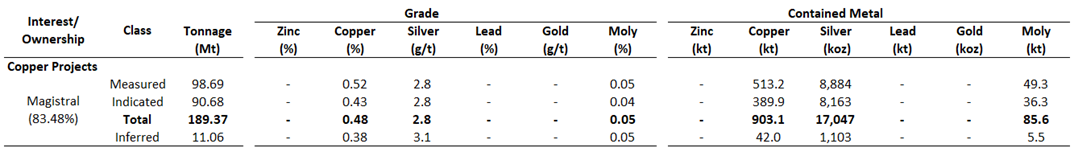

The following table shows our estimates of Mineral Resources for our copper project portfolio prepared with an effective date of December 31, 2022 (except as indicated below).

Table 5. Nexa Year-End Mineral Resources for Copper projects.

NOTES TO MINERAL RESOURCES TABLES

Mineral Resources are expressed on a 100% basis.

The Qualified Persons for the estimation of the Mineral Resources are:

Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante and Morro Agudo mines, Florida Canyon project, Magistral project, and Hilarión project - José Antonio Lopes, B.Geo., FAusIMMGeo, a Nexa employee. For the Aripuanã mine the Qualified Person is SLR Consulting (Canada) Ltd.

Mineral Resources have an effective date as of: (a) December 31, 2022, for Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante, Morro Agudo and Aripuanã mines, and Hilarion project; (b) December 31, 2021, for the Magistral project, and (c) October 30, 2020, for the Florida Canyon project.

2014 CIM Definition Standards were followed for Mineral Resources, which are consistent with definitions used under Subpart 1300 of Regulation S-K.

Mineral Resources are reported within underground resource shapes for Cerro Lindo, El Porvenir, Atacocha u/g, Morro Agudo and Aripuanã mines, and for the Hilarión and Florida Canyon projects. Mineral Resources are reported within underground resource shapes or within an optimized pit shell for Vazante and within an optimized pit shell for Atacocha open pit and Magistral project.

Mineral Resources are reported above a NSR cut-off value of: Cerro Lindo - US$42.65/t for resource shapes; El Porvenir - varies from US$59.65/t (lower zone) to US$62.37/t (upper zone) for C&F resource shapes and from US$57.99/t (lower zone) to US$60.71/t (upper zone) for SLS resource shapes; Atacocha u/g - US$62.81/t for C&F resource stopes; Atacocha o/p - US$23.81/t; Vazante - US$60.61/t for SLS resources shapes, Calamine - varies from US$23.13/t to US$28.38/t and Vazante Aroeira tailings - US$29.40/t; Morro Agudo (specific for each mine) - Morro Agudo: US$52.43/t and Bonsucesso: US$55.85/t; Aripuanã - US$48.11/t; Hilarión - US$45.0/t; Magistral - US$5.99/t for porphyry, US$5.51/t for mixed and US$5.48/t for skarn resources ; Florida Canyon - US$41.40/t for SLS resource shapes, US$42.93/t for C&F and US$40.61/t for Room and Pillar resource areas.

Metallurgical recoveries are accounted for in the NSR calculations based on historical processing data and are variable as a function of head grade. For Florida Canyon metallurgical recovery used average recoveries of 80% for zinc, 74% for lead, and 52% for silver. Forecast long-term metal prices used for the NSR calculation are: Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante, Morro Agudo and Aripuanã - Zn: US$3,250/t (US$1.47/lb), Pb: US$2,350/t (US$1.07/lb), Cu: US$8,508/t (US$3.86/lb), Ag: US$22.92/oz and Au: US$1,696/oz (also used for Atacocha o/p); Magistral project - Cu: US$8,272/t (US$3.75/lb), Ag: US$21.34/oz and Mo: US$9.90/lb; Hilarión project - Zn: US$3,246/t (US$1.47/lb), Pb: US$2,333/t (US$1.06/lb), and Ag: US$22.7/oz; and Florida Canyon project - Zn: US$2,816/t (US$1.27/lb), Pb: US$2,196/t (US$1.00/lb) and Ag: US$19.40/oz.

A minimum mining width of 4.0 m was used for Cerro Lindo. A minimum mining width of 4.0 m for C&F resource shapes was applied for El Porvenir, Atacocha u/g. A minimum thickness of 3.0 m for SLS and C&F, and 4.0 m for Room and Pillar in Florida Canyon project. A minimum mining width of 3.0 m was applied for Vazante for willemite mineralization, Bonsucesso, Hilarión and SLS and C&F stopes in Florida Canyon project. For Morro Agudo underground a minimum mining width of 4.5 m was applied. For the Magistral project a minimum mining width of 10.0 m was applied.

