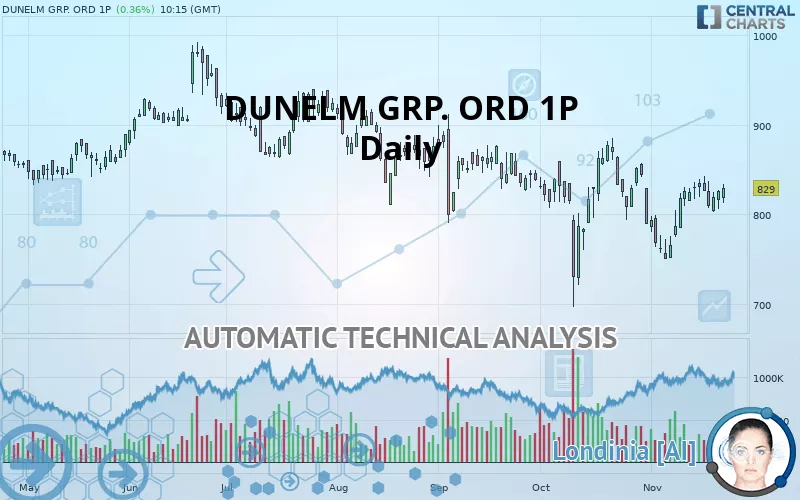

DUNELM GRP. ORD 1P - Daily - Technical analysis published on 11/22/2019 (GMT)

- 294

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

DUNELM GRP. ORD 1P rating 829.0 GBX. The price has increased by +0.36% since the last closing and was traded between 813.0 GBX and 833.5 GBX over the period. The price is currently at +1.97% from its lowest and -0.54% from its highest.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by DUNELM GRP. ORD 1P:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of DUNELM GRP. ORD 1P in Daily shows an overall bullish trend. 71.43% of the signals given by moving averages are bullish. The overall trend is reinforced by the strong bullish signals from short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

The probability of a further increase are moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Near resistance of triangle

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 750.5 | 770.0 | 799.5 | 829.0 | 838.0 | 883.5 | 912.5 |

| Change (%) | -9.47% | -7.12% | -3.56% | - | +1.09% | +6.57% | +10.07% |

| Change | -78.5 | -59.0 | -29.5 | - | +9.0 | +54.5 | +83.5 |

| Level | Intermediate | Major | Major | - | Major | Intermediate | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 790.7 | 798.3 | 812.2 | 819.8 | 833.7 | 841.3 | 855.2 |

| Camarilla | 820.1 | 822.1 | 824.0 | 826.0 | 828.0 | 829.9 | 831.9 |

| Woodie | 793.8 | 799.9 | 815.3 | 821.4 | 836.8 | 842.9 | 858.3 |

| Fibonacci | 798.3 | 806.6 | 811.6 | 819.8 | 828.1 | 833.1 | 841.3 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 744.5 | 765.0 | 798.0 | 818.5 | 851.5 | 872.0 | 905.0 |

| Camarilla | 816.3 | 821.2 | 826.1 | 831.0 | 835.9 | 840.8 | 845.7 |

| Woodie | 750.8 | 768.1 | 804.3 | 821.6 | 857.8 | 875.1 | 911.3 |

| Fibonacci | 765.0 | 785.4 | 798.1 | 818.5 | 838.9 | 851.6 | 872.0 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 508.4 | 594.3 | 691.9 | 777.7 | 875.3 | 961.1 | 1,058.8 |

| Camarilla | 739.1 | 755.9 | 772.7 | 789.5 | 806.3 | 823.1 | 839.9 |

| Woodie | 514.4 | 597.2 | 697.8 | 780.6 | 881.2 | 964.1 | 1,064.7 |

| Fibonacci | 594.3 | 664.3 | 707.6 | 777.7 | 847.8 | 891.1 | 961.1 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 54.50 | |

| MACD (12,26,9): | 5.4000 | |

| Directional Movement: | -1.1 | |

| AROON (14): | 57.1 | |

| DEMA (21): | 817.8 | |

| Parabolic SAR (0,02-0,02-0,2): | 774.7 | |

| Elder Ray (13): | 4.9 | |

| Super Trend (3,10): | 759.1 | |

| Zig ZAG (10): | 824.5 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 79.20 | |

| TEMA (21): | 824.1 | |

| Williams %R (14): | -20.10 | |

| Chande Momentum Oscillator (20): | 73.5 | |

| Repulse (5,40,3): | 2.5000 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0000 | |

| Courbe Coppock: | 9.10 |

| MA7: | 824.4 | |

| MA20: | 805.9 | |

| MA50: | 808.7 | |

| MA100: | 818.2 | |

| MAexp7: | 821.7 | |

| MAexp20: | 812.3 | |

| MAexp50: | 810.8 | |

| MAexp100: | 810.7 | |

| Price / MA7: | +0.56% | |

| Price / MA20: | +2.87% | |

| Price / MA50: | +2.51% | |

| Price / MA100: | +1.32% | |

| Price / MAexp7: | +0.89% | |

| Price / MAexp20: | +2.06% | |

| Price / MAexp50: | +2.24% | |

| Price / MAexp100: | +2.26% |

News

The last news published on DUNELM GRP. ORD 1P at the time of the generation of this analysis was as follows:

The only way is down for Dunelm, says Zak Mir

The only way is down for Dunelm, says Zak Mir

Add a comment

Comments

0 comments on the analysis DUNELM GRP. ORD 1P - Daily