Mineral Resources are reported exclusive of those Mineral Resources that were converted to Mineral Reserves. There are no Mineral Reserves at Atacocha u/g and o/p and Morro Agudo, and at the Magistral, Hilarión, and Florida Canyon projects.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Numbers may not add due to rounding.

Technical Information

Jose Antonio Lopes, FAusIMM CP (Geo): 224829, a mineral resources manager, a qualified person for purposes of National Instrument 43-101 and a Nexa employee, has approved the scientific and technical information contained in this news release.

Further information, including key assumptions, parameters, and methods used to estimate Mineral Reserves and Mineral Resources of the mines and/or projects referenced in the tables above can be found in the applicable technical reports, each of which is available at www.sedar.com under Nexa's SEDAR profile.

About Nexa

Nexa is a large-scale, low-cost integrated zinc producer with over 60 years of experience developing and operating mining and smelting assets in Latin America. Nexa currently owns and operates five long-life underground mines - three located in the Central Andes of Peru and two located in the state of Minas Gerais in Brazil - and is ramping up the Aripuanã mine as its sixth underground mine in Mato Grosso, Brazil. Nexa was among the top five producers of mined zinc globally in 2022 and one of the top five metallic zinc producers worldwide in 2022, according to Wood Mackenzie.

Cautionary Statement on Mineral Reserve and Mineral Resource Estimates

All Mineral Reserve and Mineral Resource estimates of the Company disclosed or referenced in this news release have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves dated May 10, 2014 ("2014 CIM Definition Standards"), whose definitions are incorporated by reference in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), for the metals indicated per mine and project. Accordingly, such information may not be comparable to similar information prepared in accordance with Subpart 1300 of Regulation S-K ("S-K 1300"). For a discussion of the differences between the requirements under S-K 1300 and NI 43-101, please see our annual report on Form 20-F.

Mineral reserve: is an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Probable Mineral Reserve: is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

Proven Mineral Reserve: is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

Mineral Resource: is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable.

Inferred Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Indicated Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling.

Measured Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling.

Cautionary Statement on Forward-Looking Statements

This news release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to in this news release as "forward-looking statements"). All statements other than statements of historical fact are forward-looking statements. The words "believe," "will," "may," "may have," "would," "estimate," "continues," "anticipates," "intends," "plans," "expects," "budget," "scheduled," "forecasts" and similar words are intended to identify estimates and forward-looking statements. Forward-looking statements are not guarantees and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of NEXA to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Actual results and developments may be substantially different from the expectations described in the forward-looking statements for a number of reasons, many of which are not under our control, among them, the activities of our competition, the future global economic situation, weather conditions, market prices and conditions, exchange rates, and operational and financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations on which we have based our estimates and forward-looking statements. Our estimates and forward-looking statements may also be influenced by, among others, legal, political, environmental or other risks that could materially affect the potential development of our projects, including risks related to outbreaks of contagious diseases or health crises impacting overall economic activity regionally or globally.

These forward-looking statements related to future events or future performance and include current estimates, predictions, forecasts, beliefs and statements as to management's expectations with respect to, but not limited to, the business and operations of the Company and mining production our growth strategy, the impact of applicable laws and regulations, future zinc and other metal prices, smelting sales, CAPEX, expenses related to exploration and project evaluation, estimation of mineral reserves and/or mineral resources, mine life and our financial liquidity.

Forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable and appropriate by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies and may prove to be incorrect. Statements concerning future production costs or volumes are based on numerous assumptions of management regarding operating matters and on assumptions that demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, full integration of mining and smelting operations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labor disturbances, interruption in transportation or utilities, adverse weather conditions, and other COVID-19 related impacts, and that there are no material unanticipated variations in metal prices, exchange rates, or the cost of energy, supplies or transportation, among other assumptions.

We assume no obligation to update forward-looking statements except as required under securities laws. Estimates and forward-looking statements refer only to the date when they were made, and we do not undertake any obligation to update or revise any estimate or forward-looking statement due to new information, future events or otherwise, except or required by law. Estimates and forward-looking statements involve risks and uncertainties and do not guarantee future performance, as actual results or developments may be substantially different from the expectations described in the forward-looking statements. Further information concerning risks and uncertainties associated with these forward-looking statements and our business can be found on our website (ir.nexaresources.com), and in our public disclosures filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov).

Contact: Roberta Varella - Head of Investor Relations | [email protected]

+55 11 94473-1388

SOURCE: Nexa Resources S.A.

View source version on accesswire.com:

https://www.accesswire.com/744770/Nexa-Announces-2022-Year-End-Mineral-Reserves-and-Mineral-Resources